|

| By Karen Riccio |

People are more obsessed than ever with losing weight. It’s also never been easier and more convenient to do so.

Maybe you want to shrink your waist, so your jeans don’t fit as tight. Or you’ve reached an unsafe milestone, and the doc orders you to drop 50 pounds. Perhaps as a diabetic, maintaining a consistent weight is a big part of treatment.

For decades, we dreamed of a magic bullet, a one-a-day, melts-the-pounds-away solution for the overweight and obese. That’s now somewhat a reality thanks to two leading anti-obesity drug makers: Eli Lilly (LLY) and Novo Nordisk (NVO).

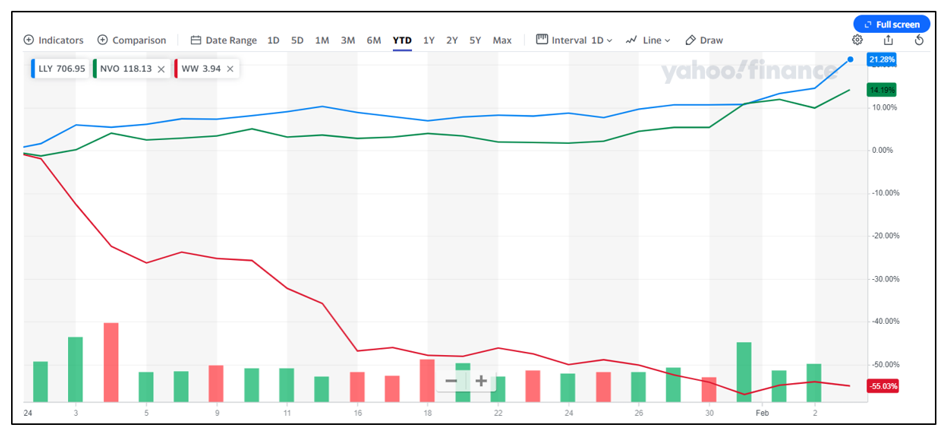

You can see in the below chart how the drugs’ popularity ties directly to the momentum gained in LLY and NVO. However, investors in old-school weight-loss programs offered by the likes of Weight Watchers’ (WW) are losing faith … and worse.

Most of the weight-loss drugs currently available are used primarily to treat diabetes, but their ability to suppress appetites also makes them viable for fighting obesity.

As such, Big Pharma (and new, smarter biotech firms eager to make their own splash) are benefiting from powerful tailwinds behind the trend.

On the other hand, WW (known formally as WW International) is facing stiff headwinds. In fact, Weiss Ratings just downgraded the stock to an “E+” on Jan. 29. That means it doesn’t belong in your portfolio.

I suspect general fitness-related stocks and even retail pharmacies might falter as well should diet and exercise continue to take a backseat to drugs.

There’s no reason to think these preferences will change. I’d say one of the biggest hurdles for mass acceptance is the need to administer the drugs intravenously. Only one weight-loss medication of its kind currently comes in pill form — Rybelsus, made by Novo.

I’m sure it’s just a matter of time before pills are commonplace and become the easiest and quickest way to shed pounds.

It sure beats the “no pain, no gain” mantra prominent for many decades. Or, in this case, “no pain, no loss.”

Dropping pounds required being drenched in sweat from around-the-clock cardio exercises and resisting carb cravings, while on a brutally strict 1,200-calorie diet.

For the better part of its 60-year history, Weight Watchers served a major purpose for loyal, wellness-focused followers who needed a strict plan … or required hand holding and regular monitoring to meet their goals.

A regimen of tracking food, conducting frequent weight checks, altering unhealthy lifestyles and group meetings drew praise from members. Success stories were a dime a dozen.

The company’s membership hit a record high 5.03 million at the end of Q1 2020. One year later, it dropped to 4.2 million. By 2022, membership slimmed to 3.5 million, primarily attributed to the pandemic and subsequent economic slowdown.

