|

| By Martin Weiss |

Last week, in the first of this two-part series, I described ominous parallels between the 1920s and the 2020s.

Not just in the stock market and the economy, but also in nearly every facet of our existence …

The influenza pandemic of that era killed over 10 times more people than World War I … and … the Covid-19 pandemic killed over 10 times more people than the wars of Iraq and Afghanistan.

Severe famines and mass migration in Russia and China back then … severe famines and mass migrations in Africa and South Asia today.

Plus, culture wars: In the 1920s, it was the battle between feminists and anti-feminists. That was ugly. Plus, it was the big battle for and against prohibition. That was even uglier.

Today’s culture wars aren’t just ugly. They’re downright dangerous.

So I asked …

What other parallels do you see?

What are the invisible forces lurking beneath the surface?

Most important, what are you doing to prepare?

One reader wondered if the “Uniparty (Democrats, RINOs and globalists), in lockstep with the World Economic Forum, are planning The Great Reset.”

Another seemed to be in despair. She’s running out of money long before she might run out of life, and the cost of long-term care at a home is about four Social Security payments per month.

I notice that many are also scrambling to find some quiet place on Earth where they can live without fear.

But what are the invisible forces?

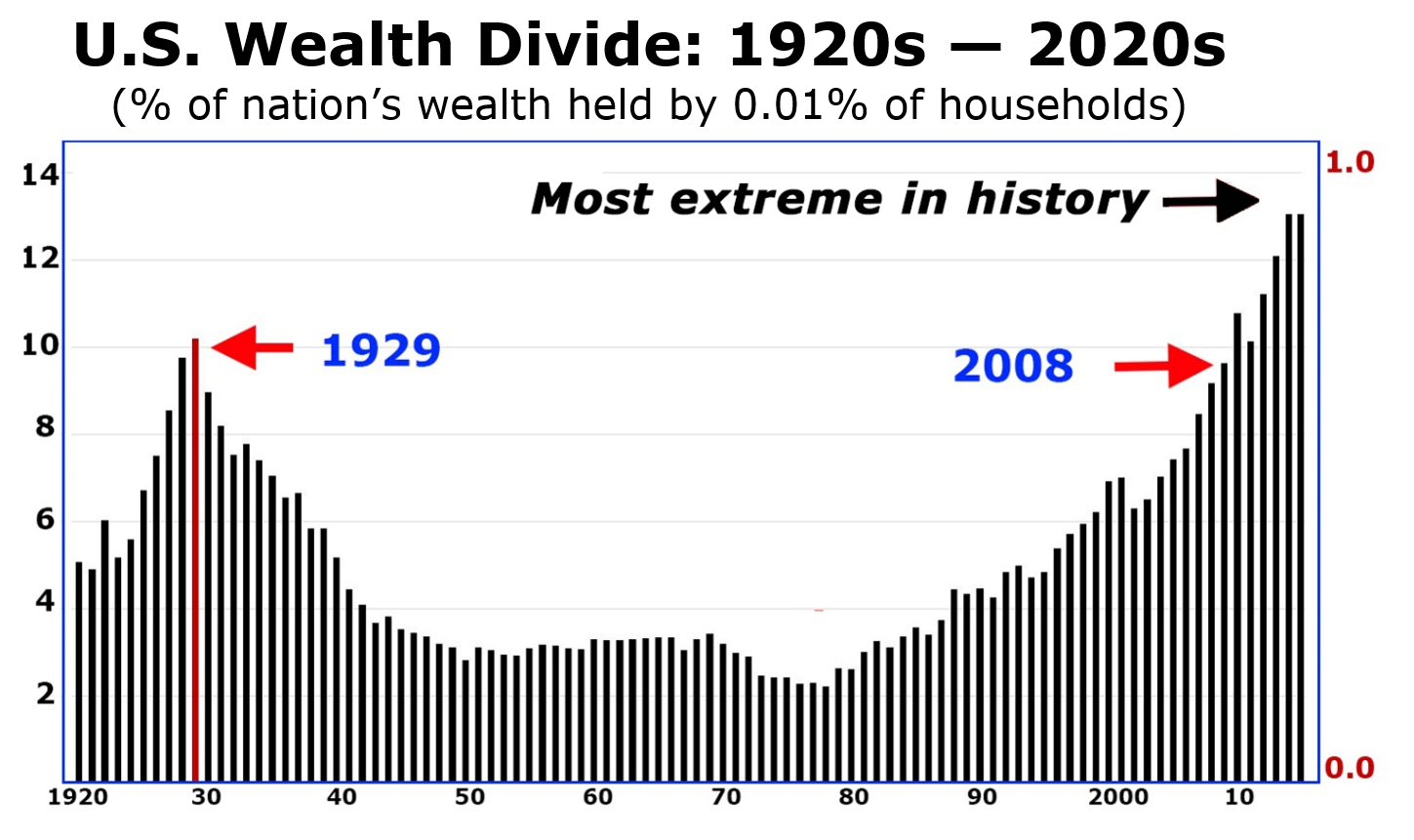

It starts with money. In the mid-1970s the ultra-topmost tier of American society controlled about 2% of America’s wealth. Now, their share has ballooned to about 14%.

