But Wait! There’s More! … We Have Screeners for Mutual Funds and ETFs, Too!

By now, there should be no doubt in your mind that the Weiss Ratings Stock Screener can help you with your personal investing portfolio.

Even if you don’t want to use the ratings, there are so many other criteria that you can sort by.

I’ve also talked about how easy it is to set up a watchlist. We’ll automatically email you if the rating of that company changes. But it’s also incredibly simple to click on the security and be taken to the complete profile.

What you may not know is that we rate more than just stocks.

We offer both the screener and watchlist functionality for banks, credit unions and insurance companies. These safety ratings can help you avoid placing your money in an institution that could be on the way to failure.

You can also use these tools on exchange-traded funds (ETFs) and mutual funds. This can be helpful since typically you can’t invest in single stocks or bonds in your 401k account.

Instead, there will be a list of participating funds that you can select. Some will be actively managed, and some based on a specific index.

I remember working to set up my first retirement account years ago. I sat down with the list and pulled up the information of each one. It took way more time that it should have, but I wanted to make an informed decision. Heading on over to WeissRatings.com takes all that legwork out.

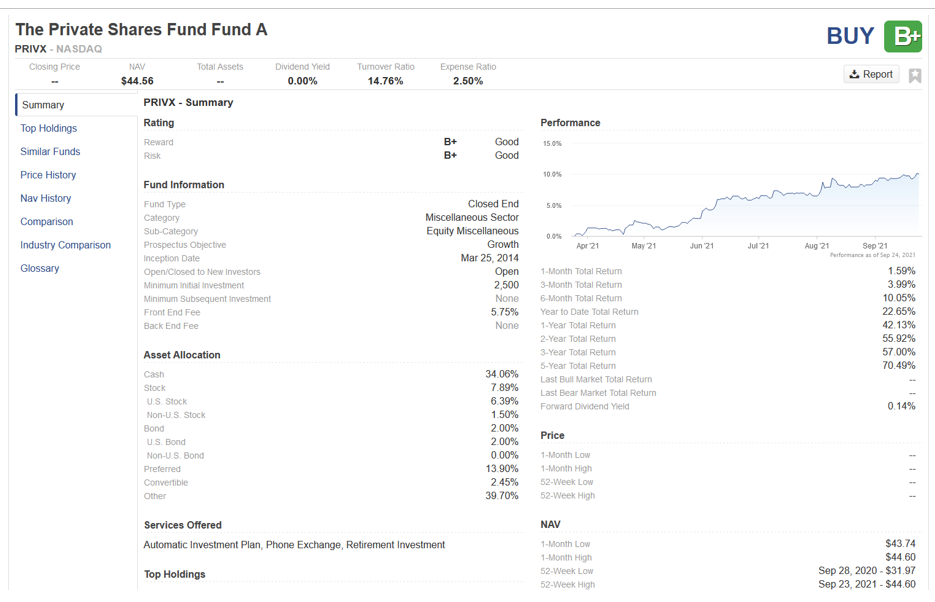

The search bar at the top allows you to search by name or by symbol. You’ll then be taken to the summary page where you’ll be able to see fund information such as fees, asset allocation, price history, company information and investment strategy.

|

On the left, you’ll see a menu that will show you even more information such as top holdings and similar funds.

Even if you don’t have a retirement account, nearly all online brokers let you buy ETFs and mutual funds as easy as buying a stock. There are currently 206 “buy”-rated ETFs and 11,173 “buy”-rated mutual funds that you could consider!

|

Clicking on the “buy” segment of either of these graphics on the Weiss Ratings home page will show you a complete list of those buys. This list opens in the screener, so you could add more criteria and narrow down your selection even more. From there, you’ll be able to see full details for any fund, and even add them to your watchlist.

If you’re interested in funds, I highly recommend you take a look at all the options. It offers a plethora of information all in one place instead of having to pull up each prospectus individually.

So, let’s take a quick look at some of the top-rated ETFs and mutual funds. Neither investment type had any in the “A”-rated range. Instead, we’ll look at what came up in the “B+” category.

There were only two “B+” rated ETFs:

1. Global X Lithium & Battery Tech ETF (NYSE: LIT)

Objective: Seeks to provide investment results based off the Solactive Global Lithium Index. This index is designed to measure the broad-based equity market performance of global companies involved in the lithium industry.

Top Holdings: Albermarle (NYSE: ALB), Ganfeng Litium (OTCMKTS: GNENF), Yunnan Energy New Material Co.

Expense Ratio: 0.75%

Dividend Yield: 0.14%

YTD Return: 35.2%

One-year Return: 122%

The best way to play lithium is by signing up for Weiss Ultimate Portfolio. Sign up to get names/tickers, along with ongoing guidance. Click here for more information.

2. ProShares Ultra Technology (NYSE: ROM)

Objective: Seek results that correspond to two times the daily performance of the Dow Jones U.S. TechnologySM Index. This index measures the performance of certain companies in the technology industry.

Top Holdings: DJ U.S. Technology Index Swaps (Goldman Sachs, Citigroup & Societe Generale), Apple (Nasdaq: AAPL), Microsoft (Nasdaq: MSFT)

Expense Ratio: 0.95%

Dividend Yield: None

YTD Return: 54.4%

One-year Return: 103.2%

For mutual funds, there were only five rated “B+.” All of them were shares of the Morgan Stanley Europe Opportunity Fund or the Private Shares fund. So, let’s take a look at the A shares of each.

1. The Private Shares Fund – Fund A (Nasdaq: PRIVX)

Objective: Seek capital appreciated by primarily investing in late-stage operating businesses.

Top Holdings: Goldman Sachs Government Fund, Marquette Medical Systems, Spacex Common Shares, Axiom Space Conv 3% 8/11/2023

Expense Ratio: 3.5%

Dividend Yield: None

YTD Return: 22.6%

One-year Return: 42.1%

2. Morgan Stanley Europe Opportunity Fund Inc Class A (Nasdaq: EUGAX)

Objective: Seeks capital appreciated with at least 80% of its assets issued by those located in European countries.

Top Holdings: DSV Panalpina (OTCMKTS: DSDVY), Evolution Gaming Group AB, ASML Holding (NASDAQ: ASML), HelloFresh SE Bearer Shares

Expense Ratio: 1.38%

Dividend Yield: None

YTD Return: 19.5%

One-year Return: 50.3%

These are just quick looks at four of the potential “buy”-rated funds that you might want to take a closer look at.

Even if you’re not looking to buy new funds, you might want to head on over to the WeissRatings site and make sure that your current retirement account isn’t full of “sell” rated funds.

Best,

Kelly Green