|

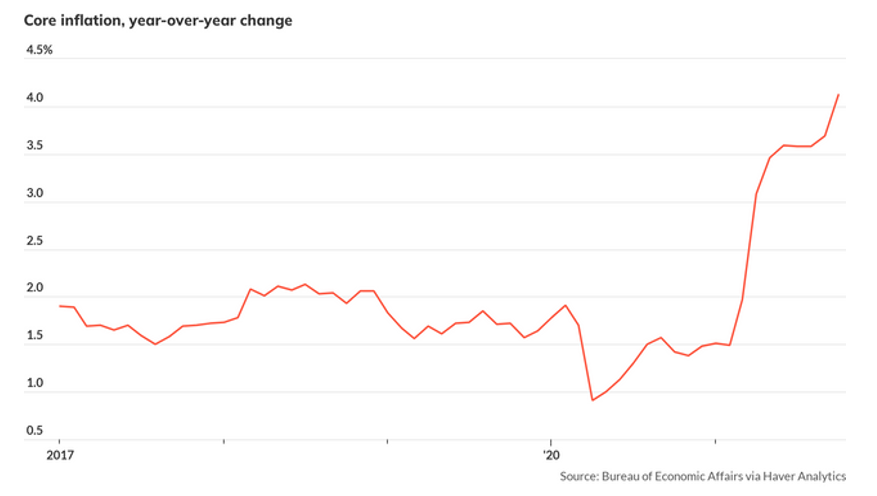

“Inflation will move down significantly over the next year.” — Federal Reserve Chair Jerome Powell, Nov. 30, 2021, before the Senate Committee on Banking, Housing and Urban Affairs |

Federal Reserve Chair Jerome Powell made that brain-dead comment just two weeks ago, but he finally admitted that inflation is a big problem … and worse yet, it will be around for a long time.

Now the Fed must re-calibrate its monetary policy and the first step is to retire the transitory talk. “I think it’s probably a good time to retire that word,” said Powell.

"The Risks of Higher Inflation Have Moved Up"

Powell is sending a new but clear message: Combating inflation is now his top priority, replacing boosting demand and improving the job market.

However, the challenge is for the Fed to tamp down inflation without pushing the economy into a recession and killing the stock markets.

|

So how is the Fed going to do that?

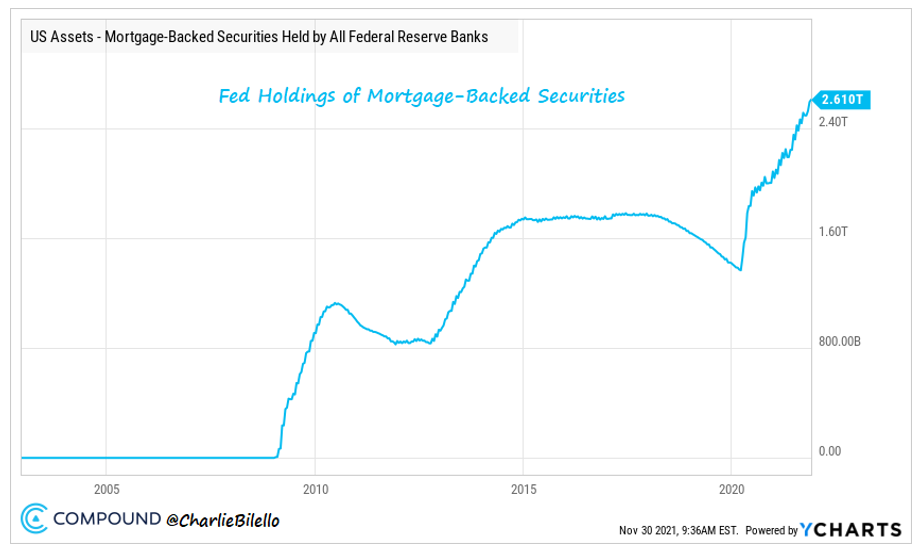

Step 1: Accelerate its taper plan and significantly reduce its monthly asset purchases. The first move from $120 to $105 billion is an inadequate baby step, and everybody expects more from the next Federal Open Market Committee (FOMC) meeting.

Step 2: Require a more dramatic (and dangerous) response of increasing interest rates … perhaps as soon as the first half of 2022.

- The problem: The Fed can only tighten the monetary screws so much before the stock market starts to bleed red ink.

What I hear is a lot of fake tough talk … the reality is that the Fed has painted itself into a no-win corner with its addiction to monetary heroin.

- If the Fed tightens too much, the stock market will tank. If the Fed doesn’t tighten enough, inflation will take off like a rocket.

Here’s what I expect to happen:

We’ll hear a lot more fake tough talk from the Fed, and it will make a half-hearted attempt to tighten monetary policy.

But once the stock market falls far enough for Wall Street to cry foul …

- The Fed will quickly reverse course and go back their two-page playbook: (1) near-zero interest rates and (2) quantitative easing (QE) to infinity.

Proof: In November alone, the Federal Reserve added an additional $126 billion to its balance sheet … which now stands at an astounding $8.6 trillion.

|

The Fed will ride to the stock market’s rescue and that’s why the new taper announcement is nothing more than a way for the Fed to reload its monetary bazooka.

Bottom line?

- The Fed cannot do what it must to fight inflation without breaking its two favorite things in the world: 1) the stock market and 2) the housing market.

Brace yourself for a bumpy ride, but don’t get spooked out of the stock market. The Fed is still its best friend.

At the same time, inflation is going to take off, which is why I’d strongly consider adding assets that do well during inflationary times. I’m talking about real assets like precious metals, farm and timber land, energy metals like lithium, natural resources and agricultural commodities.

For years, we’ve grown accustomed to markets that just go up … but 2022 is going to be a whole different ball game.

Investors need to prepare themselves.

Best wishes,

Tony