This means their share of the asset pie had grown more than sevenfold.

This is not just a problem for the poor. Nor is it an issue limited to the nation’s middle class. It also prevents high-net-worth investors from getting their fair share of the pie.

Billionaires are shoving out the millionaires. They have controlling interests of the nation’s big corporations. Those companies, in turn, have gained controlling interest over the D.C. elite.

How does this impact investors like you and me?

Well, the billionaire CEOs bought back massive amounts of their own shares. Then they cut back sharply on the dividends they pay out to average shareholders.

And this is just one of the ways that billionaires have been able to squeeze out millionaires.

Another way is via the great monopoly of megabanks and the massive subsidy they get from the Fed in terms of ultracheap interest rates.

You want proof? OK ... the chart below gives you proof. Follow along with me, and you’ll see what I mean.

In the Roaring 1920s, the top tiers of society (the richest 0.01%) were gaining rapidly. Their share of the nation’s wealth doubled from 5% in 1920 to a peak of 10% in 1929.

Starting with the Crash of ’29, however, the top tiers began to suffer big losses.

Indeed, the years that followed were the only years in modern U.S. history that we witnessed a very significant — and long-lasting — decline in the power of the top elites.

So in the 1970s, their dominance of American wealth reached an all-time low.

But from that point forward, each period of growth and each economic crisis merely hastened the rise of the billionaires and accelerated the decline of nearly all others in society, including the millionaires.

The next critical point in history is 2008. This was the first year when the financial power of America’s elites matched the peak levels of 1929.

In other words, in 2008, elite power in America was close to what history said was a breaking point. And not coincidentally, that was also the year of the Great Financial Crisis.

Trouble is, everyone seems to think the Great Financial Crisis was so bad and so dangerous that the government absolutely had no choice but to come to the rescue.

The U.S. Treasury, they say, had no choice but to bail out the banks.

The Federal Reserve, they say, had no choice but to print money by the trillions.

They all agree. But I don’t. I never did and never will.

I don’t think historians of the future will, either.

Sure, the government “saved” the economy.

But it doomed America as we know it.

What really happened?

The first thing that happened was that, in the wake of the Great Financial Crisis, the ultra-elite’s share of the nation’s wealth surged to new, all-time highs, never before witnessed in the United States.

Billionaires got richer. A lot richer.

One factor was TARP — Troubled Asset Relief Program — the U.S. Treasury’s bank bailouts. It made big banks fatter, while small banks disappeared. It created a massive quasi-monopoly among the nation’s top five megabanks — JPMorgan Chase (JPM), Citigroup (C), Goldman Sachs (GS), Bank of America (BAC) and Wells Fargo (WFC).

But the stats don’t lie. Right now, these five banks represent less than one-thousandth (0.1%) of all the commercial banks in the United States. But they control almost half of all U.S. bank assets.

What’s more, they hold 94% of all bank-owned derivatives, probably the single most important trading vehicle in the banking industry.

All this helps boost the fortunes of their CEOs, their highly bonused traders and their biggest corporate clients.

And this extremely narrow control of banking assets is just one factor that has created a small number of powerful billionaires.

Another, even bigger factor has been the Fed’s relentless, nonstop push for near-zero interest rates.

Zero interest rates smashed income opportunities for average investors and retirees.

It made it easy for high rollers to borrow money for high-risk, speculative gambits.

It helped drive even more wealth share into the hands of the billionaires.

End result: As we begin to hear the drums of world war, America is increasingly torn by a great social — and cultural — divide.

Regardless of one’s social status, it should come as no surprise when this social divide fuels powerful emotions of pride and shame, greed and envy, fear and anger.

