Six immediate threats to your stock portfolio

Today is day 33 of the longest U.S. government shutdown in history.

But the shutdown is just one symptom of a vicious civil war in Washington.

And the Washington civil war is just one aspect of a powerful global cycle that’s descending not only on Washington, but also on Wall Street and the U.S. economy.

Sean Brodrick is the only cycles expert in the world who saw it coming, and has the track record to prove it.

Now, has just released a new online video describing what he sees next …

Six Immediate Threats

to Your Stock Portfolio

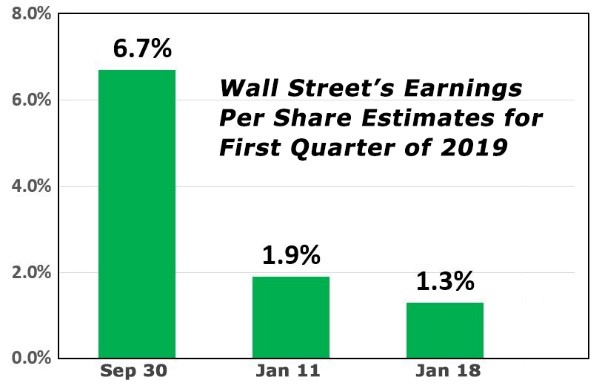

The first threat is Wall Street’s plunging estimates of corporate earnings.

Moreover, this is a trend that was firmly in place well before the government shutdown began … and will continue long after the shutdown ends.

|

Back in September of last year, Wall Street expected that earnings per share for the first quarter of 2019 would be up 6.7%.

Two weeks ago, they had downgraded their expected earnings growth to only 1.9%.

And just this past Friday, they downgraded their estimates again — to just 1.3%.

That makes a huge difference for investors — especially with most stock prices still priced for perfection.

But it’s just ONE of the immediate threats Sean lays out in our urgent briefing. Plus, Sean covers

- How much longer the stock market will continue to rally.

- What the bond market is telling us right now about the Fed’s next moves.

- Gold update: Last week’s correction and what it means.

- His No. 1 brand-new gold stock pick.

- What to buy very soon to make a not-so-small killing when the most vulnerable stocks fall out of bed.

If you missed it yesterday or want to see it again, just make your speakers are turned up and click here.

Then be sure to register for our most important event of all

"4 Shocking Forecasts and 4 New Fortunes for 2019 and Beyond."

All it takes is a single click here, and you’ll be all set for Tuesday, Jan. 29 at 2PM Eastern

Best wishes,

Martin D. Weiss, Founder