|

| By Jim Nelson |

There’s nothing in the rulebook to say you can’t have both safe, dependable income AND moonshot gains.

You aren’t restricted to boring old bonds or even slow-grow blue chip dividend-paying consumer staples to get a healthy share of income.

And you aren’t restricted to fast-paced options and microcap tech companies developing the next hot gadget for chances at a big winner.

What if there was a way to marry these two types of investment? What if you can invest in small, unknown startups and are also paid for it?

You can with a specific type of company that works more like a fund than a company with its own operations. In fact, you can get all the above AND a tax benefit to do so.

Harness 10x Potential of Startups

Startups and pre-IPO companies come with risks and rewards. Of course, like any other investment vehicle, how much risk and how much reward depends on what you invest in.

Our startup specialist, Chris Graebe, has been sharing his thoughts over the past few weeks about how profitable startup investing can be, as well as how to stay safe in this wild world of private companies.

Chris is the absolute best at what he does. I’ll have more on him in a moment. But there are other avenues into this space.

Introducing business development companies, or BDCs …

These are (often) publicly traded companies that invest in smaller innovators or products you can’t get anywhere else.

Target companies can be small businesses just moving out of their garages up to $100 million ones with a few already dominant products on store shelves. Often, they are somewhere in between.

BDCs invest in them in a number of ways — direct equity stakes, debt financing through bonds or credit lines and hybrid structures that mix the debt with equity.

In return, BDCs can make money in a dozen different ways from these investments. If they lend money or credit, BDCs will collect interest. If they own equity, any kind of exit or IPO could be a windfall.

You can probably already see how this is the perfect marriage between moonshot startups and stable income. But it gets better …

Legally Required Distributions

Business development companies fall into a strange and rare category of equities. You might already know a bit about this if you own a real estate investment trust, or REIT, or a master limited partnership, MLP. All three are often called pass-through entities.

The reason becomes instantly clear. They pay no corporate taxes. Instead, they must pass through a large portion — often 90% — of the income they make to their shareholders, trustees or partners.

Basically, income comes in … and income goes out.

All that debt interest these BDCs collect works the same way as when a REIT collects rent payments. It comes in, then goes out to their shareholders in dividends or distributions.

What makes BDCs even more exciting, however, is because of the types of portfolios they build.

Often, there are a few profitable businesses that just happen to be expanding. So, the income from those can be reliable. The BDC will also couple with that dependable income a few moonshot startups with fascinating technologies or a pre-approved drug candidate.

So, if one of these moonshots strikes it rich, the BDC is legally required to add that windfall to the other income and pay its own shareholders.

That’s how you get the potential for big gains AND solid, steady dividend income. But there’s one final tax advantage that comes with BDCs.

If you hold a BDC in an ordinary brokerage account, you can receive a portion of your dividend that is considered a return of capital. This is money the company was returned without a profit. Therefore, you don’t have to pay any taxes on this portion of your dividends.

The vast majority, however, comes in the form of regular income, non-qualified dividends and qualified dividends. Those are all taxable.

However, you can hold BDCs — like almost any publicly traded stock — in an IRA. So, the high dividends they pay won’t come back to bite you come tax season.

So, how much do these moonshot-income hybrids pay?

3 BDCs to Double Your Income

Some blue chips stocks are known for being dividend machines. Think Procter & Gamble (PG) or Coca-Cola (KO). But in today’s market, with interest rates still higher than they’ve been in over a decade, their 2.3% and 3.2% yields are a bit weak.

Bonds are paying better, with the 10-year Treasury Note paying 4.1%. But that’s still just about 1% better than inflation right now.

REITs are great for boosting your portfolio’s income. Yet, then you have to deal with value changes in the real estate market. And with commercial real estate teetering, that limits your options.

BDCs, however, blow all of these away. And it isn’t even close …

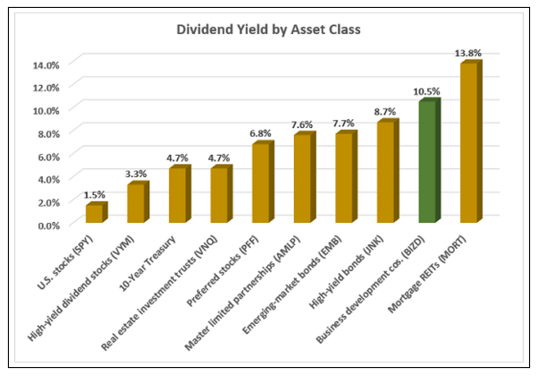

As you can see, BDCs pay more than twice what REITs do on average and more than three times what even high-dividend stocks pay on average.

Only mortgage REITs pay more. But that’s a topic for another day … one that comes with its own risks.

Not every BDC is a winner, however. They, after all, do come with risks themselves — startups fail, debt obligations are missed, etc.

But of the few dozen out there, you can find a few worth checking out.

Here are three you might consider digging further into …

- Ares Capital (ARCC) is one of the largest BDCs you can buy today. It has a $22.9 billion portfolio of investments spread across 505 companies. For well-diversified BDCs, the size and spread here is worth considering. It is also rated “B-” by Weiss Ratings — a “buy.”

- Main Street Capital (MAIN) is another well-known BDC with billions in investments … $7.2 billion to be exact. That’s spread out over 190 different companies. Compared to Ares, Main Street funds fewer, but often larger and more established, private equity opportunities. It, too, is a “buy” with a “B” rating.

- Hercules Capital (HTGC) is a smaller, yet more engaged BDC. It has $3.25 billion of investments made in its current portfolio, including a higher percentage of moonshot-type plays. Still, its growth makes it a “buy” with a rating of “B-.”

All three pay substantial dividends. Hercules’ 10.9% yield tops the list, however. Even spreading an investment into all three will get you big yields and a diversified portfolio of startups.

Of course, if you want even larger profit opportunities in this space, you’ll have to skip these middlemen. The best potential is always found by directly investing in the startup world.

But as I mentioned earlier, we happen to have the perfect person to help you. In fact, Chris — whom I mentioned earlier — found a startup that could disrupt a $4 trillion industry.

I urge you to check out his full presentation on it right here.You only have a limited time, however. We’re pulling it down from our site on Thursday at 12 midnight.

Best,

Jim Nelson