|

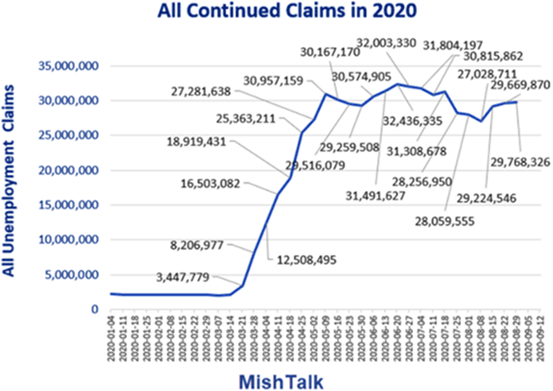

Out of the current population (roughly 330 million Americans), 164 million people are part of the U.S. labor force. Unfortunately, 30 million of those 164 million are out of work and collecting some form of federal and/or state unemployment benefits.

The Democrats and Republicans are so busy hating each other that they failed to come up with an extension of the desperately needed coronavirus stimulus benefits.

The result is some serious financial stress for the most vulnerable Americans.

|

| Source: MishTalk |

How vulnerable?

A new U.S. Census survey found that 134 million Americans said they are struggling to meet their household expenses. 25%, or 32 million, said that paying their bills is “very difficult.”

It’s no wonder three out of 10 Americans have decreased or completely stopped funding their 401k or IRAs accounts. Worse yet, a survey from MagnifyMoney found that 30% of Americans withdrew money from those retirement accounts in order to make ends meet.

|

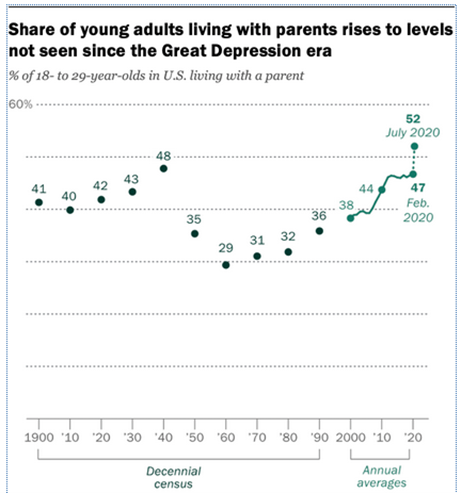

| Source: Pew Research |

Moreover, a fresh Pew Research Center study found that a record number of young adults are now living with their parents. More than even during the Great Depression!

Millennials have been hit hard by the coronavirus pandemic and have the highest unemployment rate of all adults. Of Americans between 18 and 29, an unbelievable 52%, or 26.6 million, are living with their parent(s).

The number and share of young adults living with their parents grew across the board for all major racial and ethnic groups, men and women, and metropolitan and rural residents.

Between February and July 2020, the number of households headed by an 18-29-year-old dropped by 1.9 million, from 15.8 million to 13.9 million.

Massive Ramifications for the Rental Market

That is a sad sign of financial stress, but it has huge investment implications for the multi-home real estate market. In short, apartment buildings — particularly in large metropolitan cities — are seeing costly increases in vacancy rates.

Manhattan, for example, saw a record 15,025 vacant apartments in August and a record 5% vacancy rate. Plus, the number of for rent listings jumped by 166% and the median rent decreased by 4% to $3,363 a month.

Across the country, in San Francisco, the number of apartments for rent has jumped by 50% since February and the average apartment rental price has dropped by 20%.

In short, this is not a good time to be an apartment owner/investor.

Most of us don’t own an apartment building, but near-zero interest rates have pushed millions of investors into REITs. My advice is to steer clear of these eight apartment REITs …

- American Campus Communities, Inc. (NYSE: ACC, Rated “C”)

- Apartment Investment and Management Co. (NYSE: AIV, Rated “C-”)

- Avalon Bay Communities, Inc. (NYSE: AVB, Rated “C-”)

- Camden Property Trust (NYSE: CPT, Rated “C”)

- Equity Residential (NYSE: EQR, Rated “C-”)

- Essex Property Trust, Inc. (NYSE: ESS, Rated “C-”)

- Independence Realty Trust, Inc. (NYSE: IRT, Rated “C+”)

- UDR, Inc. (NYSE: UDR, Rated “C”)

If you already own any of the above REITs, I am not suggesting that you sell them tomorrow morning. I would, however, strongly suggest you put a protective stop near the May 2020 lows for each of them.

I don’t see the job market for the millennial crowd improving any time soon. Besides, mom’s home cooking and laundry service will be hard to give up.

Best wishes,

Tony Sagami

P.S. — While REITs are currently out of the picture for smart investing, precious metals are looking better and better in this negative yield world.

The recent pullbacks should be seen as opportunities. Why? Because all the economic pain I explained above isn’t going away. And that means good news for gold, miners and investors who were smart enough to get in now.

My colleague, Sean Brodrick, has all the details you’ll need in his urgent briefing “The Great Reckoning.” I suggest you watch it now.