Short-Lived Spark for WW

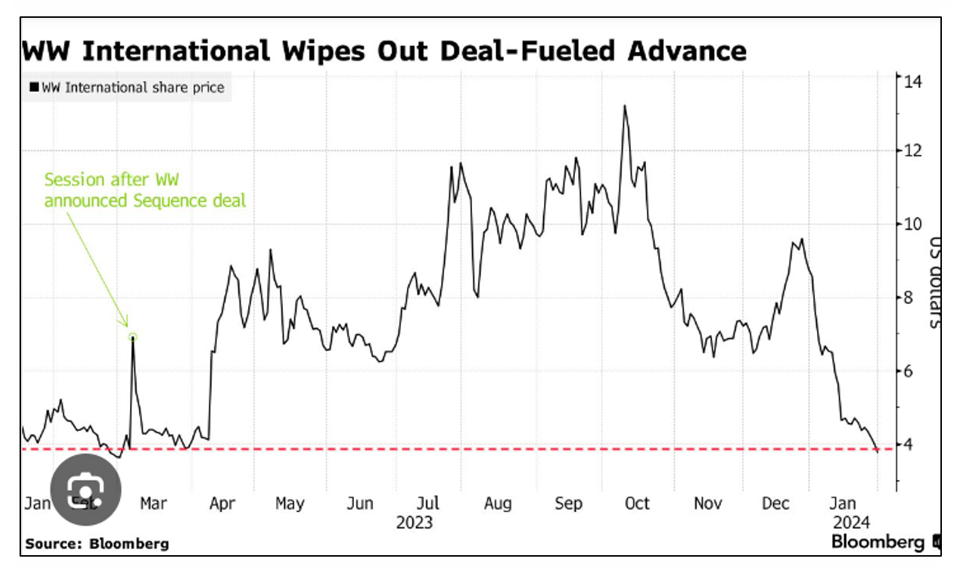

An unlikely and ironic spark reignited interest in the company (and stock) on March 7, 2023.

That day, WW announced that it had struck a deal for Sequence, a telehealth platform that offered prescriptions to weight-loss drugs like Novo Nordisk’sOzempic and Wegovy, which were just gaining attention from the masses.

At first, shareholders applauded the move and a potential turnaround in the company’s business with the biggest one-day gain since 2015. By the end of 2023, shares gained 127%.

The enthusiasm was short-lived, however, as proponents of Weight Watchers soured on the partnership with Sequence. Many saw the company’s shift from wellness/lifestyle strategies to a medicinally based weight-loss strategy as contrary to its principles and, therefore, a negative force.

As a result, WW suffered a 57% loss in January as concerns about a shrinking subscriber base weighed heavily on investors … and probably will continue to well into 2024.

That’s because these modern-day miracles won’t go the way of highly controversial diet drugs like Fen Phen. Deemed the magic bullet of the 90s, the FDA yanked it after two years on the market, when studies linked the drug to heart disease.

Though today’s drugs work similarly to Fen Phen in that they suppress appetite, no life-threatening side effects have been reported.

New Sales Model Becomes Key

The combination of safety and Eli Lilly’s recent and unusual foray into the supply chain bodes well for profits far into the future.

You see, Eli Lilly started a direct-to-consumer online service in late December 2023 that offers telehealth prescriptions and direct home delivery of its new anti-obesity drug Zepbound — the hottest of its kind today.

The ability to eliminate or reduce the middleman’s role (pharmacies) allows Eli Lilly more control over supplies and distribution. The service also eliminates the need for a doctor’s visit and trip to the nearest CVS (CVS). More pharmaceutical companies following suit could even deliver a blow to retail pharmacies.

Amid all the excitement, the makers of weight-loss drugs conveniently jacked up the already high-priced medications. For example, a monthly supply of Ozempic, a diabetes treatment also used to lose weight, rose by 3.5% to nearly $970.

Eli Lilly’s Mounjaro, also a diabetes drug used widely for weight loss, climbed 4.5% to almost $1,070 a month.

The biggest challenge for Novo Nordisk and Eli Lilly (it’s actually a good thing) is making enough supplies to meet the enormous demand.

With obesity also on the rise, demand should sustain and strengthen. In fact, more than half of the global population is forecast to be overweight or obese by 2035, compared to 38% in 2020, according to the World Obesity Atlas.

Despite the number of drugs available, they’re far from perfect. Although no life-threatening side effects have been reported, users can and often suffer from nausea, diarrhea and vomiting.

Plus, many patients must stay on the drugs for life to keep the weight off, and the long-term impacts of these treatments remain unknown. For many folks, prices also make the drugs cost-prohibitive. Europeans don’t seem to mind much, though. Eighty percent of users in that part of the world pay 100% of costs out of pocket.

How to Profit from the Next Wave

It’s obvious to me that the $100 billion global anti-obesity drug market Goldman Sachs (GS) Research expects by 2030 (16 times higher than today) definitely needs more players dedicated to improving the drugs we already have.

While there’s no shortage of stock investment opportunities, some of the biggest opportunities lie with startups looking to fund their visions for better, safer, cheaper and smarter weight-loss drugs.

The addition of AI into the drug-development equation makes me wonder just how magical the next wave of these weight-loss meds will be as we usher in a new “digital biology era.” That’s the term used by a company intimately linked to AI — Nvidia (NVDA) — to describe this new approach by biotech firms.

As I write, dozens of under-the-radar companies are developing their versions of weight-loss drugs. And it’s likely we’ll see more of them entering trials and seeking approval as demand skyrockets.

Some may be in different stages of development (the company and drugs), but investing in an ambitious, pre-IPO team riding a huge trend can be highly profitable.

Kimberly Powell, the VP of healthcare for chipmaker Nvidia, declared during a presentation to JPMorgan Chase (JPM) that, “Accelerated computing and AI make this digital biology era possible. This will be what helps build the world’s first trillion-dollar drug company.”

And I know just the person for finding startups on the path toward eight-figure success and how you can tap into them. My colleague Chris Graebe, editor of Deal Hunters Alliance, is a rock star in identifying lucrative venture capital investment opportunities.

It just so happens that Chris is gearing up to announce the name of the next startup he’s chosen for his subscribers. You can join him ahead of time by clicking here.

Until next time,

Karen Riccio