THIS Turmoil is Why I Keep Harping on Divergences, Defensives & Dangerous Fed Chatter!

|

For several months now, I’ve been hammering home three key points about this market environment ...

First: Our unbiased, emotion-free Weiss Ratings data has consistently shown that many stocks aren’t participating in rallies these days. They’re sitting on the sidelines or declining even as the narrow, mega-cap-dominated S&P 500 sets marginal new highs.

Second: Defensive, dividend-focused, anti-recession Safe Money sectors and stocks are outperforming the overhyped, over-owned, over-loved offensive ones. They’re right for this interest rate environment, right for this point in the economic cycle and right for investors.

Third: The popular theory that we’re seeing a super-bullish, 1994-1995-style Federal Reserve interest rate cycle is poppycock. The start of the last two Fed rate-cutting cycles weren’t bullish beyond a few weeks. Instead, they were followed by disastrous bear markets and recessions.

On top of that, I noted that gold and Treasuries are beating the pants off the major stock market averages ... that volatility and credit markets were NOT confirming the equity market strength ... that the inverted yield curve is warning of a coming recession ... and that you simply mustn’t ignore all those caution flags.

NOW you can see why all of that was so important! In just the past few days, the Dow Industrials plunged more than 1,700 points. The S&P 500 tumbled back into its 18-plus-month-long purgatory range. And the Russell 2000 gave up all the gains it had racked up since October 2017.

At the same time, gold exploded to a six-plus-year high of $1,486 an ounce while yields on longer-term Treasuries imploded. The 30-year bond is now yielding around 2.14% … only a few dozen basis points above its all-time low from 2016.

