|

| By Kelly Green |

I ended up in Florida seven years ago when the publisher I worked for moved me to its South Florida office.

Now, a year later, I'm not just still in the Sunshine State, but I'm only 1.5 hours from the most magical place on Earth.

I finally decided to take the offer of a local resident pass and disappeared for a mini vacation on Monday.

Apparently, I wasn't the only one with this idea. I wish I took a picture of the seas of people we encountered throughout the day so that you could have seen it.

It reminded me of the pre-pandemic world.

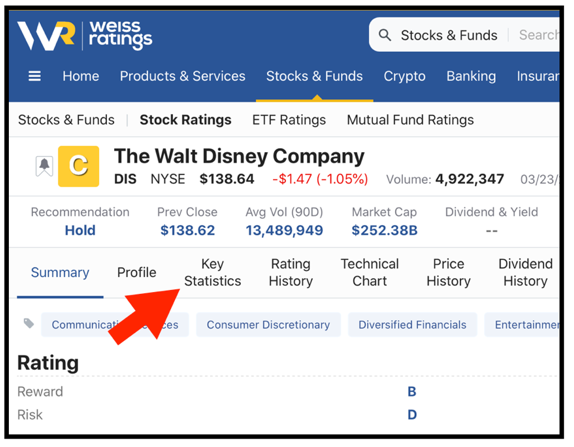

The Walt Disney Company (DIS) is a company that I've been following for years since it has historically paid a dividend.

In 2020, it became one of the many companies that decided to suspend its dividend, but I've still been checking in on the stock.

In the past, the company managed to hold in the "Buy" range for long stretches of time and would occasionally fall into the "Hold" range.

Recently, the company has maintained a "Hold" status and even fell into the "Sell" range on four separate occasions. It's latest upgrade in February saw the company move from a "C-" to a solid "C."

This most recent upgrade was due to several increases including net income, earnings per share (EPS) and earnings before interest and taxes (EBIT).

- If we can see one more increase, it might be an indicator that shares are headed back up to the "Buy" range.

But right now, shares are down 10% year to date and 26% over the past year.

The company is a lot more than just the theme parks. So the crowd I saw isn't really the best indicator of Disney's recovery.

- But it did get me thinking about if it's time to put money back into travel stocks.

And I do have a favorite indicator from the Transportation Security Administration (TSA) when it comes to travel numbers. Take a look:

The TSA publishes the number of people who have passed through its checkpoints on any given day. It also shows the numbers on the same day for 2021, 2020 and 2019. The idea is that 2019 is a pre-COVID baseline.

- A quick look at the chart shows we are consistently seeing numbers higher than last year and only a few hundred thousand behind the pre-COVID count.

And on Feb. 25, the TSA saw 2,098,325 people total … more than the 1,861,286 seen in 2019. It still was not quite as high as the 2,441,643 on the same day in 2020, which was before the pandemic shutdown.

- The travel recovery is moving forward. But that doesn't necessarily mean that companies are recovering … yet.

Across the board, companies in all industries are still seeing supply chain delays, staffing shortages and higher input costs.

That's why I recommend using the WeissRatings.com stock screener.

You can quickly use the Key Statistics tab to see a company's most recent numbers and how they compare to the industry average.

Plus, the Ratings History allows you to quickly see if a company is moving up the ratings … or moving down.

Are Airlines Taking Flight?

Let's look.

1. Southwest Airlines (LUV) is the only airline I found that was not still in "Sell" territory. The company was upgrade into the "Hold" range back in November and then again to a solid "C" in February.

The most recent rating change came with the note that EBIT and income both increased. The growth index, efficiency index and solvency indices all saw improvement as well. Just before the full shutdown in 2020, the company held a "C+."

So, it's worth noting that LUV has made improvements in that direction. But what about share prices?

Shares saw a run-up at the beginning of last year when it seemed that travel might be recovering.

- But over the past year, shares are down 27% and lower than pre-COVID levels.

If the stock's rating goes up again, I would consider buying at a discount. But for now, I'm going to add this one to my watch list. That way, I'll be alerted the next time the rating changes.

2. Delta Air Lines (DAL) is consistently ranked as one of the best airlines by numerous sources. It tends to have the most on-time departures and the least percentage of cancellations. It's also the oldest airline from the U.S. still in operation.

Prior to the COVID-19 shutdowns, the company was hanging out in the "Buy" range with an occasional drop to "Hold." In February 2020, it was sitting at a "B-."

The past year hasn't looked anything like that. The company was even downgraded to an "E+" last November but quickly jumped back to a "D."

- Out of all the companies I looked at, Delta was the highest rated before the pandemic.

So, I think I'll add this one to my watch list, too.

If it can start to climb the ratings, it might be a solid moneymaker going forward. But right now, shares are still trending in a downward direction overall.

DAL did look like it might have found a recovery point around the beginning of the year, but then it became a victim of the overall market dive caused by global political unrest. Shares are down 15% in the past 90 days and 22% over the past year.

3. American Airlines Group (AAL) has been around almost as long as Delta, with its roots dating back to 1927. The actual company was created in 1934 when businessman E.L. Cord combined three airlines under the name American Airlines.

- But longevity doesn't necessarily make something a good investment.

AAL was barely hanging on with a "C-" before the COVID-19 shutdowns moved it into the "Sell" range.

It hasn't even been able to make its way back up to the "D+" it received in April 2020. A quick look suggests the company hasn't seemed solid since prior to 2019. Unless it can see two more upgrades, this company isn't worth a second look.

And investors are noticing that as well.

Shares are down 24% over the past 90 days and 31% over the past year. Plus, it suspended its dividend in 2020.

If you managed to buy shares of these companies at the March 2020 bottom and sell sometime in the beginning of 2021, you could have made some money. But timing the market like that takes discipline and luck.

Instead, I want to build a solid portfolio that will continue generating gains for me for years to come.

Weiss has devoted the past five decades to helping regular investors build their wealth and protect it from the inevitable turmoil of the markets.

But what's likely to engulf the Western world could be far worse than anything we've faced before.

The same, time-honored cycles that predicted the Great Depression, and helped us forecast nearly every major market move since 1987… now warn of a disaster of biblical proportions.

Our founder, Dr. Martin Weiss, strongly urges you to read this to help grow and protect your wealth before it's too late.

I want my money to stay safe (and not in the bank where it's losing money against inflation).

That's why I appreciate the ease of the Weiss Ratings.

Best,

Kelly Green