|

| By Gavin Magor |

Hi, Gavin here with another heed-worthy warning.

I guess I can’t blame Federal Reserve Chair Jerome Powell for downplaying the impact on banks from holding excess commercial real estate — or CRE — loans last week when he addressed the media.

He said that banks might experience losses, but it’s unlikely to threaten the broader financial system.

I get it. It’s part of Powell’s job not to stir the pot or rattle the markets and keep optimism high regardless of the real story.

However, my job as director of research and ratings at Weiss is to be as clear as possible with you when my team comes to me with data that requires a stern warning.

That’s because we don’t want to see even one person inconvenienced, stressed out or lose money if we can raise a red flag to prevent it.

That’s why I wrote to you more than two weeks ago about the CRE/banks’ issue, including a list of banks we considered to be in potentially serious trouble.

I’m not going to go into details, because, frankly, that’s old news. But if you haven’t read it, please be sure to do so.

Today, I want to share new, potentially alarming data with you that adds …

Even More Pressure

on Banks

And I’m a bit surprised that Powell didn’t raise the issue last week. After all, this next situation is right in his wheelhouse. It involves the resolution of the debt ceiling and continued monetary tightening — and I’m not talking about interest rates.

This definitely requires a red flag because I don’t want you to be blindsided in case your bank is at risk and/or the new issue creates systemic shock. If Chicken Little were involved, he’d be running around the street yelling, “The flood is coming, the flood is coming!”

Let me explain.

Before the U.S. government “solved” the debt ceiling crisis earlier this month, it had to dip into its reserves to help fund itself. As a result, the Treasury kicked off a “borrowing spree” to replenish its cash balance by auctioning $1.3 trillion in Treasurys by the end of Q3.

Buyers taking advantage of this flooding of liquidity will include domestic and foreign banks, money market funds, pension funds and people like you who want to take advantage of attractive rates and short maturities.

It makes perfect sense for clients holding cash or liquid assets, who are making less than the auctioned Treasurys would, to jump at the opportunity. But if too many jump, it could be disruptive.

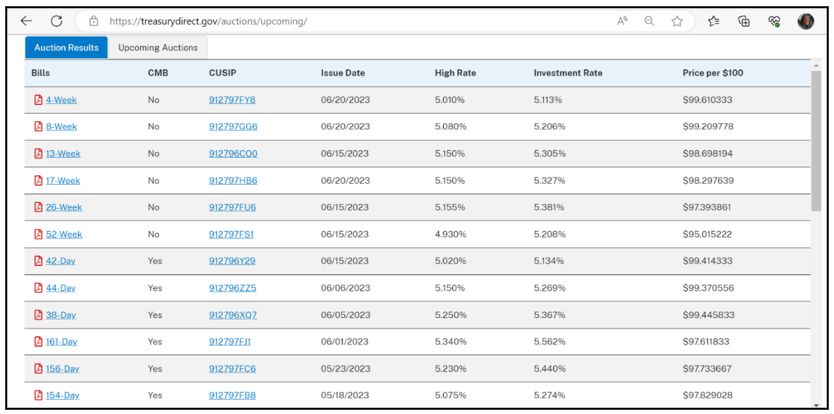

Below is a list of auctions that took place thus far in June and the juicy yields available:

Click here to see full-sized image.

Another capital flight akin to what we saw with regional banks, and the potential fallout for CRE loan-heavy banks, just exacerbates current challenges and brings a looming liquidity aftershock into the equation.

So, take a look at the list below. It includes 10 banks with at least $100 billion in assets and a 90% or more ratio of loans and held-to-maturity securities. That makes them particularly vulnerable to further drops in deposits.

Click here to see full-sized image.

If your bank made the list, be sure to go to Weiss Bank Ratings and check out all the data we compiled, any upgrades or downgrades, etc., so you can make an educated decision about what to do. If yours didn’t make the list, you call still refer regularly to our ratings for any updates.

Keep in mind that sometimes we may warn you about issues that never play out, and that’s how we always hope it goes. Our goal is always to protect the consumer and not the bank. And the best way to accomplish that is to err on the side of conservativeness and trust our research and ratings.

One more thing … if you’d like to help “bail out” the government and pad your pocket at the same time, go to the TreasuryDirect website to find a list of upcoming auctions and how you can participate.

Until next time …

Gavin

P.S. Speaking of juicy yields, my colleague Sean Brodrick’s service, Wealth Megatrends prioritizes portfolio positions that focus on dividend payers and dividend raisers. In this environment, if you’re seeking safety and income, Sean’s service is for you. Click here to learn more.