|

| By Jon Markman |

Tech bears have waited 20 years for this moment.

Unfortunately for them, their time to profit from betting against innovators still hasn’t come back around.

That won’t stop them from trying, however.

They see a new opportunity to short software-maker Adobe (ADBE). Shares slid some 14% last week after the company reported record Q1 earnings with a caveat.

That is, next quarter’s revenues should fall shy of efforts as its AI operations sputter.

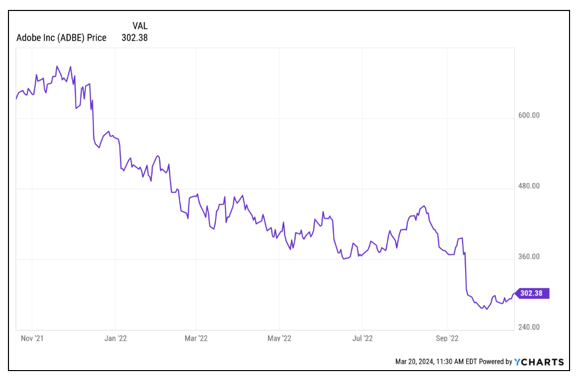

Bears see a repeat of the 2022 tech wreck, when Adobe shares shed some 58%.

They’ve been waiting a long time for this moment. Many have compared AI to the internet boom of the late 1990s, when enthusiasm about network connectivity pushed stock valuations into the stratosphere.

Reality set in during the early 2000s, and share prices came crashing back down to Earth.

It has been two decades since bears had the right stuff. That’s a long time between ticker tape parades.

The comparison to the Dot-Com Crash is dumb, for a variety of reasons.

As an investment theme, AI hasn’t even begun. Only a handful of firms are playing in this space, and those businesses are foundational.

They are building key infrastructure like specialty silicon, hyperscale data centers and the software platforms needed to integrate billions of bits of digital information.

These businesses — like Nvidia (NVDA), Microsoft (MSFT), ServiceNow (NOW) and others — are already incredibly profitable, and this is certain to grow.

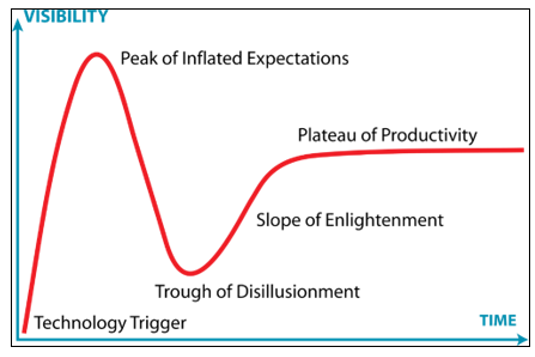

This is because the next phase of the AI hype cycle has not started.

There have been no high-profile IPOs, brash analyst calls or even evidence of mass investor euphoria.

There is no contemporary equivalent to the profitless Pets.com, Henry Blodget or surge of small investors quitting their jobs to trade Dot-Com Stocks. The opposite is true.

Analysts at Bank of America (BAC) revealed in February that fund flows out of stocks and into cash were running at an annualized rate of $1.3 trillion through Feb. 21.

As the S&P 500 crossed 5,000 for the first time, BofA researchers found that investors were more interested in defensive sectors such as energy, according to a report at Reuters.

This is why bears are so excited about the Adobe news.

Adobe is the publisher of the largest software platform for creatives. Its Creative Cloud is the industry standard.

Creatives produce, edit and send Photoshop and Illustrator digital files with the same ubiquity that office workers exchange Microsoft Word and Excel documents.

When the San Jose, California-based company announced Firefly, its AI tool, analysts immediately began raising sales and profit estimates.

Adobe was an early adopter. And adding AI to the industry standard seemed like an easy upsell.

Unfortunately for shareholders, adoption has been slower than expected.

Adobe execs expect sales of $5.25 billion to $5.3 billion next quarter. Analysts were looking for revenues north of $5.3 billion.

The lowered guidance puts growth at 9%. That’s lower than Q1, when the firm reached record sales of $5.2 billion, up 11% year over year.

Bears argue the lackluster reception to Firefly is the pin pricking the AI bubble.

Although this is an overreach, don’t be surprised if AI shares continue to trade lower in the near term as investors recoil. Many are still skeptical about AI and the tech rally in general. They are looking for reasons not to participate.

Thankfully for the rest of us, they are missing the point.

This is the infrastructure stage of AI deployment. This phase is about productivity and finding ways to eliminate enterprise costs. AI takes this to the next level.

As for Adobe, it has many things going for it besides AI, as evidenced by its record earnings. If and when it gets AI right, that should only enhance its business and, in turn, its share price.

In the meantime, the AI bulls may be missing an opportunity to profit.

That opportunity: to buy ServiceNow into further weakness for AI shares.

ServiceNow operates a cloud-based platform for enterprise workflow automation. The business is a land and expand proposition that usually begins with information technology management, and then evolves to enterprise service management.

ESM is a control center for all the departments of the enterprise, like human resources, customer service and others.

And all these departments fall under umbrella of Now — its single, unified, data-driven platform. Now is a single source of truth at the enterprise level … a place where chief financial officers can easily spot and eliminate waste.

The customer retention rate at ServiceNow is 99%, with net revenue retention at 125%.

On average, the customers remain loyal and choose to upgrade to new products and services. This competitive advantage should be enhanced by a November partnership with Nvidia to bring AI to the Now Platform.

If NOW shares continue to get swept up in the misconception about Adobe and AI in general, this could be a great time to get in.

All the best,

Jon D. Markman

P.S. Another way to play this short-term weakness in AI is to follow what my colleague Chris Graebe is recommending — invest in AI startups before they fall prey to market bears. Click here to check out how to do exactly that.