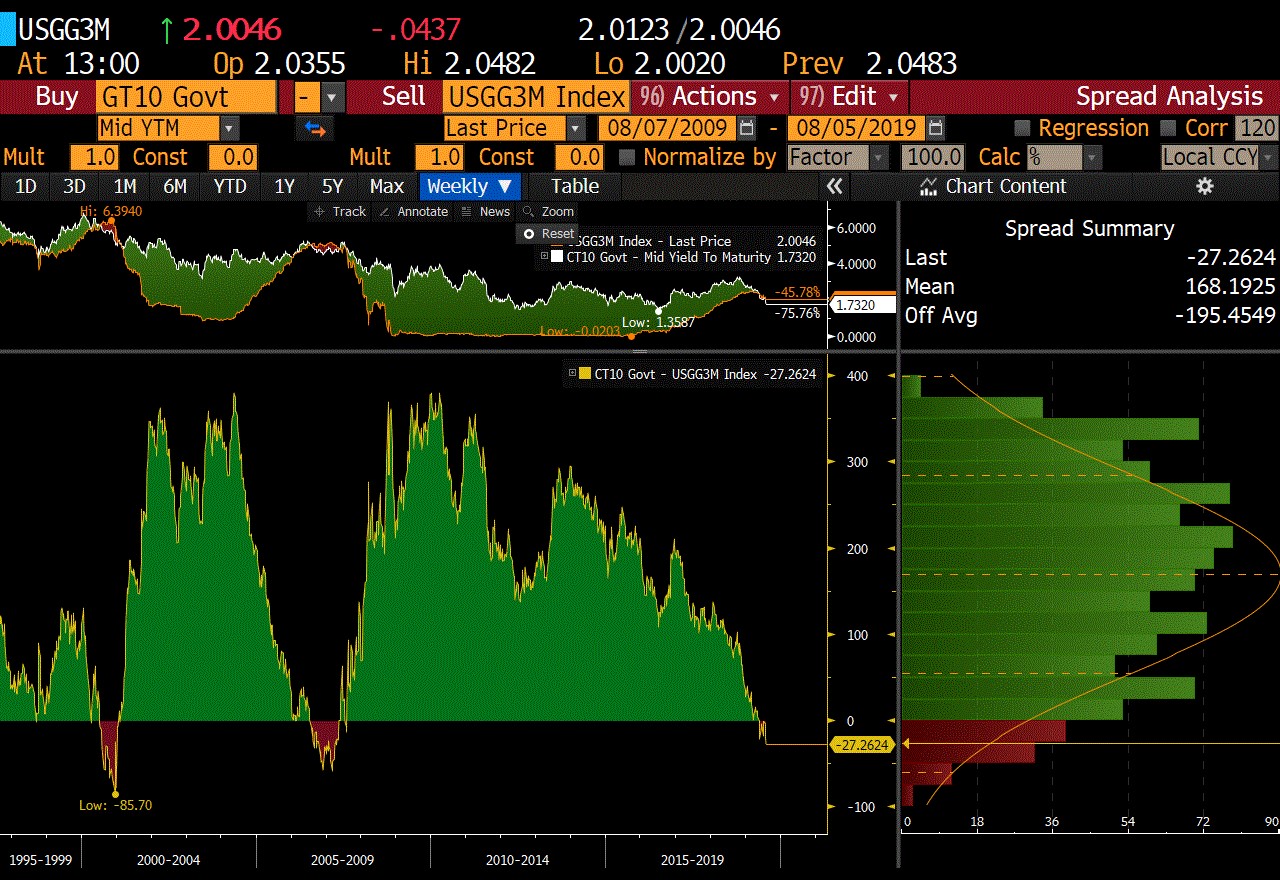

Plus, the 3-month bill/10-year note yield spread collapsed to negative-27 basis points. Not only is that a fresh low for the cycle, it’s also eerily similar to what we saw happen before the last two recessions, as you can see in the lower left-hand panel of this chart.

|

Where did this renewed turmoil come from?

The first sign of trouble emerged when the Federal Reserve cut the short-term federal funds rate target by 0.25%, or 25 bps, to a range of 2% to 2.25%. That was what I expected. But the move disappointed some easy money fans on Wall Street who wanted 50 bps.

Fed Chairman Jay Powell also botched the post-meeting press conference. He talked in circles, spoke in contradictory terms at different times and sounded defensive when reporters began to lob more aggressive questions his way.

Then there’s the more important thing I highlighted even before the news broke: The Fed isn’t starting to cut rates because everything is coming up roses. It’s doing so because it’s “very worried about deteriorating conditions around the world”. Ultimately, that’s not bullish.

Result: Stocks started tanking and bond yields started plummeting. The move only gathered steam in the ensuing days when President Trump ratcheted up the trade war with China. He pledged to slap 10% tariffs on another $300 billion in Chinese exports. The Chinese responded by allowing their yuan currency to devalue below a key threshold.

What’s the most important takeaway here? Short-term, day-to-day moves in asset markets can stem from news on tariffs or the latest Fed speech.

But it’s the bigger-picture trends that really matter!

For more than 18 months now, they’ve pointed to an unmistakable conclusion: This is NOT the same unabashed bull market we had up until January 2018. So, make sure you do NOT trade/invest like it is!

Instead, focus on the general investment themes and ideas I share here in my weekly emails. They’re tailor-made for this new environment. I also file frequent updates on my Twitter account, which you can follow here: @RealMikeLarson.

I also offer more specific recommendations in my Safe Money Report. I’m pleased to report solid single- and double-digit open gains despite the market turmoil. If you aren’t already on board, you can join Safe Money by clicking here or calling 877-934-7778.

Lastly, if you didn’t catch me in Vancouver, that’s okay. You can join me and get my latest market views at the MoneyShow San Francisco soon. It runs from Aug. 15 through Aug. 17 at the Hilton San Francisco Union Square. You can register to attend for free by clicking here.

Then later this year, I’ll be headed to the 2019 New Orleans Investment Conference for a long weekend of hard-hitting presentations, discussions, and listening sessions with dozens of top investment, money, and mining experts. You can learn more about the event, which runs from Nov. 1-4 at the Hilton New Orleans Riverside hotel, by clicking here.

Bottom line? It’s a volatile time in the markets, filled with big pitfalls for those who aren’t properly positioned. But there are also a host of opportunities which I’m dedicated to helping you identify and profit from, come what may.

Until next time,

Mike Larson

P.S. It’s been 14 years since I’ve issued a warning like this... Look, I realize that on the surface everything appears to be fine. But as you’ll see in my urgent briefing, this is really a house of cards waiting to collapse. In it, I’ll show you 4 specific steps you must take now to weather the storm. Click here to watch.