|

| By Chris Graebe |

With all eyes on the WNBA draft last night — and where the recent superstars of this year’s most-watched Women’s March Madness landed — we need to acknowledge a reality … one that could impact your own portfolio.

Careers for professional athletes may be lucrative and personally satisfying, but most are also short-lived.

On average, players last 3.3 years in the National Football League. Careers in the National Basketball League go on a little longer. And for Major League Baseball, players take the field between three and five years.

It’s rare for pro athletes to play more than five years because of their small window of big paydays before their bodies break down … or they get cut from the team — two potential and premature career-ending events.

In fact, nearly 80% of professional athletes will go broke after three years of retirement. That’s why we’re seeing a lot of athletes looking beyond the game and into the future.

Many are taking steps to change that statistic by turning to startup investing. As you may know, several prominent athletes have invested in some of the biggest startups on the planet.

L.A. Lakers’ Steph Curry invested in Pinterest. Tennis pro Venus Williams invested in the United Fighting Championship. Former Laker Shaquille O’Neal invested in Alphabet (GOOGL), Big Chicken and so many more. LeBron James invested in Beats by Dr. Dre and Blaze Pizza. Carmelo Anthony invested in DraftKings (DKNG), Lyft (LYFT) and Casper Mattress.

The smartest athletes understand that they have to leverage their time in the spotlight. They have thousands upon thousands of followers on social media and play in packed arenas nearly every single night.

They’re like walking billboards with eyeballs on them whether they’re on the bench or in the game.

As a result, they’re often approached by companies seeking funding and recognition. But the coolest part is when they land paid sponsorships to talk about the very startup they just invested in.

The other benefit to being on a team, regardless of sport, are the connections pro athletes make and the opportunities that often fall in their lap as a result.

One of the wisest athletes to understand the power of a personal brand and being in the spotlight was none other than former-NBA star Michael Jordan.

If you followed Jordan at all in his career, you know that he made an iconic move when he partnered with — the very small at the time — shoe company Nike (NKE).

Instead of taking a decent-sized endorsement check, he bet on himself and his brand, Air Jordans … and how much he could make from his professional career.

Jordan hauled in around $1.5 billion from that one decision. He set a precedent, and it's amazing what he's been able to do. Hollywood recently even made a movie about this deal.

We’re witnessing a revolution of athletes becoming some of the wealthiest people on the planet. And as those deals above prove, it’s not just about what they do on the court or field.

They’re taking their lucrative salaries and investing in startups, helping to generate massive generational wealth.

What’s really cool is to see how many other athletes have followed in Jordan’s footsteps. The craziest part, though, it’s not just the players getting into the action.

Sports Private Equity

With nearly infinite amounts of cash, some teams are creating hedge funds or venture firms to park money with nearly guaranteed returns.

For example, the Atlanta Hawks have their own venture capital firm called Hawk Ventures. The Minnesota Vikings and Los Angeles Dodgers also have venture capital firms.

It also makes perfect sense for teams to partner with startup sports tech companies making products that can lower costs or improve their fans’ experience.

That’s not all, though. There’s a fast-growing practice that allows folks like you and me to become partial owners in pro sports teams by investing in private equity firms with stakes in them.

You might know that the Green Bay Packers are famously fan-owned, with shares sold at six different times throughout the team’s long history. But now, with greater access to private equity, many others are jumping into this lucrative investment field.

In sports private equity, firms raise capital from outsiders’ funds and invest in teams in football, baseball, basketball, hockey, racing and other major sports. It’s typically funded via minority stakes, with the goal of selling for a profit within three to seven years.

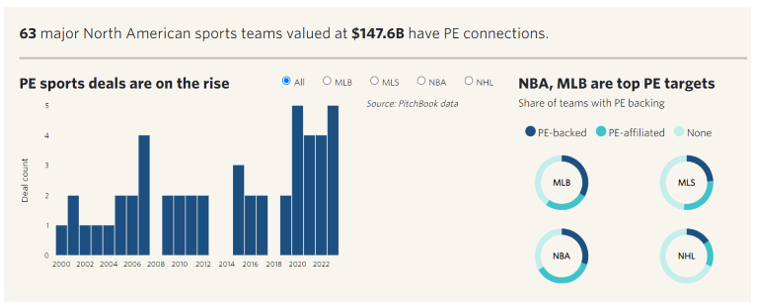

More than one-third of the 153 major professional sports teams in the U.S.— those comprising the MLB, MLS, NBA, NFL and NHL— are partly owned by private equity groups, according to a new report from Pitchbook.

The investment research group found that 60 U.S. teams (and three Canadian teams in American leagues) — collectively valued at $205.9 billion — have ties to private investing groups.

The NFL doesn’t allow this, besides the odd legacy version up in Green Bay. But that could be changing.

The teams are owned by a wide range of firms, including groups that specialize in sports investing like Arctos Sports Partners, which owns minority shares of franchises in all four eligible American sports leagues.

In early 2021, the NBA opened the door to private equity funds for the first time, allowing investors to own up to a 20% stake in a single franchise. Three months later, a newly formed private investment firm struck up a deal with the NBA’s Golden State Warriors — a 5% ownership stake at a $5.5 billion valuation.

Later that year, Arctos more than doubled its stake in Golden State, upping its ownership to 13%. Founded in late 2019, the firm also acquired minority stakes in the Sacramento Kings and the San Francisco Giants.

Between 2012 and 2021, the average NBA team’s value grew by 387%, the NFL by 215% and the NHL by 207%.

During that period, the rate of return across all five major men’s sports leagues far outpaced the S&P 500. With the boom in interest this year in women’s basketball, those gains have even more potential.

Here are some of the higher-profile, sports-focused private equity firms:

As private investment firms become further involved in the ownership of professional sports franchises, time will tell if these sports-focused funds generate outsized returns for investors like they have in the past.

I have yet to take the plunge mainly because I prefer investing in startup companies.

Unlike well-established private equity firms, startups are very early in development. Funding companies in later stages is usually less risky but with longer return horizons.

If you’d rather remain a fan of sports teams and not an investor in them, I understand completely.

You do, however, have options to invest in startups in the sports arena that mostly focus on technology, training, clothing, ticketing, etc.

Here are a few interesting ones I found while researching:

- Clippd: Advanced analytics in golf

- FANtium: NFT investments for athletes.

- Gemini Sports Analytics: AI-driven sports analytics.

- Just Women’s Sports: Women’s sports promotions through innovative media.

- Playermaker: Analytics in football training.

If investing in sports-focused private equity firms or startups appeals to you, make sure you do your homework before investing a single penny.

That includes heading into the process with the right mindset and doing your due diligence so you know if a company is worthy of your investment dollars.

It’s just as important to watch for specific red flags and scams that should make you turn the other way and run.

If you review any of the above companies and think one is worthy of your investment dollars, I’d love to hear your reasons. And of course, I’ll continue grinding to find more opportunities in this space.

Until then …

Chris Graebe

P.S. As I noted, I prefer smaller startups to large private equity firms because of the higher growth potential. This idea translates to other parts of the market. I urge you to click here to see why Bitcoin is NOT the way to take advantage of the crypto boom … despite its upcoming halving.