Is a ‘Big Shift’ in the Markets and the Economy at Hand?

|

Is a “big shift” at hand?

That’s the question Wall Street is wrestling with here. And, naturally, the answer will have major implications for investors.

Before I offer my answer to that question, let’s back up a few steps and talk about what this “shift” is, why anyone is asking about it and how it would necessitate major changes in your investing strategies.

Let’s go back to early 2018 — a different world, clearly. No one had heard of COVID-19. If you’d told anyone a global pandemic would soon throw the global economy into a tailspin and kill more than 1.2 million people worldwide, they’d have said you were crazy.

But, in the markets, you could see a subtle shift starting anyway. Sectors that do best in strong-growth environments started to falter. Sectors that do best in pre-recession environments started to lead.

Interest rates topped out not long afterward, while precious metals bottomed and began to climb. Stocks went from rallying non-stop to months and months of endless chop.

The inescapable conclusion?

The economic and credit cycles were beginning to turn. The great expansion was running out of gas. The “smart money” was picking up on that. And as these savvy investors shifted their strategies — lo and behold — “Safe Money” investments began to radically outperform.

The COVID-19 outbreak clearly accelerated and amplified those trends that were already in place.

It turned an economic slowdown into a total collapse. And it transformed a subtle, longer-term shift in market leadership into an incredibly vicious, shorter-term rout.

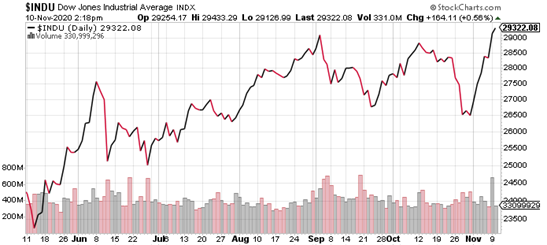

Enormous amounts of monetary and fiscal aid turned the tide. But then, the market’s momentum from spring and early summer began to fade. The advance stalled out in late August.

Now, fast-forward to this month ...

First, we got a presumptive President-elect Biden victory (even if President Trump and his allies aren’t yet willing to concede). But we didn’t get a corresponding “blue wave” in Congress. That’s a recipe for gridlock in Washington, which Wall Street historically appreciates.

Second, Pfizer Inc. (NYSE: PFE, Rated “C+”) dropped a bombshell on Monday morning. The pharmaceutical giant announced its lead COVID-19 vaccine candidate was more than 90% effective in preventing infections among volunteers in a massive clinical trial. The firm is co-developing the vaccine with the German company BioNTech SE (Nasdaq: BNTX, Rated “D”).

That said, we didn’t get full study details. Important questions remain. Other trials from other firms are still ongoing. And it will be months for enough vaccine to be manufactured and distributed widely, even assuming Pfizer gets emergency authorization for the two-dose product from the Food and Drug Administration.

But Wall Street greeted the news with euphoria anyway. Dow futures soared more than 1,700 points in the early going, then the Industrials ultimately closed with a gain of around half that much.

|

Here’s where the “big shift” question comes into play.

Even as the Dow surged, the Nasdaq tanked. Financials, energy and other beaten-down, out-of-favor sectors led. Former leaders like technology badly lagged. Many work-from-home stocks imploded, while cruise lines, hotels and airlines soared.

In other words, investors finally embraced “value” names and tossed out the “growth” stocks they were previously enamored with. They also unloaded Treasuries and precious metals.

So, is this it? Is this the moment for a radical rethinking of your approach to markets?

The short answer is “it’s too soon to say.” The slightly more complex answer is, “I highly doubt it given the major economic and cyclical issues we still face.”

I’ll explore all of it in the November issue of Safe Money Report, which drops this Friday. Click here to subscribe if you’re not already on board.

In the meantime, I would not make any major changes to your portfolio right now.

As happy as we should all be about the possibility that effective COVID-19 vaccines are coming ... and that (most of) the election drama is behind us ... pandemic and politics aren’t the only obstacles markets face.

And that’s why a Safe Money approach is still your best bet.

Until next time,

Mike Larson