|

Don’t worry about the silly pandemic (sarcasm alert), the monetary calvary — aka the Federal Reserve — has risen to the rescue. The Fed has spent trillions to prop up the stock market…and it has worked like a charm.

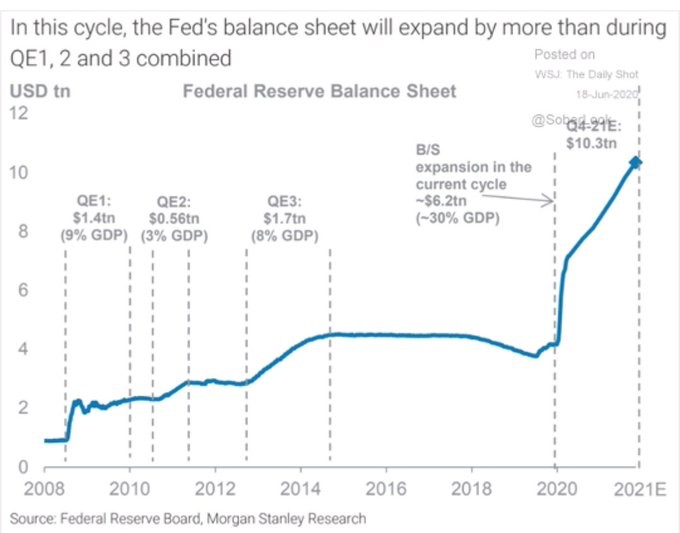

In just four months, the Fed has spent three trillion dollars on its bond buying spree since February, which is more on than QE1, QE2 and QE3 combined.

|

The Fed’s balance sheet now stands at a staggering $7 trillion dollars.

The Wall Street crowd is counting on even more Federal Reserve stimulus money, but here’s the problem — when the rate of economic destruction exceeds the rate of Fed printing … the stock market is going to sink like a rock.

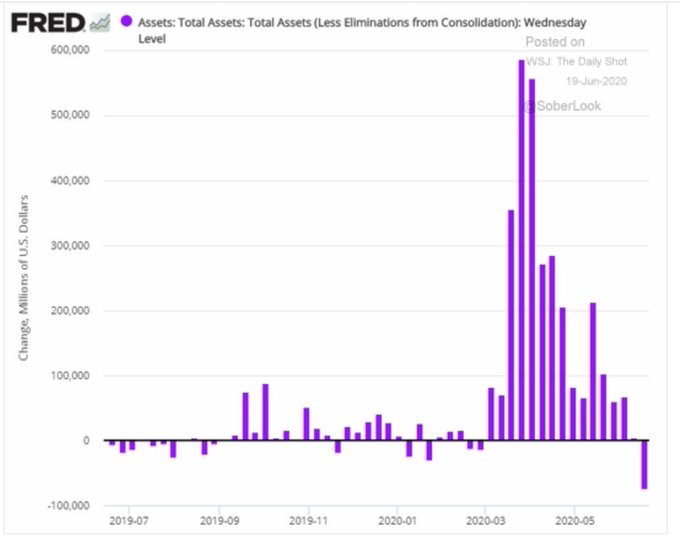

And guess what? The Fed's spending spree is about to run out.

|

Last week, the Federal Reserve’s balance sheet fell from $7.22 trillion to $7.14 trillion a week earlier, the first decrease since February.

|

The Fed hasn’t lost its willpower, but there has been a monumental shift in where the Fed is spending its money. This is really, really important, so pay attention.

The Fed has shifted its asset purchases away from propping up stock/bond markets and is now focused on propping up consumption by states and businesses.

The Fed is now directing money into its newly created Municipal Lending Facility, Main Street Lending Program and the Payroll Protection Program, aka PPP.

The goal of these lending programs is to promote consumption, not asset prices. The result is that the massive tailwind behind stock prices has stopped blowing.

In short, the stock market has lost its sugar daddy, which is why the stock market has started to struggle.

That struggle is going to get worse as we enter the teeth of corporate earnings season in the month of July.

Corporate profits, of course, have been clobbered. According to FactSet, the consensus forecast for Q2 profit of the S&P 500 are expected to fall by a staggering 43.5%. Wow!

But Wall Street is so confident that the Federal Reserve will keep pushing asset prices higher that the percentage of “buy” ratings on S&P 500 stocks has actually increased since the start of the year.

The percentage of “buy” ratings on S&P 500 stocks is 52.1% today, well above the 50.6% at the beginning of the year. Dumb!

Here is how I think the next month is going to unfold: We are going to see a long parade of companies delivering terrible profit reports and CEO after CEO is going to paint a very discouraging picture for the rest of the year.

And since the Federal Reserve is shifting its focus to municipalities and consumers, the stock market is headed for some serious headwinds (the opposite of tailwinds).

That doesn’t mean you should sell all your stocks right away. But it does mean that you need a game plan to protect your portfolio when times get tough.

Maybe that means placing protective stops, increasing your allocation to cash, using some type of market timing system like a 200-day moving average or buying portfolio insurance (put options) that will skyrocket when times turn tough.

All are viable ways to protect your portfolio. Just remember that the worst mistake you can make is to do nothing. Buying, holding and praying is a lousy investment strategy.

Best wishes,

Tony Sagami