More Stocks Signaling Buy After Strong Earnings Season

I’ve been following the markets for over 10 years now, and earnings seasons are my favorite time of year.

I tend to deep dive into my favorite companies or an industry that I find particularly interesting, but I still use the news to help me keep a pulse on what’s going on.

Recently, I saw a Reuters headline proclaim, “U.S. Companies Are Beating Profit Estimates at Record Rate.” So, I dug deeper to find some numbers.

Last Friday, a report from factset.com showed that for the first quarter, 91% of the companies in the S&P 500 had reported results: 86% of these companies reported a positive earnings per share (EPS) surprise, and 76% of the companies reported a positive revenue surprise.

This is the highest earnings beat rate going back to 1994. In fact, this first quarter is expected to be the highest quarterly profit growth since 2012.

These companies that beat earnings are, in turn, increasing dividends or reinstating ones that were suspended due to the financial uncertainty of last year.

We're seeing a great rebound from last year’s pandemic-driven financial uncertainty, and in all of the companies that I’ve done a deep dive into, management is predicting great numbers for the full year, too.

With all these positive numbers, I was sure that the rating distribution for our Weiss Rated stocks had changed.

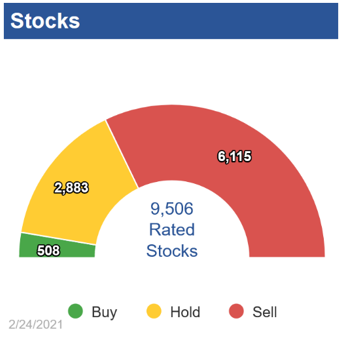

The last time I sent you a screenshot of the rating distribution was on Feb. 25:

|

At the time, I noted we were seeing 144 more “Buy”-rated stocks than we did at the end of September.

Now, we’re seeing an additional 388 in that category. That gives us a grand total of 896 “Buy”-rated companies.

|

There are a number of reasons that a company can be upgraded or downgraded.

For example, if the Weiss Ratings system sees uncertainty in financial statements, it sees a downgrade. At the same time, when it sees those numbers progress in a positive direction, it usually would signal an upgrade.

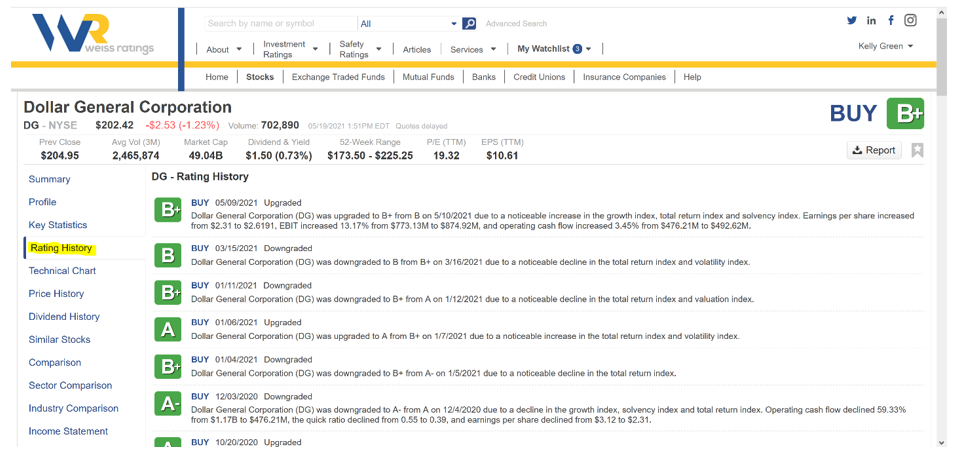

If you’re ever curious about a company’s rating history or why the rating has changed, it’s easy to see why.

Pull up the company you’re interested in and click on “Rating History” on the left side.

|

You’ll then see the rating, the day it was issued and whether it was an upgrade or downgrade from the previous rating. You’ll also see a brief reason why it was changed.

This should give you a better idea of what’s going on behind those rating changes.

Since I saw an additional 388 companies at the “Buy” level, I wanted to see if there were any new ones at the top.

The only two companies that are in the “A”-rating range are listed on the Toronto Stock Exchange (TSX).

First up is Intact Financial Corp. (TSX: IFC.TO), which provides property and casualty insurance products in Canada and the United States. The company has been around since 1908 and is based in Toronto. Shares are up 8.4% in the last six months and 22% in the past year.

There’s also Hydro One Limited (TSX: H.TO), which operates as an electricity transmission and distribution company in Ontario. It serves approximately 1.4 million residential and commercial customers. Shares are up 7.5% in the past 6 months and 22% in the past year.

All of the other “Buy”-rated companies are in the “B” range.

At the top of that group is Alphabet Inc. (Nasdaq: GOOGL). I don’t need to explain much about this one since we use the term “Google” as a verb now … but it’s important to remember the company is a behemoth in the online advertising space, cloud services and obviously web search. Plus, there’s Android, Chrome, YouTube and many other products for consumers. Shares are up 28.6% in the past six months and 64% in the past year.

Next up is Abbott Laboratories (NYSE: ABT), which we talked about last week since it was at the top of our list of dividend payers list. The company creates breakthrough products in diagnostics, medical devices, nutrition and branded generic pharmaceuticals. Shares are up 6.2% in the past six months and 34% over the past year.

Last but not least, there is Novo Nordisk A/S (NYSE: NVO). This Denmark-based healthcare company engages in the research, development, manufacturing and marketing of pharmaceutical products worldwide. Shares are up 19.4% in the last six months and 25% in the past year.

Given that there are 896 total stocks with a “Buy” rating, there’s no reason you shouldn’t be looking to help your portfolio right now.

The Weiss Ratings stock screener can help you make decisions with confidence.

Best,

Kelly Green