Halftime Report: Why 2021 Is the Year of the ‘Money Flood’

|

The “Money Flood” is a massive wave of cheap liquidity and abundant stimulus, the likes of which we’ve never seen.

I’ve said over and over that it’s pointless to fight it. Your best bet is to go along for the ride in “Safe Money” investments now despite the large consequences that we’ll all have to deal with later.

So, how’s it working out?

Swimmingly!

In the first half of 2021, the Dow Jones Industrial Average (DJIA) and the Nasdaq Composite climbed around 13%. Plus, the S&P 500 Index jumped 15%. That made this January-to-June run the strongest since 2019 and, before that, 1998.

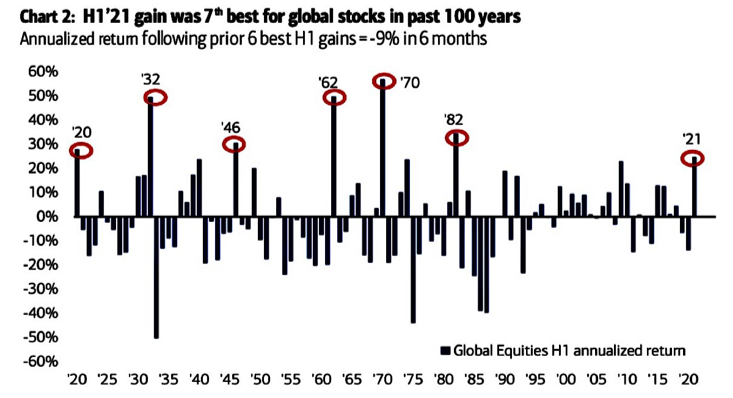

U.S. stocks weren’t the only ones riding the wave. Global equities overall had their seventh-best first half of the last century.

The most recent year when things were better? That would be 1982, when “E.T. the Extra-Terrestrial” racked up a then-record $359 million in ticket sales, and Argentina and the U.K. fought an undeclared war over the remote Falkland Islands.

|

| Source: Bank of America |

If you peel back the curtain, you see that select sectors like financials and energy handily beat the averages. Utilities lagged amid rising interest rates, and those rising rates also put pressure on precious metals.

Meanwhile, we’re already off to a nice start in the year’s second half, with the S&P 500 hitting a new record this week. So, does that portend an even stronger finish?

I gave my detailed outlook — and provided appropriate recommendations to profit from it — in the July issue of Safe Money Report a few days ago.

You can get signed up to read it here.

Although I can’t share everything here, I told my paying subscribers a very important bit of advice:

The calendar is shifting. But your investment approach should not. The market will eventually face some ugly challenges related to the debt and bubble risks I’ve discussed. But it’s not yet time to position for that.

Instead, it’s time to squeeze all the income ... and all the profits ... you can out of this “Money Flood” environment.

As long as you do so with Safe Money strategies, I’m convinced you’ll do very well for yourself.

Until next time,

Mike Larson