|

| By Sean Brodrick |

March Madness is upon us. And that means 68 teams are competing in the NCAA Division 1 basketball tournament.

You may be trying to pick the winners of all the games. Here’s a fun fact: The odds of filling out a perfect set of brackets are about one in 120 billion, according to the NCAA. It’s so hard, no one has ever successfully done it. At least not yet.

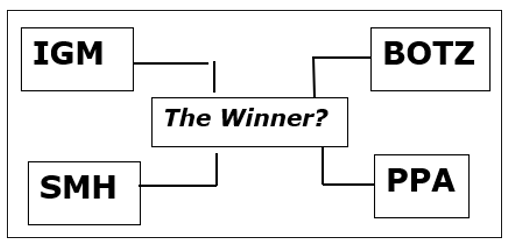

So, I have my own version of March Madness for you — one that’s much easier to win. Mine only has four entries — four ETFs that are poised for market-beating gains not only in March Madness, but also for the rest of the year. Let’s call it Brodrick’s Madness because I’m crazy about all four of these picks.

Importantly, the four contestants in Brodrick’s Madness are holding baskets of stocks leveraged to four of the biggest megatrends in the market.

Let’s start with the first one …

Theme No. 1: Artificial Intelligence

AI isn’t just a new technological trend, it’s a game-changer that is going to reshape many things — how we work, interact and invest. That’s just for starters.

The global AI market is forecast to experience a compound annual growth rate, or CAGR, of 15.83% through 2030. And it doesn’t hurt that the U.S. government is shovelling money at the industry through the $280 billion CHIPS and Science Act.

The best fund to play this trend is the iShares North American Tech ETF (IGM). This fund has $4.14 billion in total assets and a Weiss Rating of “C.” It’s also up 16.4% this year, beating the S&P 500’s 10% performance handily.

IGM doesn’t have “AI” in the name, but it has a roster of power players, including Microsoft (MSFT), Apple (AAPL), Meta Platforms (META), Nvidia (NVDA) and Alphabet (GOOGL).

Theme No. 2: Semiconductors

You can’t have artificial intelligence without the best and fastest chips.

But we are rapidly transitioning to an economy where all new technology uses more and more chips. That’s why the global semiconductor market is forecast to grow at a CAGR of 12.2%.

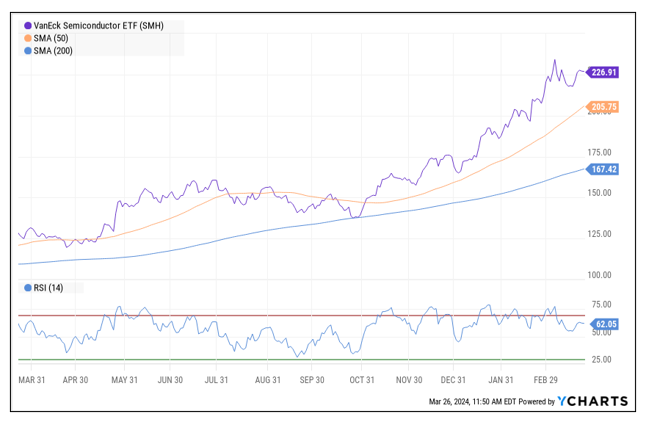

The best pick here is the VanEck Semiconductor ETF (SMH). It has total assets of $16.27 billion and a Weiss Rating of “C+.” And it is up a market-whomping 29.99% so far this year.

SMH also has Nvidia on its team. But its roster also includes Taiwan Semiconductor Manufacturing (TSM), Advanced Micro Devices (AMDO), Broadcom (AVGO), ASML Holdings (ASML) and Intel (INTC).

Theme No. 3: Robots

All those chips making artificial intelligence better and better are kicking the robotics trend into overdrive.

The global robotics market is forecast to grow at a CAGR of 11.25% through 2030. The thing about robotics is that estimates are constantly being shown to be too small. Part of that is as AI-equipped robots become smarter, they become a heck of a lot more useful.

The Global X Robotics & Artificial Intelligence ETF (BOTZ) has $2.65 billion in assets. It only gets a “D+” from Weiss Ratings, but it’s had a great 2024 — up 12.7%. Like the other names on this list, BOTZ outperforms the S&P 500.

On BOTZ’s roster, we have Nvidia (again!) along with Intuitive Surgical (ISRG), UiPath (PATH), Dynatrace (DT) and Cognex (CGNX).

Theme No. 4: Defense

Global defense spending increased by 9% in just the last year alone. The U.S. defense market size is estimated at $617.29 billion in 2024 and is expected to reach $651.16 billion by 2032.

Also, AI is transforming the military like every other industry. AI-equipped drones, tanks and submarines are reshaping the battlefield. You know what that means? Even more defense spending!

Finally, if you’re worried about a recession, a defense ETF would be the way to play it because it’s immune from economic downdrafts. Defense spending always gets a boost in the federal budget.

The best fund to play this is the Invesco Aerospace & Defense ETF (PPA). It has $2.85 billion in assets and a Weiss Rating of “C+.” Its holdings include RTX (RTX), formerly known as Raytheon, as well as General Electric (GE), Lockheed Martin (LMT) and Northrop Grumman (NOC). So far this year, PPA is up about the same as the S&P 500.

But don’t let that stop you from picking PPA as the winner. Past performance is no guarantee of future results. America is funding two wars, in Ukraine and Israel. If Congress approves more funding, or a third war breaks out — God help us — PPA could really blast off.

Who Do You Pick in the

Final Four for Brodrick Madness?

These are four excellent ETFs, all with excellent prospects.

All are leveraged to artificial intelligence. Three of them have Nvidia on their roster, and the one that doesn’t should do well even if there’s a recession.

March Madness lasts for a month. So, a month from now I’ll come back to check on the Brodrick Madness ETFs and see how they did. But no matter how they do in the next month, I expect them all to do well in 2024.

That’s all for today. I’ll be back with more soon.

All the best,

Sean

P.S. I just got word that founder, Dr. Martin Weiss, and Juan Villaverde are hosting a special presentation in less than a week. On Tuesday, April 2, at 2 p.m. Eastern, they will discuss another megatrend. They are calling it a “superboom.” Click here to sign up for free.