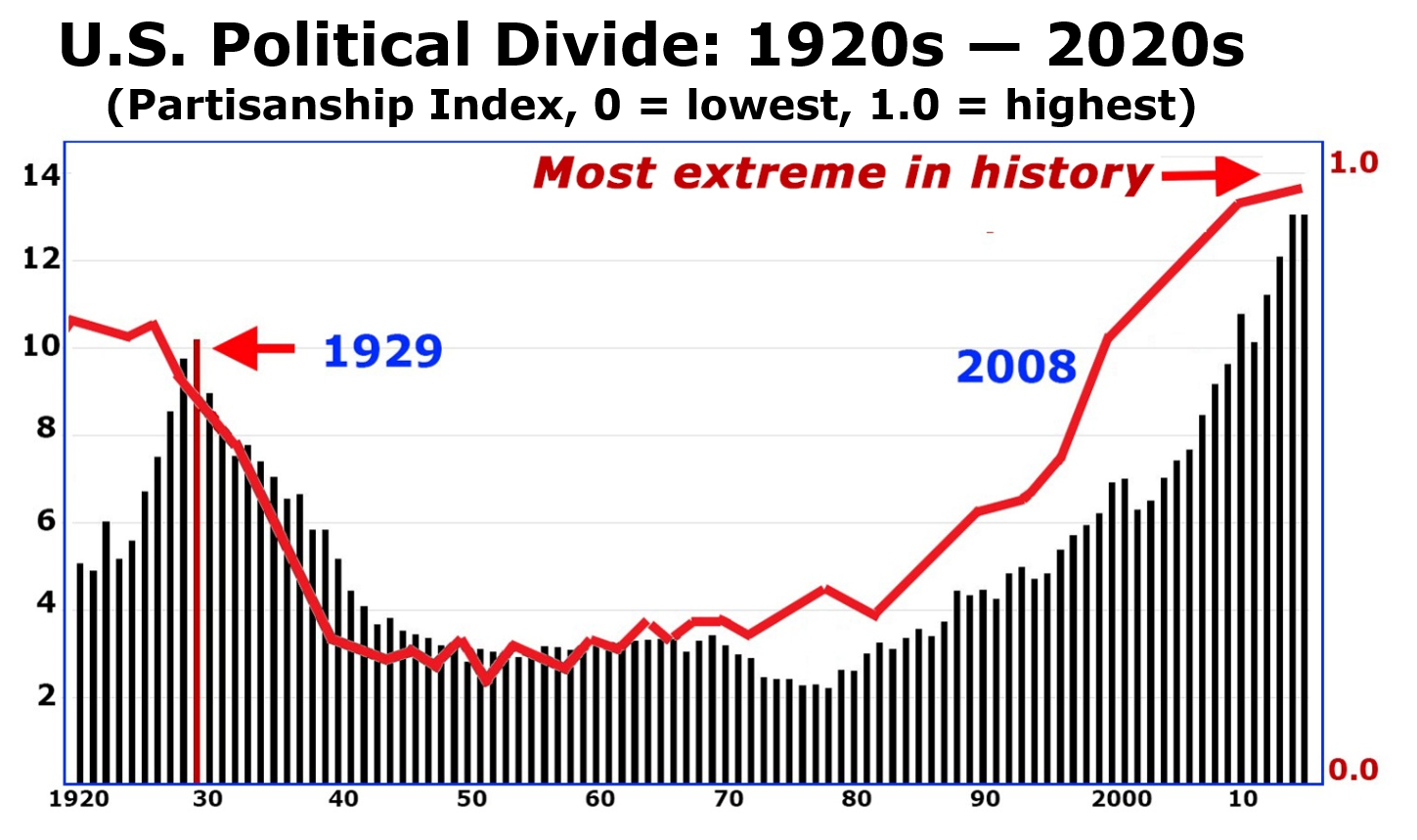

And regardless of one’s political persuasion, it should also come as no surprise that so much control in the hands of billionaires has come with extreme polarization in the politics of nearly everyone.

This chart is based on an exhaustive study of voting patterns in the U.S. House of Representatives.

I call it the Partisanship Index; and the higher the number, the more extreme it is:

- When the red line in the chart is lower, it means that Republicans and Democrats are voting more by the issues, crossing party lines and drafting new legislation together.

- When the red line is higher, it means they are disregarding the substance of the issues, voting strictly along party lines, getting almost nothing done and generally throwing bricks at each other.

That’s what began to happen in the 2010s and is really hitting hard right now.

They used to call it “Gridlock in Washington.” I call it “War in Washington.”

Again, the single biggest factor is big money. Cash flooded into the political process like never before, especially in presidential campaign financing.

The second biggest factor is fake, hyper-partisan news, which floods into the computers and mobile devices of millions of Americans via social media.

It creates confusion. It blurs the distinction between news and raw opinion, fact and fantasy. It creates a kind of fun-house effect that leaves the reader doubting everything, including real news.

And it raises the political temperature to a boiling point.

All this is bubbling up to extremely partisan politics in Washington, especially in the two houses of Congress, pushing up the index shown in the chart.

Has this index ever reached such extremes before?

Yes, but only once. It was during Reconstruction following the Civil War, the most turbulent and controversial era in American history.

Back in 1879, this index was at its highest ever recorded, at 0.79 (on a scale of zero to 1).

That was very bad. But the same index today is even worse, at 0.97.

This doesn’t augur well for resolving massive deficits in the federal budget, Social Security, Medicare or veterans’ benefits.

Nor does it give us much hope for the kinds of changes we’d like to see for America and for children.

Quite to the contrary, it sets us up for an involuntary, market-driven realignment of wealth and power.

Could it be similar to the one that helped trigger the Crash of 1929 … turned into the Great Depression … and created the conditions for the most destructive war of all time?

Or will it take us on a different path?

And what about us? What about our children and grandchildren? Where will we be during this period of turmoil that inevitably follows? Where will we wind up when the dust finally settles?

The answer depends on the critical, history-changing decisions we make today.

So, be sure to read the insights our editors provide each day. They will do their best to guide you.

And so will I.

Good luck and God bless!

Martin