As market conditions change and new leaders take over, you have to recognize the action, comprehend why it’s happening and adapt as quickly as possible.

It’s a three-step process that’s incredibly important for investors.

And it’s especially true now as the market is experiencing dramatic changes ...

Step #1: Recognize the Shift Underway

I can’t stress enough how important the sector rotation going on behind the scenes is.

You see, many investors have massively overweighted technology stocks in their portfolios.

It wasn’t an irrational thing to do. After all, tech stocks delivered some of the biggest gains in the market for a very long time.

But that’s starting to change.

As of last Friday’s close, the Technology Select Sector SPDR Fund (NYSE: XLK, Rated “B”) LOST money over the last 30-day, 60-day and 90-day periods.

It was also underperforming the SPDR S&P 500 ETF Trust (NYSE: SPY, Rated “B”) in 2022, and it’s now barely outperforming the SPY going all the way back 12 months.

So, what’s taking the lead?

Under owned, underappreciated sectors like energy, for starters.

The Energy Select Sector SPDR Fund (NYSE: XLE, Rated “C”) was recently up 18% year to date ... and a whopping 71% over the last 12 months.

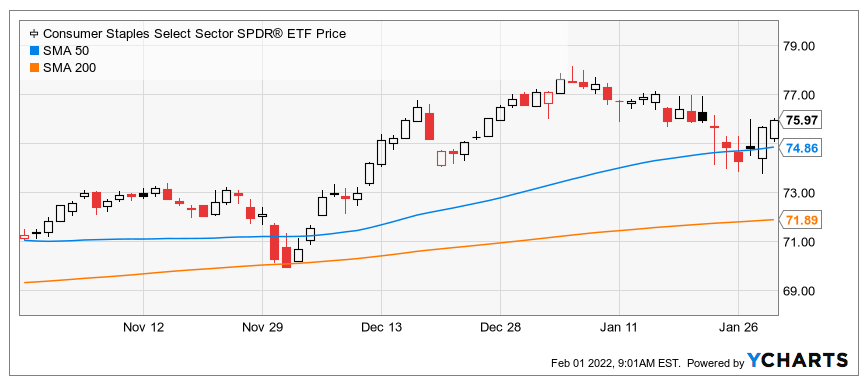

What some investors deem to be boring companies that make things like cleaning products, food and beverages are leading the way, too.

The Consumer Products Select Sector SPDR Fund (NYSE: XLP, Rated “B”) has gained around 7% in the last three months, for instance.

Then there’s the interest rate market.

Some of the hottest, best-performing funds there focused on high-yield junk bonds.

But now, riskier funds like the SPDR Bloomberg Barclays High Yield Bond ETF (NYSE: JNK, Rated “B-”) are starting to slide.

At the same time, the Treasury yield curve is flattening dramatically.

The following chart shows how the difference between the yields on the 2-year Treasury and 10-year Treasury has shrunk to just 0.63 percentage points (63 basis points).

That’s less than HALF the peak of 1.58% last March, and …

- That signals the bond market is increasingly worried that more Fed rates hikes NOW will crater the economy, and markets, LATER.

So, why is all this happening? That brings me to …

Step #2: Comprehend the Forces Driving These Shifts

The Federal Reserve is driving most of the action.

In recent comments, including the most recent post-meeting press conference, Chair Jerome Powell made it clear that he’s not the market’s best friend anymore.

He’s ready to raise interest rates, stop buying billions of dollars’ worth of bonds and otherwise make life harder for Wall Street and retail investors.

That’s raising rates on shorter-term Tresaurys. Meanwhile, concerns about the impact of those hikes on growth is helping keep long-term rates from surging.

- The result? A flattening yield curve.

Investors also know that Fed hiking cycles tend to bring out new leadership in markets.

Money typically rotates to cheaper, value-oriented stocks and away from more expensive, growth-focused names.

This naturally leads to …

Step #3: Adapt as an Investor

Don’t fight these important changes. Embrace them.

What do I suggest?

1. Keep more cash on hand now that the Fed is tightening the screws.

2. Own less tech and more defensive, yield-oriented, higher-quality stocks.

3. Stick with investments in precious metals and mining shares.

4. And adjust your bond holdings or bond fund positions to profit from a flattening curve rather than a steepening one. That includes reducing any exposure to funds with high levels of credit risk.

Following this three-step process could make the difference between a highly successful 2022 ... and a potentially lousy year.

And speaking of adapting, Dr. Martin Weiss is the master of the art.

He’s moving his money from the Traditional World of Saving and Investing into new, more unconventional investment methods … but based on the big yields he’s achieving, the move’s really paying off.

To find out why and how he’s doing this, click here now.

Until next time,

Mike Larson