How Readers Could Have Gotten a Free Crypto Portfolio

|

| By Nilus Mattive |

In the early days, I was a crypto skeptic.

Philosophically, I loved what Bitcoin (BTC) was trying to do.

But I didn’t believe the concept would gain enough mainstream traction to actually work in the real world.

Then, a few years ago, my opinion started to change.

I saw that crypto adoption really WAS starting to happen …

Regular people WERE taking an interest in the space …

And even if they initially got involved because of the quick profit potential, they were sticking around … learning about the various coins and ecosystems … and creating a snowball effect that was turning into new and exciting opportunities.

What’s more, Wall Street was also starting to pay attention — including some of the same big-name personalities that had been naysaying the crypto space since its early days.

So, I changed my stance and started telling investors to at least consider allocating a small amount of money to the asset class.

Crypto now offers us new ways to guard our wealth from the ravages of inflation and other government-imposed threats …

It can provide additional — and much-needed — diversification from traditional markets like stocks and bonds …

Plus, it allows us to move money more quickly and privately than any other asset in history.

This is precisely why one of the first big moves I made when I took over the Safe Money Report was recommending readers get a small allocation to Bitcoin.

That was back in February 2023 — roughly 14 months ago.

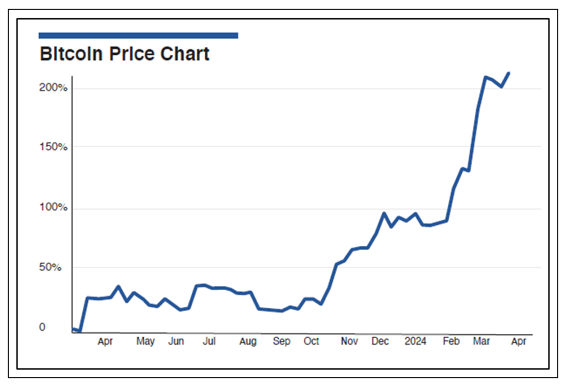

Here’s how BTC has performed since then …

As you can see, this relatively new asset has soared more than 200% over the last 14 months.

And because of the specific recommendations I made — including a well-timed switch from BTC itself into the Grayscale Bitcoin Trust (GBTC) — we’re tracking much bigger cumulative gains in our own model portfolio.

I’m talking about the order of 240%+ in a little more than a year’s time!

Heck, the GBTC position alone rose more than 200% in roughly six months!

Do I think Bitcoin could run even higher before this rally is over?

Absolutely.

The halving is imminent …

We should see continued inflows into the ETFs as more advisors sit down with clients to discuss Bitcoin allocations …

And there are now additional future catalysts like the possibility of spot Bitcoin ETFs launching in Hong Kong, opening up a whole new market for Chinese investors.

Yet, Safe Money Report is a conservative investment newsletter.

And the reality is that our GBTC position has been one of the biggest, fastest gains that the Safe Money Report has ever seen in roughly 50 years as a publication.

So, I recently told readers to sell two-thirds of their original position to make sure the well-timed gains didn’t all disappear.

Assuming they have a roughly 200% open gain, that did three things …

- It returned all of the original capital they invested …

- PLUS, a booked 100% profit on that capital …

- And still left them with the same allocation to GBTC that they originally started with!

This sounds crazy, but let me show you how the math works …

Say you invested $1,000 in GBTC when I told you to buy it.

After a 200% increase over the last six months, your position is worth $3,000.

If you sell two-thirds, you lock in $2,000. That’s your original $1,000 plus another $1,000, or 100% more.

And then you still have $1,000 invested in GBTC — the same amount you started with.

Amazing, right?

It’s the best of everything!

Going forward, they can keep an allocation to Bitcoin without really worrying about it at all.

They’re essentially invested “for free.”

I also told them to sell half of their position in the Grayscale Ethereum Trust (ETHE), as well.

Since it had more than doubled in roughly six months holding time, that means they could have also gotten all of their original capital back out of that position while still maintaining the same original allocation to Ethereum “for free,” too.

On top of that, I told them to put their GBTC profits into a new recommendation — a special investment that that holds Bitcoin, Ethereum and eight other up-and-coming cryptos.

It can be bought in a regular brokerage account and was recently trading at a 35% discount to the value of the cryptos on its books!

Add it all up and the Safe Money portfolio now has three crypto-related positions:

- One pure play on Bitcoin

- One pure play on Ethereum (currently trading at a 25% discount to market prices)

- Plus, a third new position that augments those two core holdings, while also extending our overall allocation into eight other top cryptos (at a 35% discount to market prices).

In other words, we still have a crypto allocation that’s 50% bigger than what we started with …

Spread across ten different cryptos …

With a big built-in downside cushion …

After getting all our original investment capital back out of the crypto markets along with the banked gains from my earlier BTC recommendations.

I don’t see how it can get much safer than that!

Best wishes,

Nilus Mattive

P.S. Want more risk but A LOT MORE potential reward from the red-hot crypto markets?

Then I encourage you to check out this special update from Dr. Martin Weiss and my friend and colleague Juan Villaverde.

In it, they explain how smaller cryptos rose 205 times more than Bitcoin’s own spectacular gains during a prior bull market …

Why a similar price explosion may have recently begun …

And how their proprietary “New Crypto Wonders Index” is tracking what’s happening and giving them a reliable tool to help predict where their favorite plays could be going next.