‘Worst Case’ Economic Scenarios Show Why Safe Money Approach STILL Works Best

|

We may be living in a “worst-case” scenario.

That’s exactly what it sounds like. The absolute worst outcome to any threat that an analyst, investor, policymaker or economist can dream up could be unfolding before our very eyes.

I’ve seen a lot of these scenarios in the 23 years I’ve been researching and writing about the markets. The ones that crossed my desk during the Great Financial Crisis (GFC) of 2007-2009 were particularly grim.

But I’ve never seen anything quite like what’s hitting the tape now.

The figures about the potential economic damage from the coronavirus outbreak are simply mind-boggling.

A U.S. unemployment rate of up to 30%?

A GDP plunge of as much as 50%?

Up to 3 MILLION Americans filing for unemployment claims in a single week?

These numbers are astounding. And as much as we all wish they were unbelievable, plenty of people see them as plausible instead.

Let’s talk about that 30% unemployment figure for a minute. This is a worst-case scenario floated recently by St. Louis Federal Reserve President James Bullard.

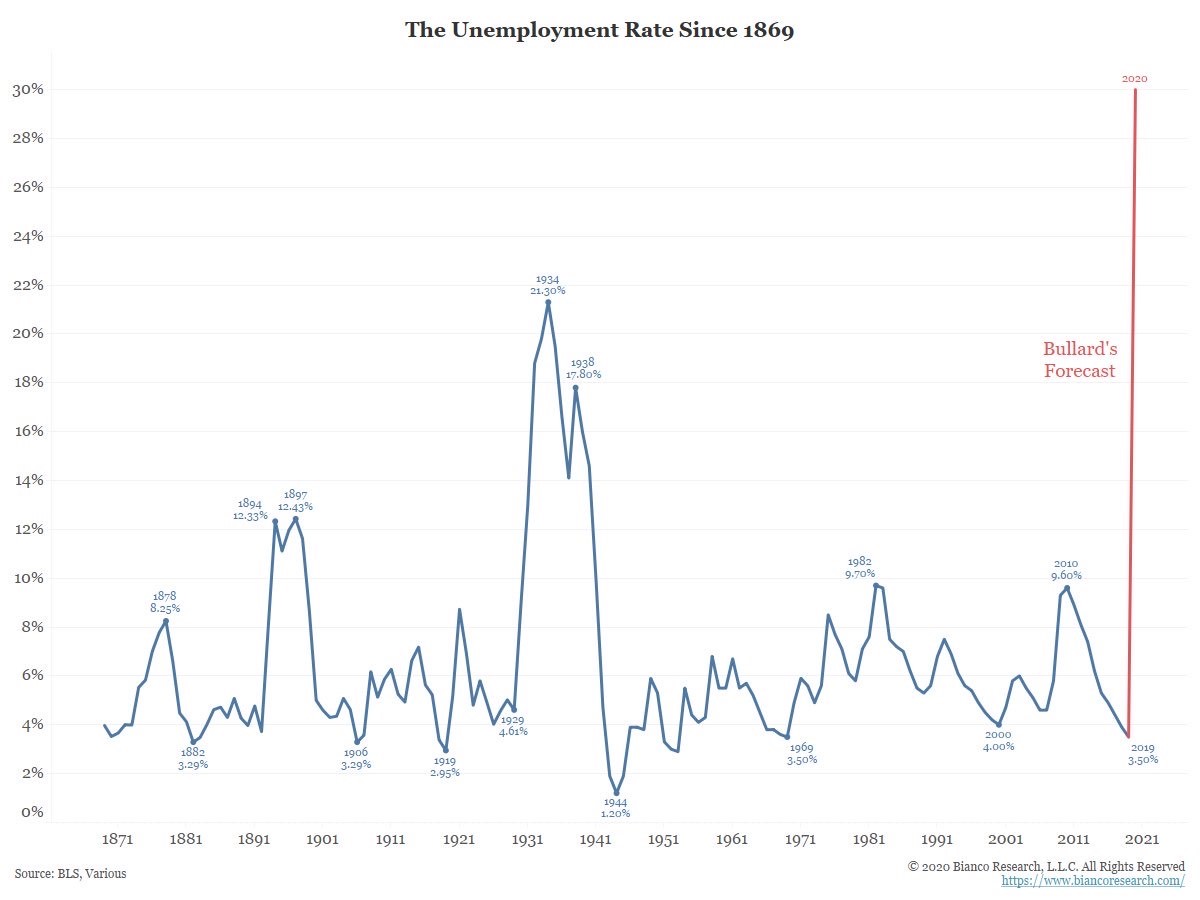

How would that compare to what we’ve seen in previous economic crises and recessions? Consider this chart from Bianco Research:

|

You can see that during the two worst modern recessions — the GFC downturn and the early-1980s slump driven by the highest interest rates in modern history — we topped out around 10%.

So, we’re talking about unemployment surging to more than TRIPLE anything most Americans have seen in their lifetimes unfolding this year

With that said, go back further and look at the Great Depression in the 1930s. Even during the worst of the years-long downturn, U.S. unemployment “only” hit 21%. The current “worst-case scenario” for employment is about 50% higher than that!

Will we hit 30% unemployment? Shockingly, it seems impossible. But is it really? Given the nature of this crisis, it’s a possibility… although, ultimately nobody knows for sure.

The early numbers coming in from after the outbreak news started deteriorating certainly aren’t encouraging.

The Empire State Manufacturing Index plunged a record 34 points in just one month to -21.5 for March. That was the lowest since the GFC in 2009.

A separate index for the Philadelphia region swung from positive-36.7 to negative-12.7, far worse than the positive+8 that economists expected. These kinds of moves are simply staggering.

Policymakers are responding with everything they can to head it off.

This past Monday morning, it went “all in.” It said it would shift from a $700 billion QE program aimed at Treasuries and residential Mortgage Backed Securities (MBS) to an UNLIMITED buying plan. It also added commercial MBS to the mix.

