What to Do as Corporate Bond Buying Ramps Up & Income Options Dwindle

|

For every borrower, there’s a lender.

But when discussing interest rate cuts, pundits and policymakers always focus on the benefits to the former ... NOT the costs to the latter.

And guess whose hide those costs come out of?

Income-seeking investors just like you!

Consider Monday’s Federal Reserve announcement. This one covered how the Fed will start buying individual investment-grade corporate bonds DIRECTLY. This is instead of purchasing ETFs that, in turn, purchase those bonds.

The move is clearly designed to benefit two constituencies ...

The first is Wall Street firms and investors who own bonds that will trade at artificially inflated prices as a result.

The second is corporations themselves, whose borrowing costs will artificially drop.

The Fed is assuming/hoping these companies will use the money for something productive. Something like investments in plant and property, or research and development or at the very least to just keep the lights on and workers employed until the COVID-19 pandemic wanes.

But the track record of the last several years isn’t very encouraging.

In the last few years, corporations trashed their balance sheets borrowing on “financial engineering.” That’s Wall Street jargon for things like overpriced takeovers, record stock buybacks and other similar actions.

But what does this kind of news mean for YOU?

Simple. If you’re an income-seeking investor, you get hosed!

When you buy a corporate bond or ETF or mutual fund that invests in them, guess what? You’re effectively the LENDER. You’re the “bank.”

You can and should expect to get compensated for the risk the companies you’re lending to will default. And that compensation should come in the form of higher yields. Specifically, higher yields than you would get on U.S. Treasuries. After all, the federal government has a much lower chance of default than a private corporation.

In times of economic crisis ... when credit ratings are falling sharply ... revenue and earnings are under severe pressure ... and corporate balance sheets are in lousy shape ... you should expect yields to be even higher.

Why? You’re taking on much more risk as the “lender.”

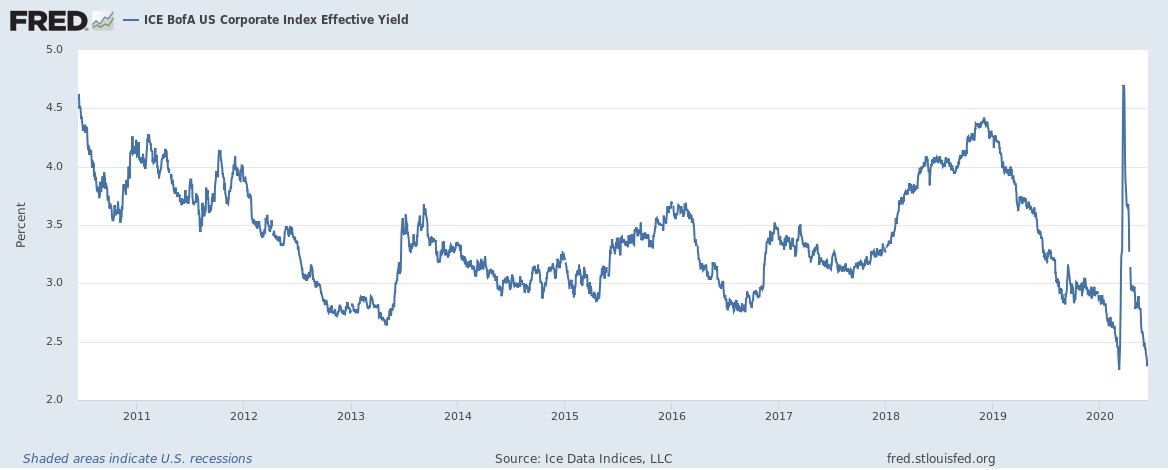

But take a look at this chart. It shows the effective yield on a broad index of investment-grade corporate debt.

|

|

SOURCE: Ice Data Indices, LLC |

Yields shot up to more than 4.5% a couple of months ago. That was at least a reasonable amount of income in return for assuming greater default risk.

But thanks to the Fed’s recent actions, yields have collapsed right back to where they were in early-2020!

We’re talking about roughly 2.3%. That’s the lowest in modern U.S. history!

And that’s despite the radical deterioration we’ve seen in underlying corporate default and debt fundamentals that started before the worst of the COVID-19 outbreak hit.

It’s not just corporate bonds where we’re seeing yields plunge again. We’re seeing it in municipal bonds. We’re seeing it in emerging market bonds. We’re seeing it in high-yield, or “junk” bonds.

In other words, there’s no relief in sight if you’re looking for generous income for reasonable amounts of risk.

Or is there?

Is there a way you can boost the income your portfolio is spinning off? With relative safety, and in a prudent fashion?

As an income-focused analyst, that’s precisely what I’ve been helping my subscribers do for many years. You can click here to subscribe and get my two latest recommendations, both of which spin off market-beating yields and sport other attractive attributes.

Given everything I’ve just told you about the yields available on a wide variety of traditional income-producing investments, one thing is clear:

Never in our lifetimes have we seen a greater need for an income-boosting strategy.

And based on our research, this powerful and reliable system could be just the answer for you ... right here, right now.

Until next time,

Mike Larson