There’s a Very ‘Real’ Reason Why Precious Metals Are So Darn Attractive!

|

I’ve been a vocal bull on precious metals since late 2018 for several reasons.

Gold and silver offer “chaos insurance” in times of market volatility. Central banks have been big buyers in recent years. And relative to a whole host of radically overvalued investment alternatives, metals had grown just too darn cheap.

But there’s one more very important, very “real” reason to get — or stay — on board this runaway train.

This force has to do with interest rates.

When we borrow money, we’re quoted a rate of interest we have to pay for the privilege. When we invest money in bonds or dividend-paying stocks, we’re quoted a yield we earn for the risk involved.

But those are so-called “nominal” rates and yields. They don’t factor in INFLATION.

This is where REAL yields come in. They’re yields AFTER accounting for the loss of purchasing power from the overall rate of inflation.

For instance, let’s say you buy a bond that yields 4%. Whether that’s a “good” or “bad” deal depends on inflation. If inflation is running at 2%, then it’s an okay buy. You’re making 2% per year because the nominal 4% yield MINUS the 2% inflation rate EQUALS a 2% real yield.

But what if inflation is running at 5%?

Then you’re not making anything! Your money is actually LOSING 1% per year (4% nominal yield – 5% inflation rate = -1% real yield).

Of course, those figures are hypothetical. You can track expected real yields every day by looking at the trading action in the bond market — specifically the yields offered by Treasury Inflation Protected Securities (called “TIPS”).

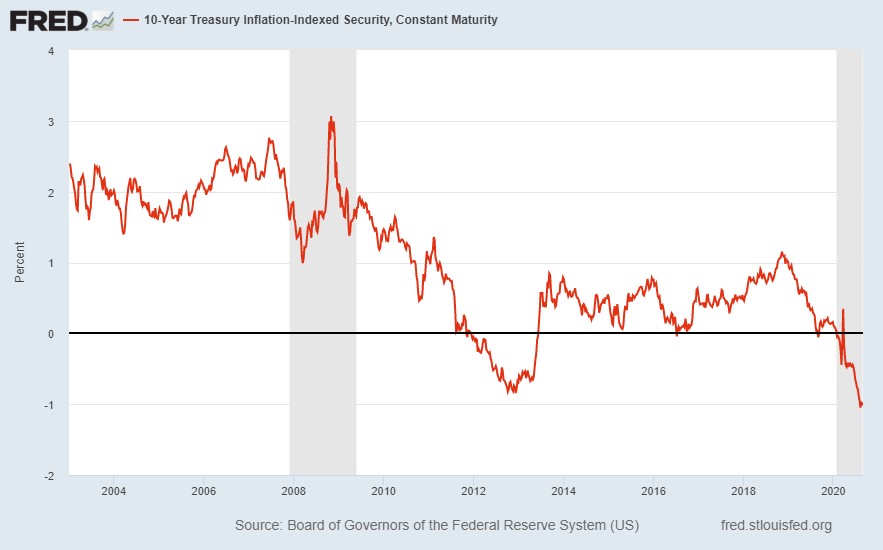

A few days ago, the 10-year TIPS real yield was NEGATIVE 1.02%. As you can see in this chart, that’s the lowest in modern history!

|

This low has several driving forces: The Federal Reserve is helping suppress nominal yields, investors are clamoring for the safety of bonds, the U.S. dollar is falling and longer-term inflation worries are gradually rising.

So, what does this have to do with gold and silver?

Negative real yields mean that yields on things like U.S. Treasuries aren’t even keeping pace with the inflation rate, much less beating it.

The real value of your money is declining!

Is it any wonder that investors are flocking to gold and silver? Mining shares? Other alternative stores of value like cryptocurrencies? Not at all!

There’s a very REAL reason to do so.

Unless and until the Fed changes its policy course, you have a huge built-in tailwind as a precious metals investor. But the Fed has made clear that it has NO intention of changing its “ZIRP (zero interest rate policy) forever” approach.

Bottom line? Be sure you stick with the higher allocation to gold, silver and mining shares. Or if you’re not on board yet, dig into the last few issues of my Safe Money Report. They’ll tell you all the details about what metals investments to buy now. You can subscribe here if you don’t have access yet.

And there’s another safe-haven asset investors are flocking to: cryptocurrencies. Not only are cryptos decentralized — meaning there’s no central policy maker who has the ability to devalue an asset through extensive printing — but there are crypto assets that can earn yields of up to 6%.

Real yields are pushing investors into this new realm of trading, and Dr. Martin Weiss believes it can facilitate The Greatest Money Revolution of All Time.

If you’re interested in learning more about it, watch his recent presentation here.

One last thing: I’ll be participating in the New Orleans Investment Conference again this year. It runs from Oct. 14-17. But as you might expect, the 2020 event has shifted to a virtual platform.

You can get more information about the speaker line up, participating exhibitors, cost to attend and more by clicking here.

I can tell you from years of past experience that Brien Lundin and his team always do an exceptional job with the event. And the 2020 virtual gathering couldn’t be better timed given the bull market in metals! I hope you’ll join me online.

Until next time,

Mike Larson