|

| By Sean Brodrick |

I’m really bullish on gold. I’m even more bullish on silver.

The market is pretty sure that the Fed is done hiking, and the next thing it will do is cut rates. This optimism is lighting a fire under gold and silver, which are held back by higher rates because the metals don’t pay interest.

And this is on top of the existing drivers for precious metals: tight supply, increased demand from the world’s central banks, surging demand in China and fears of runaway spending by the U.S. federal government.

Heck, we just learned that central banks bought 290 metric tonnes of the yellow metal in Q1 — the strongest start to any year on record. That’s according to the World Gold Council.

So, that’s why as bullish as I am on gold, I’m even more bullish on silver.

It not only has the standard reasons driving gold — supply and demand — but also some forces that are unique to silver itself.

2024 Is Silver’s Year to Shine

A record 654.4 million troy ounces of silver were used in industrial applications in 2023, a new record. That was part of a larger 1.195-million-ounce total demand, according to data from The Silver Institute.

Driving that demand is silver’s increasing use in electronics, including electric batteries, solar panels, chemicals and more. The Silver Institute also expects that silver will be incorporated into more AI technologies. That could light the fuse on demand and prices.

While AI demand is longer term, just in 2024, the Silver Institute is forecasting total silver demand to rise 2% to 1.219 million ounces.

Meanwhile, global silver mine production fell 1% last year to 830.5 million troy ounces. That’s thanks to labor actions at mines, lower grades overall and some mine closures in Argentina, Australia and Russia.

It would have been worse if not for increased supply from Chile and Bolivia as well as more recycling. Result: the Silver Institute says that in 2024, we could see the second-biggest deficit in the silver market in 20 years.

Above-ground stockpiles will make up the difference, at least for a while. But add increased demand to less supply, and it sure looks like we have the potential for a squeeze in silver prices.

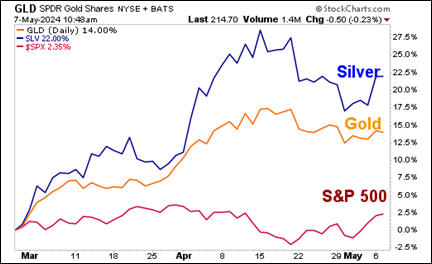

Finally, silver outperforms gold in a bull market, and it’s exactly what we’re seeing now. Here’s a performance chart of two popular ETFs that hold physical gold and silver — funds you can buy — that track the precious metals closely.

Since the last time precious metals bottomed in late February, gold as tracked by the SPDR Gold Shares (GLD) is up 14%, and silver as tracked by the iShares Silver Trust (SLV) is up 22%. Both of the metals are leaving the S&P 500 in the dust, with its 2.35% gain over the same time frame.

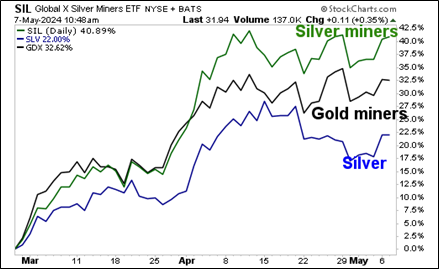

But as good as gold and silver are doing, miners are doing even better. Take a look at this next performance chart …

You can see silver with its 22% gain is lagging the 32.62% gain in gold miners as tracked by the VanEck Gold Miners ETF (GDX), and the whopping 40.89% gain in the Global X Silver Miners ETF (SIL) is leaving both of them in the dust.

It would not surprise me to see the price of silver QUADRUPLE over the next few years. Along with it being the most useful of metals, we’re probably heading to a currency crisis eventually, driven there by a combination of uncontrolled government spending and demographics.

During the short time span that I’ve shown you in the above charts, silver miners nearly doubled the performance of silver itself. Over the longer term, the opportunity in silver miners could be extraordinary.

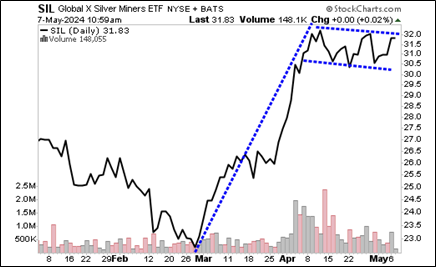

Now, let’s look at a short-term chart of silver miners …

It sure looks like SIL is forming a “bull flag,” and as the saying on Wall Street goes, “Flags fly at half-mast.” That gives us an initial target of around $42 on a breakout.

And that’s a GREAT reason to own silver miners.

You can drill down into SIL and buy individual stocks for potential outperformance. Or you can just buy this basket of stocks and do pretty well. The choice is yours. But don’t let the golden opportunity in silver pass you by.

That’s all for today. I’ll be back with more soon.

All the best,

Sean

P.S. Just yesterday, Dr. Martin Weiss unveiled another way to significantly beat the S&P 500. I’m talking about 51 times the performance of the large cap index. Click here for all the details.