At the same time, the Fed rolled three new programs. The first two, a Primary and Secondary Market Corporate Credit Facility (PMCCF and SMCCF, respectively) are designed to bailout and support the corporate bond market. This makes it easier for higher-quality corporations to raise money selling debt.

The third, a Term Asset-Backed Securities Loan Facility (TALF), is designed to make it easier and cheaper for banks and other lenders to bundle packages of student loans, auto loans, credit card loans, etc. into securities for sale on Wall Street.

Meanwhile, Congress is very close to passing an enormous fiscal stimulus bill. Various provisions would send money directly to Americans, expand unemployment benefits, fund small business and corporate loans, bail out troubled companies in industries like airlines and more.

This is basically the “Mother of All Bazookas” being fired by monetary and fiscal policymakers. It’s much broader and more aggressive than what we saw in 2007-2009, while also being rolled out in a much shorter timeframe.

But what does all this mean for you and your portfolio?

Well ...

1. An aggressive fiscal stimulus bill is and has been what investors wanted. Now that they’re getting it, it is prompting stocks to rally. And that rally could carry for a little while.

2. But unless and until the underlying virus trends turn for the better, any rallies will likely be used by others to lighten up and/or rebalance into less-risky investments. I suggest you do the same.

3. Even when we get through the acute, enormous economic stresses tied to the virus ... which we will ... we STILL have to work off the wild asset market valuation excesses and extraordinarily reckless lending, borrowing and investing imbalances of the last decade. That will take time, and it means lower prices for assets artificially puffed up in the process.

In short, there is NO logical reason to waver from the “Safe Money” investment approach I’ve been advocating since early 2018.

There is no reason to underweight or avoid safer assets like gold, whose price just shot up more than $100 an ounce on Tuesday.

There is no reason to go back to investing 100% of your money in stocks, rather than maintaining a much higher reserve of cash.

And there is no reason to completely ignore some of the worst-case scenarios being bandied about. Rather, you should be factoring them into your decision making when it comes to both investment and personal finance choices.

I don’t know if we’ll face a “worst case” scenario. I hope not. But a little bit of preparation and adaptation — just in case — can go a long way.

Until next time,

Mike Larson