America's Best Funds are Reserved for the Rich. Or are They?

|

I've squirreled away a pretty good pile of acorns, but apparently not enough to be invited to a $10,000-a-plate political fundraising dinner. Good thing, too; I'd tell them to pound sand.

However, I recently received an invitation to invest in a private-equity fund.

Private equity? Remember all the hullabaloo around private equity funds when Mitt Romney ran for president in 2012? Romney made his fortune (estimated at $200-plus million) from Bain Capital, one of the largest private-equity fund managers in the world.

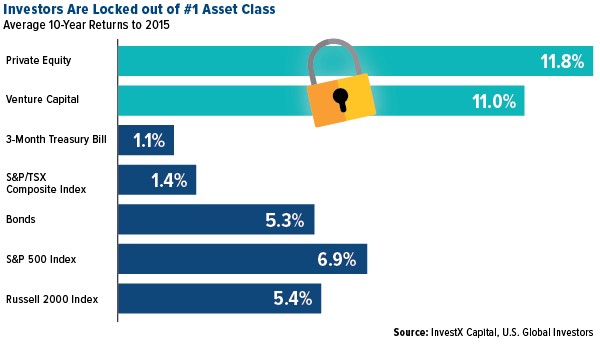

Study after study has shown that private-equity funds — as well as venture capital and hedge funds — have delivered some of the fattest returns on the planet. Much better than index funds and the most popular mutual funds and ETFs. I was seriously interested.

|

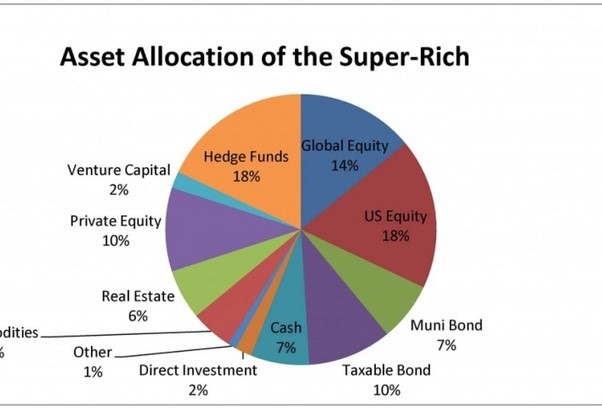

No wonder the super-wealthy invest almost one-third of their money into private equity, venture capital and hedge funds.

I asked my friend to send me the details, and after reviewing them, I was ready to invest. But getting invested was going to require more paperwork than getting a mortgage. And it was all so complex that I could tell I'd need some help from my lawyer AND accountant.

|

That's a shame.

One of the biggest and least-talked-about reasons for income inequality is access to the best money managers.

For a moment, forget about the large investment minimums and focus on the bureaucrats who make up the investment laws. They have those laws set it up to restrict everyday investors from participating in private equity, venture capital and hedge funds.

The barriers to entry are too high for 99% of investors. The result is that the rich are getting richer and the poor are getting poorer. And for that, we can largely blame policies of envy that increasingly restrict investors' access to wealth-building instruments.

At the same time, the accounting/auditing cost of running a public mutual fund or ETF has doubled since 2016. One of the reasons is that publicly traded firms are facing tougher and costlier regulations.

At the same time, the fees for private funds has stayed the same. As a result, the best money managers are closing their public funds and opening new private funds instead.

That's exactly how I got the invitation I wrote about at the start of this article.

It simply isn't fair that only zillionaires can invest in private equity, venture capital and hedge funds.

But what can you do to change that?

Well, one option is to write to your Congressmen/women and Senators. It will take a lot of letters to change the mind of the entrenched swamp rats in Washington, D.C., so please do your part.

While we wait for large-scale change, you can invest in Business Development Companies, or BDCs. They are also known as closed-end funds. These are publicly available funds that are similar to private funds.

Congress created BDCs in 1980 as a job growth program designed to help small and mid-sized businesses raise capital. BDCs make investments in private companies and receive a generous participate in the companies' growth and profits.

Some of the largest BDCs include Ares Capital Corp. (ARCC), Main Street Capital (MAIN), Owl Rock Capital (ORCC), Golub Capital (GBDC), Bain Capital Specialty Finance (BSCF) and Triple Point Venture Growth (TPVG).

As always, you need to do your homework and make sure a BDC is right for your situation and needs. But if you want to invest like the ultra-rich, BDCs are worth considering.

Best wishes,

Tony Sagami