As Health Insurance Premiums Rise, You Can Profit by Buying Insurance Stocks

When it comes to rising health insurance costs, I have a simple piece of advice: Don't get mad, get even ... by investing in the insurance companies making money from them!

Before I get to my recommendations, though, let's cover some background on those costs. Count yourself fortunate if you work for a company that provides health insurance. While few companies pay for 100% of the cost of health insurance these days, most cover a significant portion of the cost.

How much does health insurance cost? Well, if you had to pay for all of it out of your own pocket — like I and millions of self-employed Americans do — you would faint at how expensive it is.

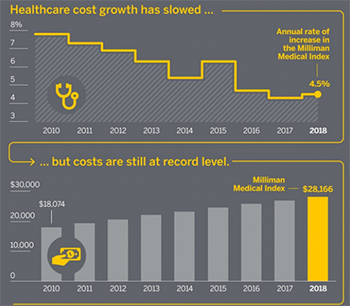

According to Milliman, a large international actuarial and consulting firm, the average cost for a family of four — two parents and two children — is now at $28,166 a year.

|

|

Click image for a larger view. |

That is a 4.5% increase in the last year, which may not sound too bad. But it translates into a $1,200-plus increase.

Worse, the percentage of each increase falling on employees rather than companies is rising, according to Milliman.

"Over the long term, we have seen employees footing an increasingly higher percentage of that total. That trend continues in 2018, with employee expenses increasing by 5.9% while employer expenses increased by only 3.5%."

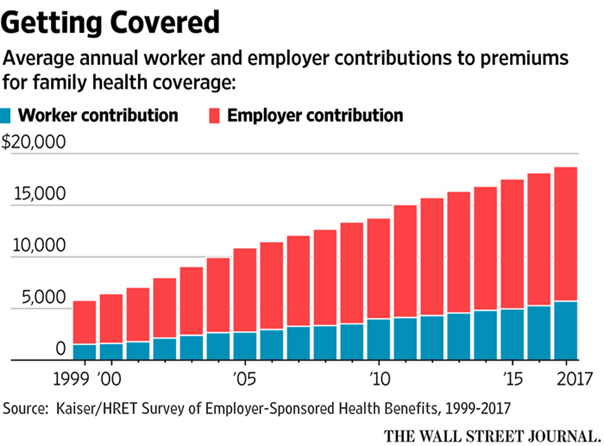

According to The Wall Street Journal, the average American family pays $6,690 a year in health insurance premiums. Moreover, the average annual, per-person deductible is $1,200 a year. Ouch!

|

|

Click image for a larger view. |

The high cost of health insurance doesn't disappear when you retire, either. Even with Medicare, retirees spend a small fortune on health insurance. According to the Bureau of Labor Statistics, the average 65-plus household spends $499 a month on healthcare. That includes $4,000 a year for health insurance (above and beyond Medicare).

With all those billions being spent on health insurance premiums, you know that somebody has got to be making a mountain of money. So, you might as well try to get your share by investing in one or more of the major health insurance companies. Here are the largest players, and their Weiss Investment Ratings:

- Aetna (AET, Rated "B")

- Anthem (ANTM, Rated "B")

- Centene (CNC, Rated "B")

- Cigna (CI, Rated "B-")

- Humana (HUM, Rated "A-")

- UnitedHealth Group (UNH, Rated "A")

- WellCare Health Plans (WCG, Rated "A-")

Of course, the goal of any insurance company is to collect more in premiums than is spent on claims. But one of the biggest keys to profitability is size.

That's because the largest health insurers can negotiate lower prices from hospitals/doctors, and they can collect more in interest from the premiums they are paid.

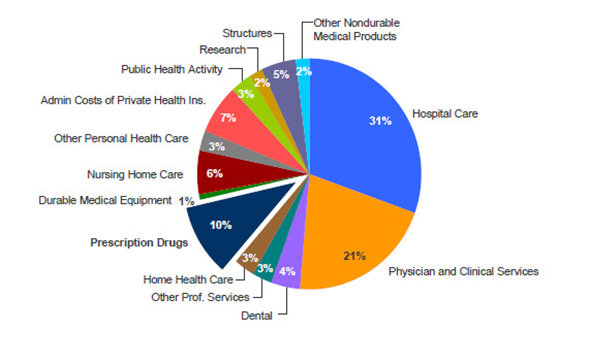

The key metric to look at is the ratio of healthcare costs to premiums.

Different insurers call it different things, but look for the medical loss ratio (MLR), medical benefit ratio (MBR) or medical cost ratio (MCR).

The lower the ratio, the better.

|

|

Click image for a larger view. |

Who has the lowest, most profitable ratio? As of the end of 2017, it was UnitedHealth Group at 81.4%.

That doesn't mean you should rush out and buy UNH today. As always, timing is everything. So, I recommend that you wait for it to go on sale — OR for my buy signal in the Weiss Ultimate Portfolio. Click here to see how you can use this Ultimate Wealth-Building Strategy to go for 67% gains per year.

But make no mistake — somewhere in our $3.3 trillion of annual healthcare spending, you'll find big stock market profits just waiting to be made. Exposure to the health insurance industry could be just the thing to goose your portfolio returns to healthy heights.

Best wishes,

Tony Sagami

P.S. No matter what happens in in the world, your investments, your retirement and your LIFE can be richer and more secure than you ever imagined. Watch this video about "The Ultimate Wealth-Building Strategy for Uncertain Times," and see how you can get the ultimate in peace of mind today.