Why Direct Public Offerings Are Better Than IPOs and SPACs

|

| By Tony Sagami |

Everybody knows what an initial public offering (IPO) is. Heck, you may have bought a few IPOs yourself. Perhaps you even hit a home run with one.

The appeal of an IPO has been the ability to get in on the ground floor and capture huge gains.

As of April 14, there were 417 IPOs this year, an astonishing 942% increase from a comparable time period in 2020. (You can track up-to-date IPO data here.)

It’s true that, historically, “big” IPOs have delivered outsized returns. But, generally, it’s more sizzle than steak when it comes to a hot new offering.

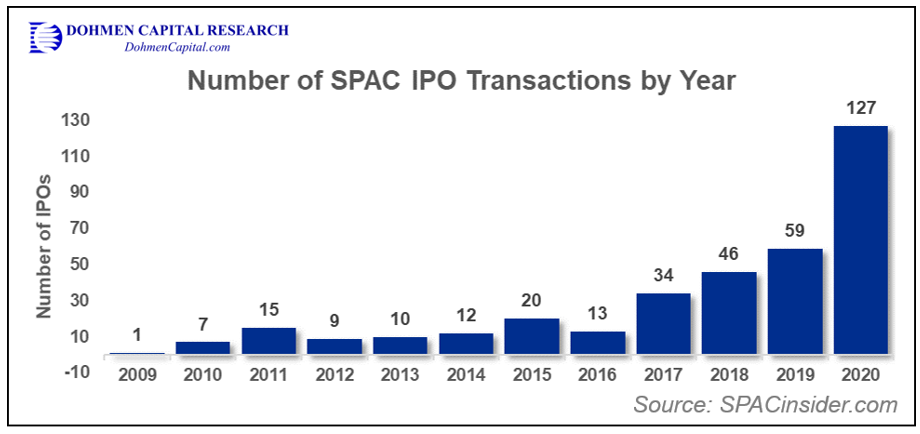

That hasn’t stopped the emergence of a “hot new offering” vehicle, the special purpose acquisition company (SPAC).

SPAC Attack

An SPAC is a shell company created for the sole purpose of raising money through an IPO to eventually acquire another company.

|

SPACs are also known as “blank check” companies because managers can buy whatever they want. You could even think of SPACs as pre-IPO vehicles.

Here’s an example of how the process works. In December 2019, Diamond Eagle Acquisition Corp. went public as an SPAC.

It then purchased sports betting brand DraftKings Inc. (Nasdaq: DKNG) and gambling tech platform SBTech. Diamond Eagle merged those two companies and completed the IPO of DraftKings in April 2020.

Investors who bought the Diamond Eagle Acquisition Corp. SPAC have made 500% in just one year.

That’s impressive. But my purpose here isn’t to get you to buy the next hot new SPAC.

In fact, there’s another new vehicle that’s even better than either IPOs or SPACs.

It’s Best To Be Direct

A direct public offering (DPO) is an alternative to the traditional IPO route. Through a DPO, as the name suggests, shares are sold direct to the public, completely bypassing Wall Street.

There’s a major difference between a DPO and an IPO: The former involves the sale of existing shares, while the latter involves the sale of new stock.

With a direct public offering, company employees and investors sell their stock to the public. In an IPO, a company sells an ownership stake by issuing new shares.

The DPO option offers several advantages compared to the traditional IPO route:

• The company saves hundreds of millions of dollars in underwriting fees. The typical IPO generally costs between 3.5% and 7% of the gross IPO proceeds. Call me cynical, but I enjoy seeing Wall Street cut out of the loop.

• Unlike an IPO, in which the share price is negotiated prior to trading, the price of the DPO stock depends solely on supply and demand.

• DPOs allow employees and early investors the ability to sell as many of their shares as they want on the first day of trading without being handcuffed by the typical “lockup” period. With IPOs, the expiration of the lockup period often results in a flood of shares hitting the market and depressing the share price.

We haven’t seen a lot of DPOs to date, but that’s about to change in a big way.

|

| Source: TD Ameritrade |

Three companies — Spotify Technology S.A. (NYSE: SPOT), Slack Technologies Inc. (NYSE: WORK) and Palantir Technologies Inc. (NYSE: PLTR) — have exploited the DPO route to great success. A third, Coinbase Global Inc. (Nasdaq: COIN), debuted on April 14 with a market capitalization north of $100 billion.

Note that I’ve recommended Coinbase for my Disruptors & Dominators subscribers, and I personally own it. So, I’m “talking my book” at the same time I’m “eating my own cooking.”

The thing to note here is not that it’s time to rush out and buy every DPO that hits the market. As is the case with an IPO or an SPAC, each is different. Some are dogs, while others are rocket ships readying for blast-off.

DPOs do cut out the Wall Street middleman. From there, as always, you have to do your homework before you invest.

Best,

Tony Sagami