|

| By Sean Brodrick |

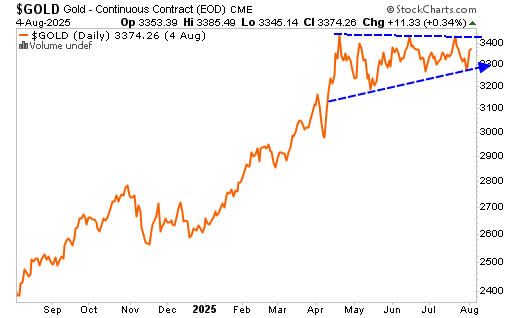

Gold is coiling up for a major breakout.

After a powerful surge from under $2,500 to over $3,300 in the past year, the yellow metal has formed a textbook ascending triangle.

I’ll show you it in a moment. First, here are the parameters.

The top of this triangle, around $3,400, has held for months.

But the floor keeps rising, with buyers stepping in at higher and higher levels.

That rising support line is a clear signal of increasingly aggressive accumulation.

This type of setup often ends with an explosive move to the upside.

When gold breaks above $3,400 with conviction, it will trigger the next leg of its bull run.

Meanwhile, U.S. debt is ballooning, central banks around the world are buying gold with both hands and other long-term forces I’ve pounded the table about are still in place.

Now, let me show you five specific drivers that make this moment especially ripe for gold investors.

Gold Driver No. 1: The Fed Is Cornered

Markets are pricing in nearly an 89% chance of a rate cut at the September FOMC meeting.

After the latest weak jobs report, traders are now betting on three cuts between September and January.

That is a full quarter-point reduction at three of the next four meetings.

While three cuts seem optimistic to me, what matters most in the short term is sentiment. And sentiment favors lower rates.

Lower rates tend to weaken the dollar, and a weaker dollar is rocket fuel for gold.

President Trump has pushed for rates to be three percentage points lower than today’s 4.25% to 4.5% range.

His pressure campaign includes frequent attacks on Fed Chair Jerome Powell, whom he has publicly called “a numbskull” and “a moron.”

With Trump poised to remake the Fed with new appointments, and with at least two of his appointees already dissenting in favor of rate cuts, the institution may be tilting in a direction that will favor gold over the coming months.

Gold Driver No. 2: The Job Market Is Cracking

One reason the Fed could soon be forced to act is weakness in the labor market.

The most recent jobs report was dismal.

Nonfarm payrolls rose by only 73,000 jobs, far below expectations of 104,000.

Worse, the May and June numbers were revised downward by a combined 258,000 jobs. That is a massive revision.

Trump claims the data is manipulated and has fired the head of the Bureau of Labor Statistics.

Reality: The labor market is stalling out.

A deteriorating job market could force the Fed to cut rates, regardless of inflation.

Gold Driver No. 3: The Dollar Is Losing Ground

The greenback has fallen nearly 9% against a basket of major currencies.

At one point earlier this year, it was down more than 10%. While the dollar has bounced slightly, the trend remains down.

This is important when you look at a performance chart of gold and the S&P 500 over the past year.

At the bottom of the chart, I’ve put the S&P 500 priced in gold terms rather than the usual dollar terms.

If you price the S&P 500 in ounces of gold rather than in dollars, the index has lost value over the past year.

This means while nominal stock prices are up, their real value is eroding.

That is a flashing red warning for investors relying solely on equities for returns.

Does this mean you should sell your stocks? Heck, no!

But you sure better hedge with gold against a weakening U.S. dollar.

Dollar weakness is not just about interest rates.

Political risk, fiscal chaos and tariff-driven inflation are all part of the story.

Trump’s tariffs are raising consumer prices.

His pressure on the Fed may shake confidence.

And his desire to weaken the dollar to improve the trade deficit brings back memories of the 1985 Plaza Accord, which triggered a 48% drop in the dollar.

Some analysts are modeling what they call a “Mar-a-Lago Accord,” projecting a 20% dollar depreciation and a surge in gold toward $5,000 an ounce.

Turbulence in bond markets and doubts about U.S. fiscal credibility only add fuel to that fire.

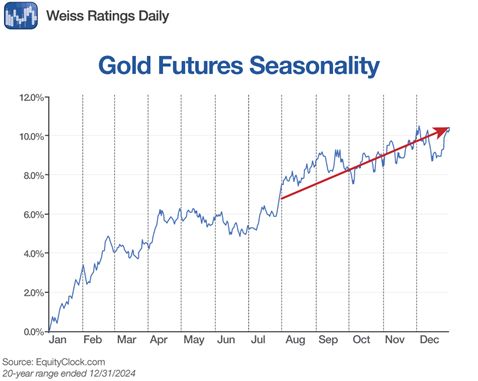

Gold Driver No. 4: Seasonality Points to Higher Gold

There is another reason to be bullish, and it has nothing to do with politics or macro data.

Seasonality. Historically, gold tends to perform well in the second half of the year.

We are now entering that strong seasonal window.

This pattern, combined with an already bullish technical and macro setup, could give gold the push it needs not only to break out, but to run like a raging bull.

If gold punches through $3,400, it could attract a wave of fresh buying from both institutional and retail investors.

Gold Driver No. 5: $4,100 Is the Next Stop

My intermediate-term target for gold is $4,100 an ounce. That would be a move of over 20% from current levels.

In the longer term, I continue to target prices above $6,000 an ounce during this bull run.

Debt is exploding. The dollar is wobbling. And trust in the integrity of economic data is eroding.

In that kind of environment, gold remains the ultimate safe haven.

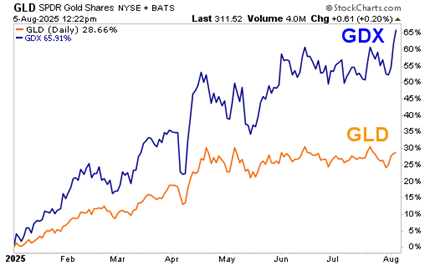

And let’s not forget the miners.

If gold breaks out, companies leveraged to rising gold prices could see outsized gains.

A 20% rise in the gold price could translate into 50% to 100% gains in some quality producers and developers.

How You Can Play It

Buying the SPDR Gold Shares (GLD) or iShares Gold Trust (IAU) for that 20% move is a fine way to play it.

But you’ll probably get more bang for your buck with the VanEck Gold Miners ETF (GDX).

The GDX has already doubled the performance of gold and the GLD so far this year.

I believe the gains for gold miners going forward could be extraordinary.

So, the GLD is good. The GDX is better. But select individual gold miners are the best.

If you want my absolute favorite gold (and silver) miners to play this next leg up, check this out.

All the best,

Sean