[Fed Rate Hikes] Too Little, Too Late!

The Fed has promised to raise rates.

But will that stop inflation? Fat chance!

Consumer price inflation has already surged to 7%.

Energy price inflation is 29.3%.

Even used car prices, which are supposed to decline with age, are soaring 20%, 30%, sometimes 40%.

To get that kind of wild inflation under control, the Fed would have to jack up short term rates to a level that’s far above the inflation rate.

That’s what Fed Chair Paul Volcker did in 1980-1981, and it was the ONLY way that official interest rates made a difference; the only way they could tame the raging inflation.

But is that what the Fed’s doing or planning to do now?

Heck no!

The chart above proves my point beyond a shadow of a doubt:

Back in January of 1981 …

- The Fed let the primary rate it controls — the Fed Funds rate — surge to an all-time high of 19.08%.

- That was far above the inflation rate of 13.5%.

- So, even when the Fed slacked off a bit and let its interest rates slide a few points, it was still able to crush inflation.

- High inflation virtually disappeared for nearly 40 years!

Now, in January of 2022, we see precisely the opposite …

- The Fed has shoved its rates down to an all-time LOW of 0.08%.

- That’s far BELOW the inflation rate of 7.0%.

- So, even if the Fed raises rates a few times this year, it will still be unable to make a dent in inflation.

- High inflation could continue to plague the American people for decades to come.

What About Your Retirement?

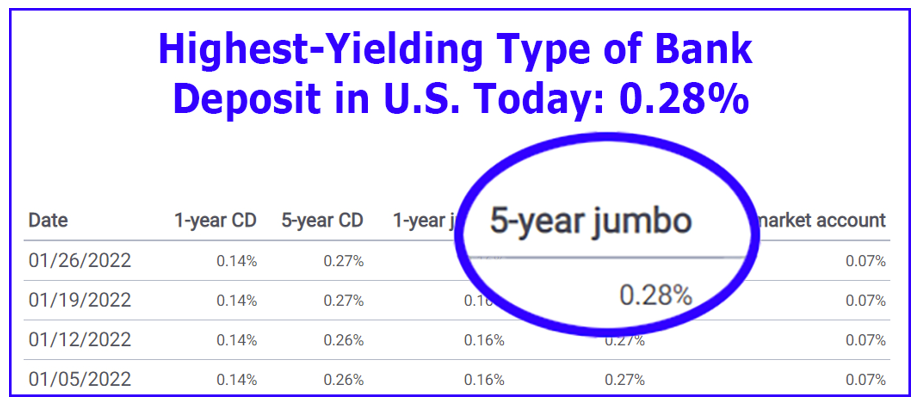

Well, first, let me show you how much interest people are earning in a bank.

Then, I’ll show you how much I’m making.

The highest-yielding type of bank deposit in the country is the 5-year jumbo CD.

It requires a minimum deposit of $100,000 and a fixed-rate lock-up period of five years.

- How much do they pay you in interest? According to Bankrate.com, an absurdly low 0.28% per year, on average.

And if you think that’s bad, check out their other yields:

On a 1-year CD, they pay a meager 0.14% per year.

On a money market account, they pay even less — an infinitesimal 0.07% per year.

What happens if the Fed raises rates?

Hah! That’s a joke. Even if the Fed Chair Powell does everything he’s promising without fail, you’d be lucky if you could START making a still-crappy 1% by year’s end.

My Solution

I’m earning almost 70 times the rate of 5-year jumbo CDs.

And I’m doing it WITHOUT the risk of sharp price declines like we often see in stocks, corporate bonds and even Treasury bonds.

Most people would say this combination — unusually high yield and unusually low risk in the same investment — is impossible.

But in the video presentation I’m releasing tomorrow, I will introduce you to a new kind of high-yielding deposit that’s paying me a whopping 19.5% per year.

Like I said, that’s nearly 70 TIMES HIGHER YIELD than what folks get in a 5-year jumbo CD.

What’s more, unlike the jumbo CD …

I don’t have to deposit $100,000 — there’s no minimum to qualify for the 19.5%.

I don’t have to lock up my money for five years — I can withdraw it at any time without penalty.

Sounds hard to believe, I know.

But tomorrow I will personally send you an email with the proof.

Good luck and God bless!

Martin