I’ve been writing to you every Thursday for nearly 18 months now. In that time, I’ve looked at stocks based on their sectors, industries and whether they pay a dividend. I’ve also looked at stocks that relate to a particular trend or news story.

In all that time, in all those different screens, we’ve seen some stocks with an “A” rating. But often, our highest rated companies fell in the “B” range.

Over that time, I have pointed out that we are seeing more companies with higher ratings. So today, I wanted to take a moment to see what the highest ratings look like as we move into 2022.

I simply entered into the stock screener that I wanted to see all companies in the “A+” to “B-” range. The result: 1,299 stocks. Nineteen of them are in the “A” range.

Let’s look at the top three rated companies:

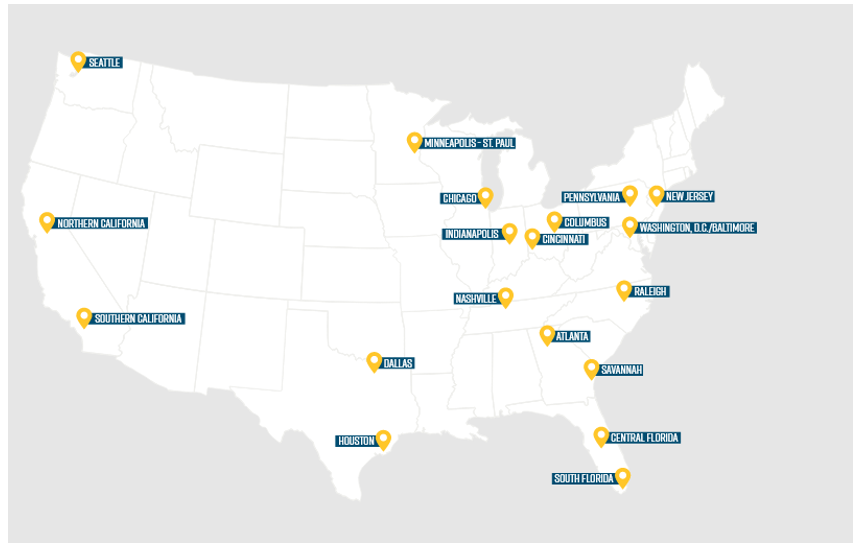

1. Duke Realty (NYSE: DRE) owns and operates approximately 159 million rentable square feet of industrial assets in 19 major logistics markets. Think high-quality warehouse and distribution spaces for companies of all sizes.

Source: Duke Realty

Source: Duke RealtyThe company has a history of being in the “Buy” range, but since the end of 2019, the company has managed to slip into the “Hold” range a handful of times. That’s where it ended 2020, and couldn’t get back out until August. DRE was recently downgraded from an “A+” to an “A,” but still holds at the top of the list.

Shares are up 25.2% over the past 90 days and 66% over the past year. The company also pays a quarterly dividend of 28 cents for an annualized yield of 1.6%.

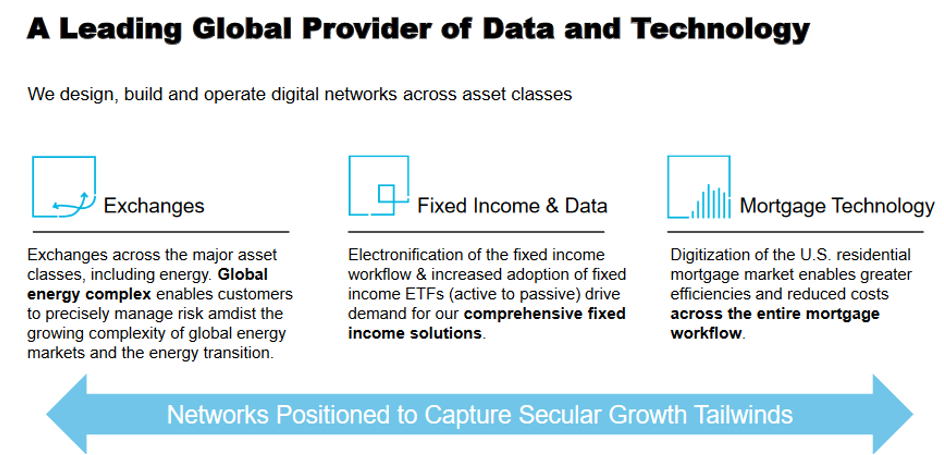

2. Intercontinental Exchange (NYSE: ICE) operates regulated exchanges, clearing houses and listing venues for different markets across the world. This includes commodities, financials, fixed income and equities. Geographically, the company services the U.S., the U.K., the E.U., Singapore, Israel and Canada.

Source: ICE investor presentation

Source: ICE investor presentationThe company has been in the “Buy” range since 2015. But that doesn’t mean the rating didn’t fluctuate. It’s held every letter from “A+” to “B-” over that time. Its most recent ratings change was on Dec. 30, when it was upgraded from a “B+” to an “A.”

Shares are up 14% over the past 90 days and 19% over the past year. The company also pays a quarterly dividend of 33 cents for a 1% annual yield.

3. Microsoft (Nasdaq: MSFT) is a company that needs little explanation. It’s a software giant that offers business and personal computing solutions. The company also offers PCs, tablets and gaming consoles.

The company has been labeled a “Buy” since 2014 for all but 90 days in 2016. The most recent upgrade was Dec. 27, when the company climbed to a solid “A” from an “A-.”

Shares up 7% over the past 90 days and 48% over the past year. The company also pays a quarterly dividend of 62 cents for a 0.69% annual yield.

Remember, this is just a quick look at the top three.

If none of these sound like a good addition to your portfolio, I highly recommend heading over to the stock screener to see what other companies have received recent upgrades.

Best,

Kelly Green