|

| By Sean Brodrick |

Gold zoomed higher for three weeks before cooling off again. You might wonder if the yellow metal is teasing us, or if this is the start of something bigger.

I’m in the “something bigger” camp. At the end of January, I made my case for why gold was about to rally. Gold rallied nearly 7% from there before giving back a bit — a normal and necessary part of any bull market.

Now, I have a few charts that say the next big move isn’t just coming … it’s nearly here!

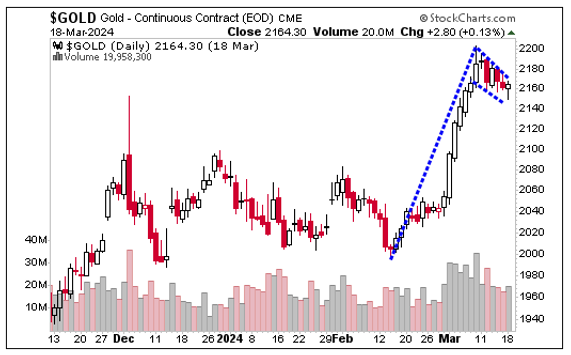

First, let’s look at this chart of recent gold price action.

You can see that gold rocketed for three weeks and is now giving some of it back. This sure looks like what’s called a “bull flag” pattern. And as the saying goes on Wall Street, “Flags fly at half-mast.” This gives us an INITIAL target of $2,409.60 on a successful breakout.

Longer term, I believe gold is in a two-year cycle — a cycle that should bring it to my target of $2,931!

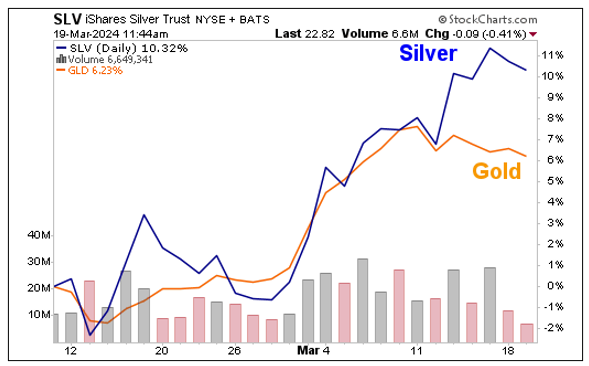

The next chart is a performance chart of silver and gold.

As you can see, silver is starting to outperform gold. That’s good because it’s what you expect to see in a bull market. Both metals have pulled back recently. But when gold breaks out again, they’ll both springboard higher, and silver will lead the way.

Waiting for a Catalyst

There is the list of usual suspects to drive gold higher: tight supply and demand, rising mining costs, central bank gold purchases, geopolitics and more.

Interestingly, hedge fund managers’ bullish bets on gold have risen to a two-year-high, according to Saxo Bank.

Still, the thing that drives gold the most, at least recently, is anticipation of Fed hikes and cuts.

Today, the Federal Reserve is announcing its latest rate move. Unless the market has entirely misjudged it, the Fed will stand pat, leaving its Fed funds rate unchanged at 5.25% to 5.50%.

What the market will be watching is comments from Fed Chairman Jerome Powell’s presser after today’s FOMC meeting to try and auger the future direction of Fed policy.

As I write this, the markets are pricing in a 60% chance of the Fed cutting its benchmark rate at its meeting on June 11-12. What traders glean from the Fed’s comments will push the odds of that rate cut around — and move gold along with it.

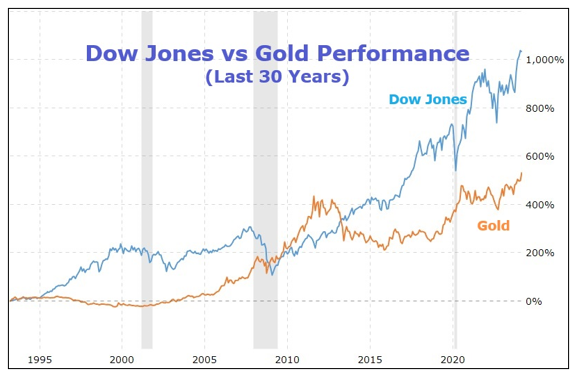

Now, the Fed might disappoint. That might cause gold to slide … in the short term. But I’ll also point out that gold is darned cheap compared to the overall stock market.

This chart shows the performance of the Dow Jones Industrial Average compared to gold over the past 30 years. The Dow is up 1,038%, while gold is up just 532% at the same time.

There was a period starting in 2008 when gold outperformed — and that was the last precious metals bull market. I strongly believe we’re entering a period like that again.

In January, I recommended the SPDR Gold Shares (GLD), an exchange-traded fund that holds physical gold and tracks the price movements in the yellow metal closely. It’s up nicely. But if we’re at the stage of the rally where silver is going to lead, you might want to check out the iShares Silver Trust (SLV). It holds physical silver.

If you followed along with my recommendation in January, you already have a golden ticket for the next precious metals rally. Now, a silver ticket might be even better.

And speaking of getting a golden ticket, my colleague Chris Graebe has found a startup that could disrupt a $4 trillion industry. I urge you to check out his full presentation on it right here. You only have a limited time, however. It’s getting pulled down from our site on Thursday at 12 midnight.

That’s all for today. I’ll be back with more soon.

All the best,

Sean