Farm life is hard — my father worked 100 hours a week and expected his children to work at least half that during the summer.

He never made much money, but his farmland steadily grew in value.

- In fact, farmland has been one of the best long-term investments on the planet.

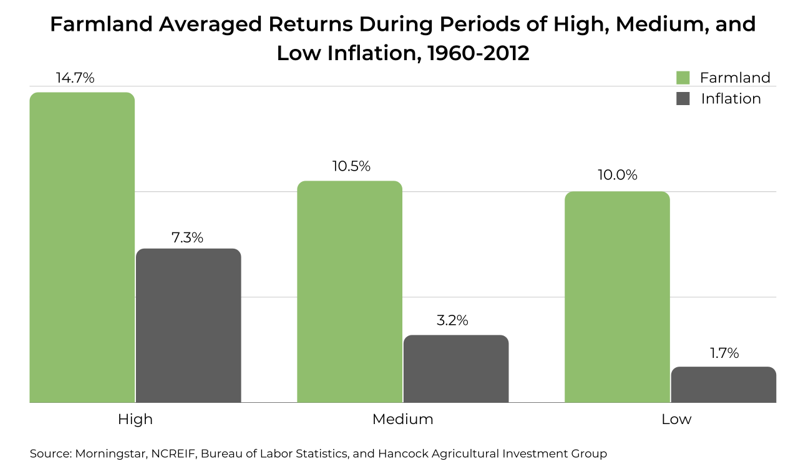

According to Bloomberg, farmland has historically beat inflation and is a better inflation hedge than gold. Farmland does especially well during inflationary periods and beats the pants off stocks and residential real estate.

|

| Source: AcreTrader |

In fact, the higher the rate of inflation, the better farmland performs.

As the chart above shows, farmland appreciated by an average of 14.7% a year during highly inflationary periods.

Adjusted for inflation, average farmland has gone from $1,500 an acre in 1993 to over $3,000 an acre in 2020.

And here’s the best part …

- Farmland has gone up in price EVERY year for the past three decades.

That’s what I call consistent.

Turning Heads

That track record of stellar, steady growth is attracting a lot of institutional investors, including Bill Gates.

In 1994, Gates opened his family office, Cascade Investment, L.L.C. Every year, Gates sells off a portion of his personal stake in Microsoft (Nasdaq: MSFT) stock and reinvests it through Cascade Investment.

|

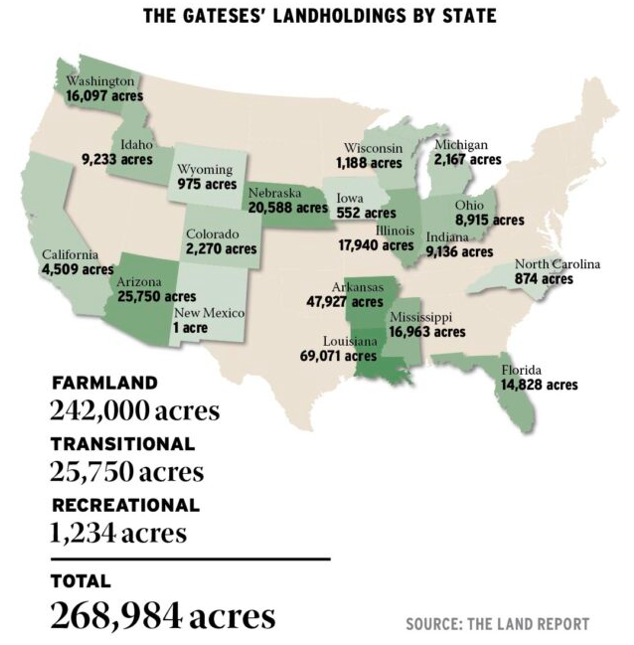

Gates has acquired 269,000 acres of farmland across 18 states.

That sounds like a lot (which it is), but there are 283 million acres of farmland in America, and 40% of that farmland is owned by seniors aged 65 or older.

Gates is also a major investor in Memphis Meats, a developer of cutting-edge synthetic meats that are grown in a lab from livestock cells.

I do think all rich countries should move to 100% synthetic beef … eventually, that green premium is modest enough that you can sort of change the [behavior of] people or use regulation to totally shift the demand.

Gates can dictate what will or won’t be grown on his farmland, so synthetic meat and soybean burgers may be in our future. There’s no question that Gates is going to profit from the push for green energy and the carbon credit market.

|

If you think Bitcoin and cryptocurrencies are red hot, you need to take a look at the carbon credit market:

In Europe, the price of a carbon credit has soared from less than $10 in 2018 … to $70 today.

- That’s a 700% increase in just three years!

One of the best ways to sequester carbon is through soil, and farmers can potentially make more money from selling carbon credits than from selling corn, wheat and other agricultural commodities in the not-too-distant future.

How to Potentially Play It

As I just mentioned, there are 283 million acres of farmland in America. Even with his money … Gates can’t buy all of it.

But there are two farmland real estate investment trusts (REITs) you should consider:

- Gladstone Land (Nasdaq: LAND) owns land in California, Florida, Arizona, Oregon, Colorado and Michigan.

Over the past year, shares are up an astounding 98.40% and trading around all-time highs.

|

- Farmland Partners (NYSE: FPI) owns land in Arkansas, Colorado, Florida, Georgia, Illinois, Kansas, Louisiana, Michigan, Mississippi, Nebraska, North Carolina, South Carolina, Texas and Virginia.

Shares have traded sideways for the better part of the past year, but they are still up 44.51% over that span. At the time of writing, FPI is testing its 50-day moving average as support and trading at $12.07.

Always do your own due diligence before entering any investment. But be mindful that farmland can act as a hedge against inflation … when inflation is rearing its ugly head.

Best of all, you won’t have to wear dungarees and threadbare flannel shirts like my father.

Best wishes,

Tony