Veeva’s Technology Is Helping to Transform Health Care

By the time you read this, deaths from the COVID-19 pandemic in the U.S. will have surpassed the number of dead due to the 1918 influenza pandemic.

Here’s Bloomberg:

The U.S. has reported 673,768 deaths since the start of the pandemic, according to Johns Hopkins University data — just shy of the 675,000 that are estimated to have died a century earlier. The toll has increased by an average of 1,970 a day over the past week.

That’s despite the rapid deployment of revolutionary vaccines whose development was actually decades in the making. Indeed, “the coronavirus pandemic brought a breakthrough,” according to Nature.

Unfolding in the background of such monumental events is the more prosaic transformation of health care delivery as the result of what Jon Markman calls the “Great Digital Transformation.”

Sure, COVID-19 continues to grab the meaningful real estate when it comes to headlines ... but if you take a little time and dig a little deeper, you can find nice ways to profit from a long-term trend.

Here’s Jon with the Sept. 17 entry for Pivotal Point readers, “Finding Profits at the Intersection of Health and Tech”:

Occasionally, good stocks decline even when business is growing strongly.

It’s the weirdest thing … and it’s always a promising sign that savvy investors should pick up on as a very positive indicator for a buying opportunity.

Right now, there’s a glaring example of this in Veeva Systems (NYSE: VEEV) — which has a great business with a terrific executive team, great products and strong competitive advantages.

Veeva operates in three segments:

1. Helping large pharmaceutical companies with filings to comply with government regulations;

2. Capturing clinical trial data; and

3. Performing as a customer relationship management tool for sales professionals.

The entire healthcare sector is undergoing its own digital transformation.

Source: SeekingAlpha Many parts of health care still use paper for regulatory filings. Veeva’s cloud-based software eradicates paper. It’s an instant productivity boost and it’s leading to heady sales growth.

The Pleasanton, Calif.-based company reported spectacular second-quarter financial results on Sept. 1, beating on both the top and bottom lines.

Executives even raised guidance for Q3. And shares tumbled 7%.

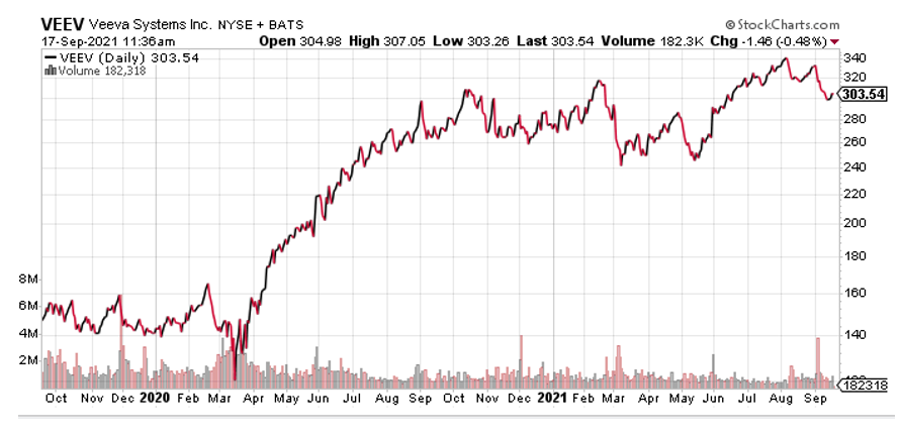

Here’s VEEV’s daily chart:

There was no reason for this, apart from technical selling.

A report from Investor’s Business Daily noted that shares were toying with its No.1 sell rule for so-called momentum traders.

This is the idea, according to IBD, that a share price should never retreat more than 7% to 8% below a technical buy point. Veeva shares are now well below that point.

The restlessness of short-term momentum traders looks like a dumb reason to sell shares. Every time shares have corrected by 15% or more since 2016, a move to substantial new highs occurred five months later, on average.

• And that brings me to my point of this issue: Savvy investors need to ignore technical mumbo jumbo and consider buying shares.

Let me reiterate: Business at Veeva is not good … it’s GREAT:

• Sales during Q2 grew to $456 million, up 29% from a year ago.

• Earnings per share (EPS) surged to 94 cents, up 31%, and 7 cents clear of the FactSet analyst consensus expectation.

• Longer-term subscriptions accounted for $336 million in Q2.

The company is making good progress moving more of its business to longer-term subscriptions, and this steady source of cash usually leads to higher share price valuation because the executive team has better earnings visibility.

Jon closes by noting that VEEV is a long-term holding for the Weiss Technology Portfolio, and it’s currently up around 83% since adding it in August 2019.

Click here to learn more about how you too can follow his timely buy and sell signals on this and other high-profit-potential tech stocks.

This offer expires Tuesday at midnight, so be sure to click that link right away.

Best wishes,

David Dittman