|

| By Jon Markman |

In a banner week for artificial intelligence, executives at Nvidia (NVDA) and Broadcom (AVGO) hosted major industry events.

These are the big takeaways for investors …

Spending for AI infrastructure is growing exponentially as hyperscale data center customers move away from general purpose computing. This transition is putting the two AI power players on a collision course.

Investors should relax, though.

This is a potential buying opportunity for both.

Blackwell is the newest Nvidia AI chip, developed at a cost of $10 billion, according to Jensen Huang, chief executive officer.

Named after the mathematician David Blackwell, the graphics processor unit has a staggering 208 billion transistors. The GPU is also the centerpiece of a platform that marries hardware, software and interconnects for seamless AI training, learning and generation.

Huang is building a best-of-breed ecosystem that he claims is 25 times more efficient than previous GPU setups. Blackwell will lock in customers.

At Nvidia GTC last week, representatives from Amazon.com (AMZN), Microsoft (MSFT), Alphabet (GOOGL), Oracle (ORCL) and International Business Machines (IBM) all spoke glowingly about Blackwell.

Despite the prospect of getting stuck in the Nvidia web, the operational benefits are too alluring. These firms operate hyperscale data centers with hundreds of thousands of chips. Streamlining AI training, learning and generation is a gamechanger.

Deploying AI at scale against their business models will slash operational costs. Changing the trajectory of energy consumption alone is worth billions at the hyperscalers.

At the same time, accelerated computing opens new doors for internal problem-solving.

Execs at Meta Platforms (META) attributed the rescue of its digital advertising platform to innovative AI strategies that would not have been possible with general purpose computing.

Ironically, these same hyperscaler customers are also working feverishly with Broadcom to develop custom silicon for AI. These new chips will run internal workloads and lessen the dependence on expensive chips and costly proprietary interconnects from Nvidia.

The opposing AI strategies at the hyperscalers were in focus last Wednesday morning during the first-ever AI investor day at Broadcom.

Charlie Kawwas, president of Broadcom Semiconductor Solutions Group, said the unit is currently on an annual $30 billion run rate, growing at double digits.

Unlike Nvidia, BSSG does not make GPUs. Rather, the unit builds all the components for the high-speed connections between XPUs — alternative processors to conventional central processing units used in general purpose computing.

In laymen’s terms, Broadcom is making all the open standard gear to support the transition to AI from CPUs.

This is an exceptionally lucrative business.

There is a huge barrier to entry into this segment. Broadcom owns all the most important patents and continues to spend aggressively on research and development to widen the lead. Kawwas says $3 billion has been allotted in 2024 for R&D.

Moreover, even Nvidia, with all its advanced AI chips and proprietary interconnects, must use open standards to connect with the larger network.

Consequently, Broadcom and Nvidia are not really competitors, despite vying for capital expenditures from the same hyperscaler companies. In fact, Kawwas says that Nvidia is the fastest-growing customer at Broadcom.

Broadcom and Nvidia’s paths will eventually converge.

However, in the intermediate term, there is plenty of business to go around. Hyperscalers are enthusiastic to buy Nvidia gear, while they build custom solutions for internal AI projects.

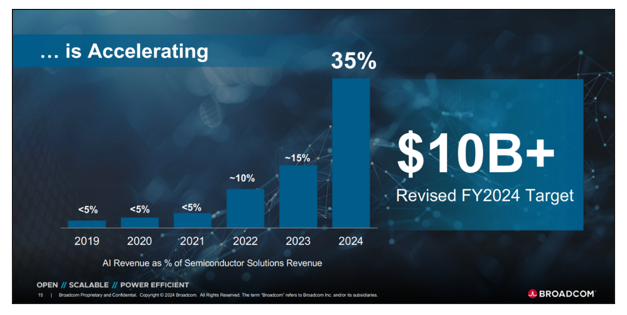

At the investor day on Wednesday, Kawwas said that 35% of semiconductor revenues in 2024 will come from AI, up from the 2023 forecast on only 10%.

For perspective, AI revenues accounted for only 5% of semiconductor sales in 2021. This acceleration is leaving no doubt that the transition away from general purpose computing and CPUs is happening.

Nvidia and Broadcom are sucking up all the capital expenditure budgets.

Both companies will continue to be winners. And the firms within their ecosystems, such as Cadence Design (CDNS), Synopsys (SNPS), Dell Technologies (DELL), Super Micro Computer (SMCI), Arm Holdings (ARM), Arista Networks (ANET), Lam Research (LRCX), Taiwan Semiconductor Manufacturing (TSM) and others will benefit, too.

The bottom line is the AI upgrade story in only getting started. Investors should buy the leaders into every significant decline.

All the best,

Jon D. Markman

P.S. There’s another story that is only just getting started. If you think Bitcoin has had a good run, you’ll be blown away by these other cryptos that deliver 205x those gains. Click here to join our exclusive presentation early next week.