The Reason Why Stocks are Going (Much, Much) Higher From Here

|

For crying out loud, don’t American consumers know that the stock market dropped by 800 points last Wednesday?

Well, either they didn't notice or they just don’t care. Americans have been spending money hand-over-fist, showing tremendous confidence in the future of the U.S. economy.

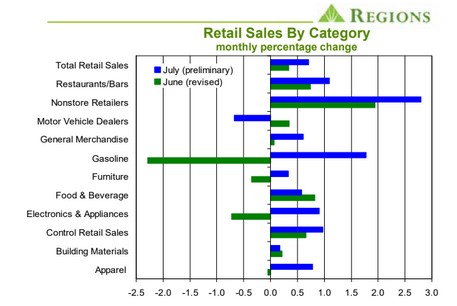

The most recent retail sales numbers showed that Americans are spending in a manner that suggests a rip-roaring economy. In July, retail sales screamed higher by 0.7%, blasting past Wall Street expectations by 0.4%.

|

Everything other than automobile sales, which are notoriously variable, were higher. Without taking auto sales into account, the number jumps to 1.0%.

That’s some BIG spending!

Walmart (WMT, Rated "B-") shoppers are some of the biggest spenders. The company reported much, much better-than-expected results, pulling in $130.4 billion of sales in just 90 days, beating the quarterly forecast of $129.2 billion.

That’s an extra $1.2 billion of sales, so we’re talking about an astronomical amount of money.

The profit picture was just as impressive. Walmart made $1.27 per share, 10% above the $1.22 that Wall Street was expecting.

The shopping enthusiasm extends far beyond Walmart parking lots …

The Conference Board — a non-profit business membership and research organization — reported that consumer confidence jumped to 135.7 in July. That’s the highest level of the year and a massive increase from 124.3 in June.

Lynn Franco, senior director of economic indicators and surveys, said:

"Consumers are once again optimistic about current and prospective business and labor market conditions. In addition, their expectations regarding their financial outlook also improved.

"These high levels of confidence should continue to support robust spending in the near-term despite slower growth in GDP."

The bottom line is that American consumers have tuned out all the Trump tariff talks, an inverted yield curve, surging gold prices, protests in Hong Kong and all the other woes that the talking heads on CNBC are telling you to worry about.

Remember, consumer spending is roughly 70% of our economy, so the consumer spend-a-thon is going to work its way into the GDP numbers.

I know, I know. I can hear the “but” coming …

The stock market has had a tough month and that 800-point drop in the Dow Jones Industrial Average earlier this month has a lot of investors worried.

That kind of market volatility may even have you worried. But don't focus on that.

What I want you to focus on is what central bankers all over the world — including our Federal Reserve — are doing. They’re flooding the world with more monetary steroids: cutting interest rates, increasing QE programs, and even using government money to buy shares of stock!

- The Fed heads are at their annual Jackson Hole, Wyo., symposium right now, deciding just how flexible they want to be with monetary policy.

- Meanwhile, the Hong Kong Monetary Authority revealed a new $2.4 billion stimulus plan last week.

- The Bank of China announced that it will soon unleash a plan to boost disposable income.

- And the European Central Bank is about to drop another “whatever it takes” stimulus package.

Olli Rehn, a member of the ECB rate-setting committee, said that the ECB will start another QE round of “substantial and sufficient” bond purchases, chop interest rates even deeper into negative territory and start using central bank more to buy equities.

The world’s central banks in a desperate race to the bottom. And that means higher stock prices.

Much higher stock prices.

That's what we're betting on in my Weiss Ultimate Portfolio. But we're not buying Walmart. However, we are buying other highly rated stocks that are throwing off some fast, double-digit gains like 57.5% in Match Group and 36.3% in Veeva Systems in just three months … 39.4% in PaySign in just a little over a month … and more. Check out my trading system here. It works in all kinds of market conditions -- and in a market scared of its own shadow, that's very attractive indeed.

Don’t be scared. Be greedy!

Best wishes,

Tony Sagami