The Greatest Stock Market Story You’re NOT Being Told!

|

It’s the greatest story that’s NOT being told. The tale of amazing, unheralded, outperformance of “Safe Money” investments. And I’m determined to change that ... because it could make a dramatic difference in the performance of YOUR portfolio for the rest of 2019 … and far beyond.

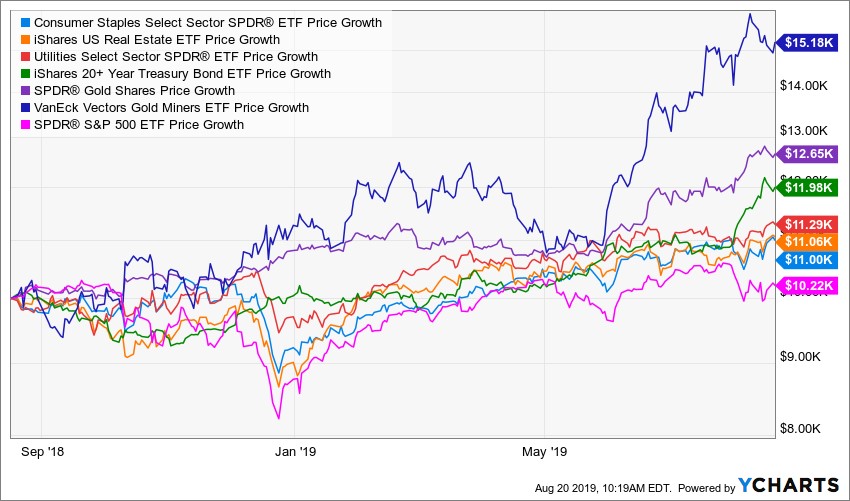

Let’s start with the facts. They’re undeniable. They show that over the past year, you’ve basically made squat if you just owned ETFs or mutual funds that track the S&P 500. The SPDR S&P 500 ETF (SPY, Rated “B-”) is up by only around 4% in 12 months.

BUT during that same time frame (as of earlier this week) ...

- The Consumer Staples Select Sector SPDR Fund (XLP, Rated “C”) and the iShares U.S. Real Estate ETF (IYR, Rated “B-”) are both up 14%, around 3.5 times more than the S&P ...

- The Utilities Select Sector SPDR Fund (XLU, Rated “B”) is up 17.5%, about 4.4 times the S&P ...

- The iShares 20+ Year Treasury Bond ETF (TLT, Rated “C”) is up 21%, 5.3 times the S&P ...

- As for precious metals, fasten your seatbelt! The SPDR Gold Shares (GLD, Rated “C”) is up 26%, while the VanEck Vectors Gold Miners ETF (GDX, Rated “D+”) has soared a whopping 50.5%. That’s 6.5 and 12.6 times the gain in the S&P, respectively!

Bottom line? There is a RAGING BULL MARKET in “Safe Money” investments, the kinds of things I recommend in my Safe Money Report.

In fact, two of my favorite stocks in the utility and Real Estate Investment Trust (REIT) spaces just hit all-time highs yesterday. That’s working out great for subscribers who are following the model portfolio recommendations. You can join them by clicking here or calling my team at 877-934-7778.

But you hear very little about these trends on financial television. You read little about them online or in print media. Why? Because utility, consumer staples and REIT shares aren’t “sexy.” Neither are Treasuries or gold. They’re boring.

Talking about them doesn’t generate big viewership or ratings numbers for the press. And Wall Street firms would rather you buy their latest money-losing tech IPOs than stodgy utility stocks because the former generates bigger fees and commissions.

But you know what? I don’t care about any of that junk. My job is to find you winning investments any place I can! And ever since early 2018, when the market environment began to change (as I explained at the time), Safe Money-style investments have absolutely crushed the averages.

I mean, would you rather hear about (and own) sexy stocks that are going nowhere — or worse, losing value? Or safer, “boring” stocks, bonds, gold and other defensive investments that are up 14% ... 17.5% ... or more than 50% in a year? I’m pretty sure I know what your answer would be!

My advice? Tune out the hype and hysteria you’re hearing elsewhere. The winning stocks and sectors you AREN’T hearing about from others are exactly what you ARE learning about here from Weiss Ratings. You have my commitment that won’t change.

And don’t abandon my winning Safe Money strategies! I believe they’ll continue to work best for you in the remainder of 2019 … and well beyond.

Until next time,

Mike Larson

P.S. If you want to know more about how to generate gains like those I just described, I have good news for you: I’m taking my message on the road a few more times before the end of this year. That should give us plenty of opportunities to talk about today’s volatile markets, my concerns about the economy, investment strategies to help you navigate them, and much more.

First, you can catch me at the MoneyShow Philadelphia that runs from Sept. 26 to Sept. 28 at the Philadelphia 201 Hotel. Just click here to view my event schedule and register for free.

Second, I’ll be attending and presenting at the MoneyShow Dallas, running from Oct. 13 to Oct. 14 at the Hyatt Regency Dallas. General information, details abut my schedule, and registration can be found here.

Third, I’ll be joining scores of metals, mining and market experts at the New Orleans Investment Conference. It runs from Nov. 1 to Nov. 4 at the Hilton New Orleans Riverside hotel. You can find more details on schedule, pricing and venue by clicking here.

Fourth, I’m participating in the 2019 Money, Metals & Mining Cruise. It runs from Dec. 6 to Dec. 14 aboard the Crystal Serenity, sailing from Fort Lauderdale to San Juan.

I’ll be joined by Gold Newsletter executive editor Brien Lundin, Sprott U.S. Holdings CEO Rick Rule and Mary Anne & Pamela Aden from the Aden Forecast on this extraordinary voyage. You can find complete details on the itinerary, ship, costs and more at this link.

I hope to see you in person at one or more of these events soon!