|

| By Jon Markman |

Digital transformation is subsuming every facet of the physical world. Bitcoin (BTC, “A”) is now killing the use case for gold, and this is going to accelerate.

The price of Bitcoin is sitting at $72,788, a record high price. Hard asset investors who favor gold are excited about the price of the yellow metal reaching $2,175, also a record. Goldbugs should not be excited.

They should probably sell their gold and buy Bitcoin.

I want to be clear. I’m NOT making a blanket recommendation to buy Bitcoin. I believe investors should buy shares of high-quality growth companies building digital transformation infrastructure.

In my opinion, equities offer superior stability. And a well-selected portfolio is the best way to play the larger digital trend. Let me back up, though.

All investments are priced by investors. That is their worth.

Gold has stood the test of time because long ago someone decided that the shiny metal was valuable. This made sense …

Centuries ago, gold was difficult and costly to extract. People with the resources to mine gold accrued wealth. Gold as a store of value existed before governments and continues after many regimes have collapsed.

So, governments got smart. They created money, currencies that were initially tied to the gold holdings of a nation. Then fiat currencies came along, “money” that was backed up by the ability of the government to tax its citizens.

Unfortunately, the supply of money is unlimited. Governments can — and do — create new money supply at will, producing inherent inflation.

This inflation impacts gold. After all, the hard asset is priced in U.S. dollars, British pounds, Eurodollars, Japanese yen and other fiat currencies.

Bitcoin Is the New Gold

Bitcoin is the digital equivalent of gold.

Some investors scoff at this notion. They are wrong to do so.

The first rule of asset pricing is that the perception of value is paramount. If the consensus of investors see value, the asset is valuable. Investors clearly view Bitcoin as a store of value and a compelling alternative to physical gold.

The price vectors of the two asset classes are undeniable. They move in lock step.

Bitcoin is superior to gold in terms of scarcity, divisibility and portability.

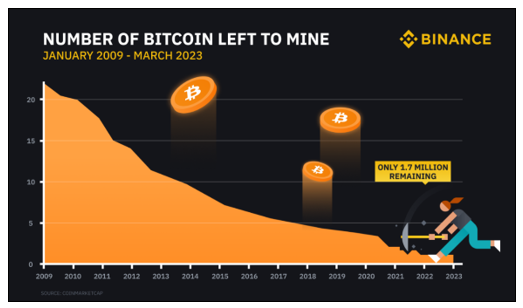

The supply of Bitcoin is programmatically limited to 21 million coins. Moreover, the issuance of new coins becomes increasingly more difficult the nearer to this threshold.

The opposite is true for gold. There is no limitation. Vast quantities of gold are unmined only because it isn’t economically viable.

Goldbugs claim that gold is the ultimate currency of last resort. This is not really true. Selling the precious metal involves commissions and other hidden fees. Dividing a chunk of gold to buy a flat screen TV at Best Buy is a nonstarter, whereas, by design Bitcoin, is divided into tiny fractions called Satoshis. There are 100 million of these units in every Bitcoin.

In theory, Bitcoin could be used to assign value to everything in the physical world, from a grain of rice to the Dallas Cowboys football club.

And like a digital photo taken on an iPhone, Bitcoin is instantly portable. It can be stored digitally and transferred across the globe in seconds.

This removes the physical restrictions of fiat currency, where large transactions must occur within the context of banks and other financial institutions. Not only are these transactions impossible with gold, storage requires fortified vaults, like Fort Knox.

Federal Reserve chairman Powell signaled in October that interest rate cuts are likely in 2024. Cutting the Federal Funds rate leads to increased supply of money in the system … and inflation.

Investors responded by buying assets, stores of value. Since October, through the close on Friday, Bitcoin and gold prices have rallied by 151.2% and 19.3%, respectively.

Investors are choosing Bitcoin over gold as a store value, and it isn’t even close …

Bitcoin’s Path to $374,670

The value of all of the mined gold in the world is estimated at $14.6 trillion. This is based on the current market price multiplied by 212,582 metric tons, the total mined production according to a 2024 report from the World Gold Council.

The comparable figure for Bitcoin is only $1.4 trillion, based on 19 million Bitcoins. These market capitalizations are rapidly converging, and this trend will accelerate as investors choose the inherent digital advantages of Bitcoin.

The actual math for where the price of Bitcoin might land relative to gold is complex. However, if investors ultimately conclude that Bitcoin should have a market capitalization near one-third the value of gold, the price of a single Bitcoin would have to surge to $374,670.

It’s hard to wrap your head around this number. It seems inordinate. Yet, the origin of gold as a valuable asset followed a similar path. Value is about perception … the rest is math.

In the era of digital transformation, Bitcoin is the natural evolution of gold.

All the best,

Jon D. Markman