What ‘Safe Money’ Investors Do When the Going Gets Loud

|

Tuesday morning, just before 6:30 a.m. Eastern, Tesla Inc. (Nasdaq: TSLA) CEO Elon Musk tweeted, “I kinda love Etsy.”

That’s it; “that’s the tweet,” as the social-media-savvy like to say.

But it was enough to whip investors into a frenzy.

Etsy Inc. (Nasdaq: ETSY) — the purveyor of custom artwork, jewelry, ornaments and other products — soared more than $14, making it the S&P 500 Index’s biggest gainer in the early going. ETSY has now surged more than a staggering 300% in the last year, despite shares retracting slightly yesterday.

A couple of weeks earlier, Musk tweeted his followers should “Use Signal,” referencing the encrypted messaging app with the name. Again, that’s the tweet: “Use Signal.”

But traders subsequently bid up shares of a completely unrelated public company, Signal Advance Inc. (OTC: SIGL). In no time, SIGL soared from just 60 cents to more than $70. SIGL had no sales as recently as 2016 and only employs a single person full time, according to CNBC.

It’s not just a couple of tweets by an eccentric tech CEO driving a couple of stocks higher, though.

Individual investors and day-traders have been ganging up in various online venues — including the “wallstreetbets” forum on the social media community and discussion site Reddit — to push multitudes skyward.

It absolutely, positively smacks of the kind of stuff I saw going on in the late 1990s during the worst of the dot-com bubble.

And that has extremely important implications for investors, especially “Safe Money” ones who’ve been around the block a few times.

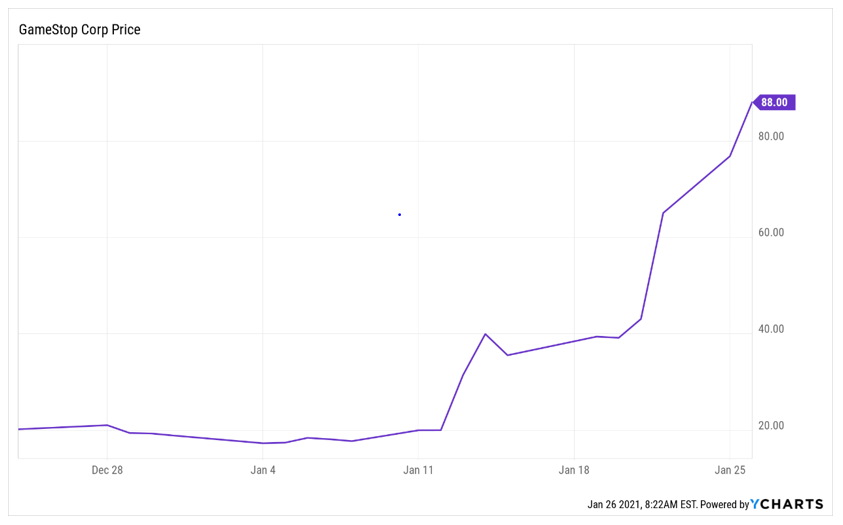

Just look at how the struggling mall-based retailer of video games, GameStop Corp. (NYSE: GME), soared more than 144% at one point on Monday — and has now more than quadrupled since mid-January.

Why? Because we’re not just talking about a handful of day-traders with a couple hundred bucks invested.

We’re seeing extremely heavy stock and options buying that’s impacting a wide range of names — particularly those that professional investors and hedge funds have been “shorting” on the expectation their shares would decline.

When you short a stock, you borrow and sell the shares. Your hope is that you can buy them back later after they’ve fallen in value.

When the shares soar instead, you start losing money hand over fist, and you have to buy them back at exorbitant prices.

That process is called a “short squeeze,” and it can fuel extraordinary moves like those shown in this GME chart ...

|

Moreover, the frantic buying spread to many other unrelated names this week. Take The Clorox Company (NYSE: CLX).

It’s one of my favorite longer-term recommendations in my Safe Money Report. I like the company’s businesses. I like its lengthy history of paying generous dividends. I like its attractive Weiss Ratings track record.

But it’s not some tiny stock that should be easily subject to manipulation. It sports a market capitalization of almost $26 billion. It’s not one of the new-fangled “SPACs” that have attracted so much frenzied day trader interest.

It’s also not a technology IPO. And it has nothing to do with electric vehicles, renewable energy or any of the other whiz-bang industries that have been pulling in billions of investor capital searching for the “next big thing.”

Yet, on Monday, its shares soared out of the gate and kept climbing — on no news. I saw the same pattern playing out in other names as well.

Don’t get me wrong; I’m happy my subscribers are seeing bigger gains when they open their brokerage apps.

But the CLX action — along with the action in countless other stocks, like GME, ETSY and SIGL — is classic dot-com-bubble/frenzied-like behavior.

Back then, short-term investors dog-piled into hot stocks thanks to tips shared on Yahoo Finance and Raging Bull message boards. Now, amateur pump-and-dumpers are doing the same thing on Reddit.

Back then, money-losing internet commerce stocks soared hundreds of percentage points in days, even hours. Now, money-losing EV, battery and retail companies are doing the same.

Back then, hyperactive traders on platforms like E-Trade, Datek Online and Schwab dominated the market for a while. Now, hyperactive traders on platforms like Robinhood are doing the same thing.

So, what does it all mean for investors like you?

Well, I’ve been advocating a “Safe Money” approach to this market for a long time. My strategy involves recommending targeted, selective investments in high-quality, higher-rated, higher-yielding stocks exhibiting bullish trading patterns.

It’s paid off well for subscribers in several instances (click here to learn how you can join them).

But what we’re seeing in the market right now is the kind of frenzied, high-risk, manic behavior you tend to see when a bullish environment starts morphing into a euphoric one.

It doesn’t mean you sell everything. It doesn’t mean you rush to join the beleaguered short sellers.

It means you structure your portfolio in a “Safe Money” way and that you have “insurance” positions in other assets — think gold, silver, precious metals miners and the like.

Stick with that approach. Ignore the dot-com-era dreck. And keep an eye on updates like these.

That’s how you’ll navigate this environment with much better long-term results than those throwing caution to the wind.

Until next time,

Mike Larson