The Retirement “Thief” That Could Leave You In Debt

Your Medicare Bill May Put Your Retirement Savings in Jeopardy

You’ve been saving for years, looking forward to a comfortable, stress-free retirement.

But what if, God forbid, you get seriously ill or suffer a major accident? You could find yourself owing tens of thousands — or even hundreds of thousands of dollars in medical bills.

Just one major health event could wipe out your retirement money… or worse, leave you with crushing debt.

It’s a brutal reality: Medicare doesn’t cover 100% of medical costs, and you could be on the hook for thousands of dollars in premiums, copays and out-of-pocket expenses.

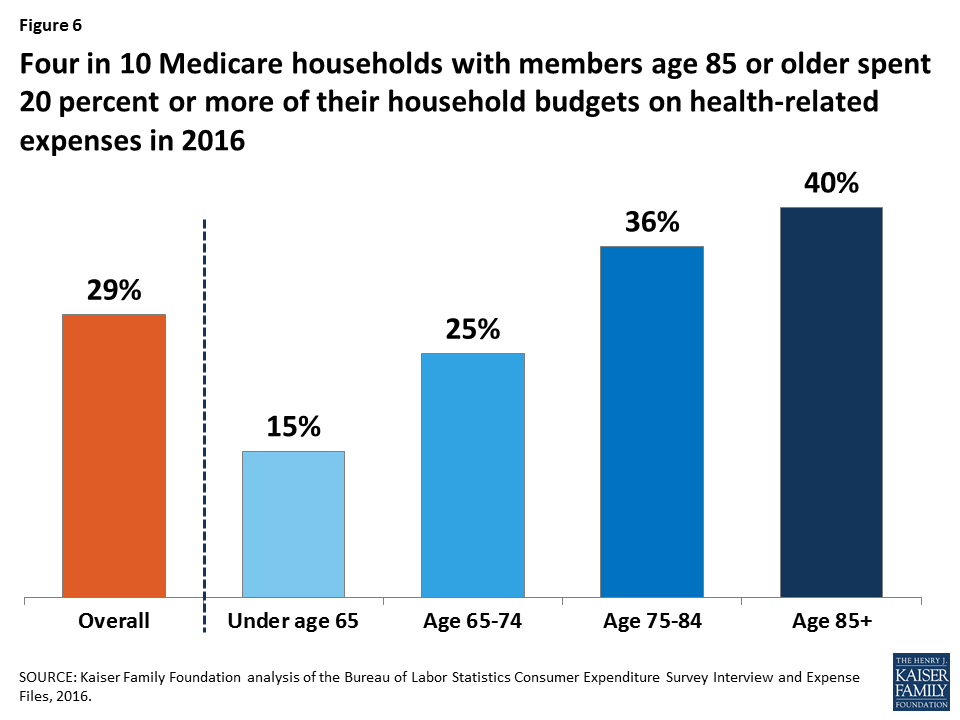

And as you get older, the amount you’ll need to spend on health care will inevitably rise, at the same time your nest egg shrinks. It’s easy to see how healthcare costs can become burdensome… very quickly.

This only highlights the importance of monitoring health care affordability — especially if you are on a limited budget.

If you aren’t willing to risk your retirement reserves when the unexpected happens, Medicare Supplement Insurance — or Medigap as it’s commonly called — can help immensely.

First, Medigap plans cover most or all of the gap between what doctors or hospitals charge and what Medicare pays for. No co-pays to worry about.

Second, you're free to choose your own doctor and see a specialist whenever you need to. Compare that to Medicare Advantage plans, which restrict you to doctors and hospitals within a network and require referrals for specialists.

And third, you're free to go to clinics and hospitals that are most convenient, and that will do the best job taking care of you.

Under Federal law, Medigap plans are all standardized. In other words, every Plan A is the same as every other Plan A, every Plan B is the same as every other Plan B, and so on.

But you may be surprised to hear that the premiums you’ll pay for Medigap coverage can vary wildly ... even for the exact same plan from one insurance company to another.

In Pennsylvania, for example, premiums for a 65-year-old man, for Plan G vary from a low of $1,721 to a high of $5,335, representing a 210 percent difference in cost.

Clearly it pays to shop around. Otherwise, you may end up overpaying by tens of thousands of dollars over the years – money that could be going towards enjoying your retirement.

But, finding the right insurance for your unique needs can be a daunting task.

You could easily spend hours, days or even weeks compiling all the information about every available plan in your area. And if you are on regular Medicare and you switch, you only have until December 7th to secure your policy

Weiss Ratings offers a custom guide that includes a complete list of plans from ALL Medigap insurance companies based on your age, sex and zip code – along with current rates for each plan. And it’s delivered to your inbox in minutes.

Additionally, the Weiss safety Rating is provided for each insurer. Because, believe it or not, a higher price doesn’t always mean the provider is more financially stable. In fact, there are many instances where the exact opposite is true.

Bottom line... you don’t want to put your hard-earned nest egg at risk. So, make sure to get all the information.