|

Love him or hate him, there is no question President Trump is taking a tougher stance against China than any president in my lifetime.

Over the weekend, Trump tweeted that he plans to raise the tariffs on $200 billion of Chinese goods from 10% to 25%. The higher tariff will affect thousands of Chinese imports, such as electronics, furniture, auto parts, clothing, luggage and bicycles.

My expectation is that it is only a matter of time before we reach some sort of trade agreement with China. But in case you think I'm wrong and believe Trump can do nothing right, you should take a close look at your portfolio to see what stocks could get hammered from an ongoing trade war.

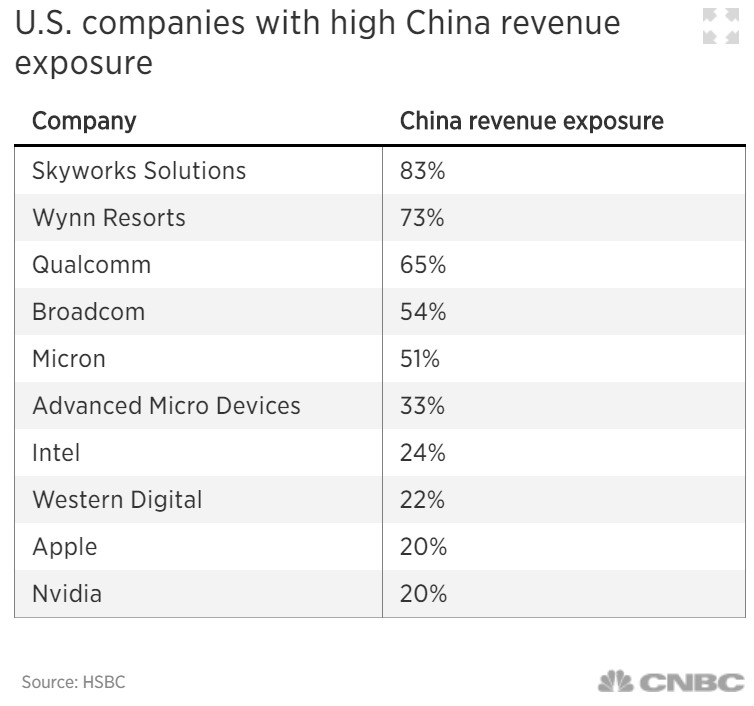

U.S. companies that get a big chunk of their revenues from China would be among the hardest hit. Who would that be?

According to HSBC, the American companies with the highest exposure to China are Skyworks Solutions (SWKS), Wynn Resorts (WYNN), Qualcomm (QCOM), Broadcom (AVGO), Micron Technology (MU), Advanced Micro Devices (AMD), Intel (INTC), Western Digital (WDC), Apple (AAPL) and Nvidia (NVDA).

Of those, the one stock that I believe is headed for trouble — trade dispute or not — is Apple. Here's why …

|

Apple recently reported their quarterly results, and Wall Street was delighted that Apple was able to beat a very low hurdle of expectations.

The reality is that Apple is no longer the growth juggernaut that it used to be. In fact, it is reversing course and getting smaller.

Over the last 12 months, Apple's revenues actually shrunk by 5% and is growing by just a fraction of its heydays. Most of that revenue drop is due to disappointing iPhone sales in China.

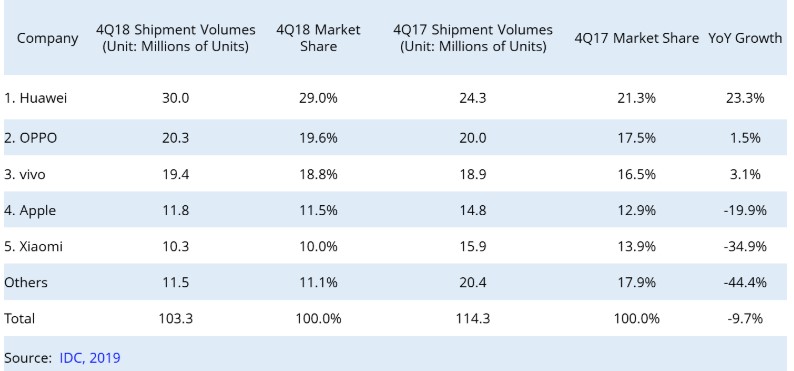

In the last year, Apple's market share of the smartphone market in China shrunk from 12.9% to 11.5%. Moreover, Apple shipped 20% fewer iPhones to China to because of that slowing demand.

My guess is that Chinese consumers (as well as Americans) aren't eager to drop $1,000 on a cell phone when there are substantially cheaper alternatives … with substantially similar performance … such as phones from Xiaomi and Huawei.

And if the U.S./China tariff wars gets uglier, iPhone sales in China are going to get even worse.

|

Furthermore, Apple has a "C+" rating from Weiss Ratings. That is two notches below the minimum "B" rating that I require before I recommend a stock for the Weiss Ultimate Portfolio.

I don't own Apple stock and if I did ... I'd sell it YESTERDAY.

Best wishes,

Tony Sagami