As Job Market Heats Up, This Group of Stocks Should Catch Fire

|

When the Bureau of Labor Statistics reported that our economy created 312,000 new jobs in December, the Dow Jones Industrial Average leapfrogged by 746 points, or 3.3%.

Those 312,000 new jobs are impressive, especially since this figure blew past Wall Street's forecast of 177,000 new jobs.

That's not a one-one-month aberration, either. Last year, our economy created 2.64 million new jobs — up from 2.19 million in 2017.

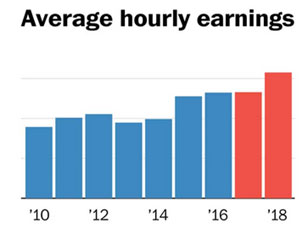

However, what really impressed me was the increase in wages.

|

Ever since the 2008-'09 financial crisis, wages have been creeping higher at a snail's pace. But the strong economy and low unemployment are forcing companies to compete more vigorously to attract and retain workers.

The result is that wages are starting to take off.

|

|

Average hourly earnings for all workers increased by 0.4% in December, following a 0.2% gain in November.

On an annualized basis, wages jumped 3.2% over the last year, tying it with October for the strongest wage growth since April 2009.

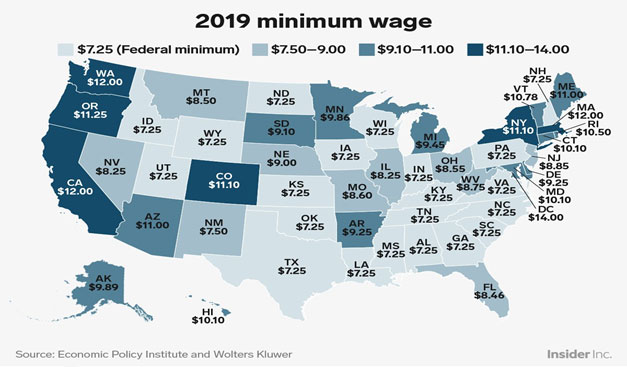

Those wage numbers are going to get even better as 20 states increase their minimum wage, including Massachusetts (from $11 to $12), Colorado ($10.20 to $11.10), and Maine ($10 to $11).

Other states — Arizona, California, Colorado, Maine, Missouri, New York and Washington — are phasing in increases that will result in minimum wages of $12 to $15 per hour.

These minimum wage increases affect more people than you may think. The Economic Policy Institute estimates that around 5.3 million workers, or 8% of the American workforce, will see their paychecks increase.

|

Is there a way to profit from the jobs boom and rising wages? You bet there is!

Bigger paychecks are going to translate into stronger consumer spending. That's a boon for our consumer-driven economy. But the biggest investment winners may be staffing companies, such as:

• Heidrick & Struggles International (HSII, Rated "C")

• KForce Inc. (KRFC, Rated "C+)

• Insperity Inc. (NSP, Rated "B")

• Robert Half International (RHI, Rated "B-")

• BG Staffing (BGSF, Rated "B")

• Korn/Ferry International (KFY, Rated "B+").

Sure, the stock market has been struggling, but these companies' revenues and profits are booming. Those are precisely the type of stocks I've been recommending in the Weiss Ultimate Portfolio. We recently bagged a 15.3% gain on one of these names, and another is currently trading just below our entry price, which makes this a great time to start a new position. (Not a member yet? Start here.)

The jobs situation is only going to get better. This reality is going to keep our economy humming along, boost corporate profits and, ultimately, give a nice lift to stock prices.

Lots of investors are worried about stocks. And it makes sense to be cautious in any type of market. But instead of running for the hills, I suggest you rotate some of your portfolio into the parts of the economy that are thriving. And staffing stocks look like a great place to start.

Best wishes,

Tony