A Key Difference Between Weiss Stock & Bank Ratings

|

| By Gavin Magor |

Sometimes, we love to be contrarians here at Weiss Ratings.

Now is one of those times!

And this is thanks to one regional bank headquartered in the Long Island town of Hicksville, New York.

It’s a bank you probably have heard a lot about over the past month and a half. It has been a hot topic for the talking heads on Wall Street with its stock plunging.

I’m talking about New York Community Bancorp (NYCB).

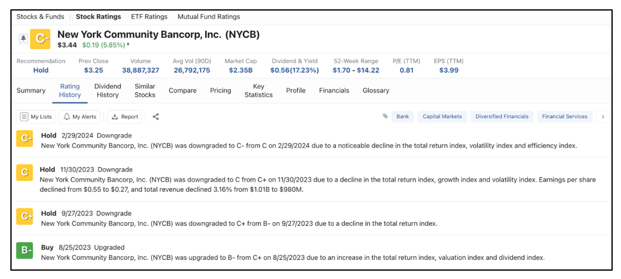

We first covered this bank a little over a month ago, when the trouble first began. We have since downgraded its stock rating … but not its bank safety rating. This gives us the perfect opportunity to show you why these can be so different.

Here’s the full story …

On Jan 31., NYCB reported a bad quarterly loss and a 70% reduction of its dividend. This was completely surprising to many. Shares nosedived, falling a staggering 60% in a one-week span.

And this is not some little bank in the middle of nowhere. New York Community Bank is the 35th largest bank in the U.S. by market capitalization.

The company again made headlines last year when it acquired the assets of failed Signature Bank. That is not actually the reason it had an awful past quarter financially.

New York Community Bancorp was badly hurt on its commercial real estate exposure and new rent controls.

So, whilst the stock and parent company, New York Community Bancorp, appears to be struggling at the moment … it’s major and primary bank, Flagstar Bank, actually appears to be doing very well in terms of its bank safety and structure.

NYCB’s Stock Rating vs. Bank Rating

We here at Weiss are always 100% independent and want to help investors judge the safety and future prospects of a stock.

We also want to help bank customers with their decisions on who to bank with. Our bank ratings, just like our stock ratings, have a strong bias toward safety.

So, for all of the concern we’ve been hearing about the riskiness of New York Community Bank’s stock, its major primary bank, Flagstar, appears to be quite safe.

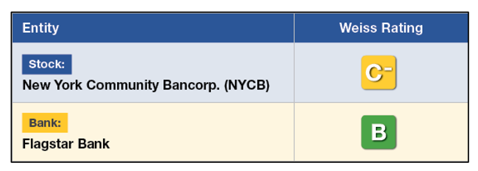

Currently, we rate Flagstar as a “B,” which means this bank has good security and is likely to remain healthy in the near future.

As you can see above, five out of the six summary screeners are “good” or higher. That’s very positive.

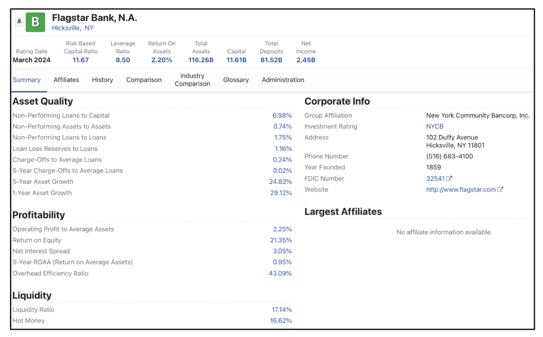

And in terms of its quarter-over-quarter structure, the bank’s Tier 1 capital ratio only dropped fractionally. A bank’s Tier 1 capital ratio is the ratio of a bank’s core equity capital to its total risk-weighted assets.

Risk-weighted assets are all of the assets held by a bank with credit risk. The Tier 1 capital ratio is a vital bank safety barometer for us.

The bank’s adjusted assets are about the same quarter over quarter, and its asset growth appears to be healthy and stable.

Let’s take a gander at its summary on the Weiss Bank Ratings page:

Now, whilst we do believe Flagstar is a healthy bank, there are some slight areas of concern. The bank’s current adjusted nonperforming assets to total assets went up from 0.56% to 0.74%.

Nonperforming assets are loans that are currently delinquent by more than 90 days. So, you don’t want to see this percentage go up.

But that is not overly concerning.

On a positive note, charge-offs to average loans went from 0.04% to 0.24%. That’s quite low compared to a lot of other banks. This metric indicates the debt owed to the bank that is unlikely to be recovered.

Another thing that’s very positive for Flagstar is that its current liquidity ratio went up quarter over quarter from 14.53% to 17.14%. These are assets that can quickly be turned into cash.

We have strong reason to believe Flagstar is fine. You may not be hearing that on the news, but it appears to be true. Yes, its stock paints a much different picture.

What About Its Sliding Stock?

An actual bank and its stock are two different animals.

Most banks are private. But there are around 600 publicly traded banks in the U.S. It really just boils down to ownership structure. Typically, larger banks are public so they can grow … and have easier access to cash for that growth.

NYCB, as evidenced by its acquisition of Signature Bank last year, is indeed trying to grow. But investors are now viewing that growth as a lot riskier.

In its latest weak earnings report, investors did not like the excess risk, thanks to its growth. Of course, they were also displeased by the massive slash in dividends from 17 cents per share to only 5 cents. When you have less excess cash, dividend cuts get a lot more common.

As you can see above, EPS declined steadily. Total revenue also dropped.

Make no mistake — a major reason many investors liked this stock previously was for that juicy dividend yield.

In general, most banks are not going to see massive growth in share price like a tech name. Instead, investors view bank stocks as stable and often own them for a big dividend. It appears NYCB previously fit that bill.

And now, when you compile this with the fact that many tech names are surging, investors probably viewed this weak earnings report and dividend cut as a warning sign.

So, Gavin, is now a time to buy with its bank being stable and stock price down so far now?

Certainly, that argument could be made. And shares may now be undervalued. In fact, some major Wall Street players believe so.

Last week, a group of investors struck a deal to infuse NYCB with $1 billion in new capital.

The bank is also now planning a one-for-three reverse stock split of its common stock to shareholders. This will artificially increase the value of NYCB shares by reducing the number of total shares.

A new CEO was also appointed, with backing from former U.S. Treasury Secretary Steve Mnuchin.

Time will tell if the stock can rebound, but whether it’s a good investment is a totally different topic from whether it’s a good bank.

If I were to put my money down on something right now, it wouldn’t be NYCB shares. However, I will tell you where you should consider investing your money … with my friend and colleague Chris Graebe’s Deal Hunters Alliance.

He just shared his newest pre-IPO, angel funding investment with readers. This is a unique opportunity that I don’t want you to miss.

I strongly urge you to check it out, because the profit potential is enormous. Be sure to click here now.

One thing you can always bank on is the reliability and usefulness of the Weiss Ratings research. Chris uses it. So should you!

Cheers!

Gavin Magor

with

P.J. Amirata