History Tells Us Techs Will Keep Moving Higher in 2020

|

I made a lot of money last year. And I hope you did, too.

But generating higher income on investments is tricky. That’s why Dr. Martin Weiss and the team here at Weiss Ratings poured $3.2 million into data costs and conducted more than 500 case studies to achieve our ultimate goal: To create a safe income-generating machine anyone can use.

The result of all this work is the biggest income breakthrough in Weiss’ 48-year history.

And we’re revealing this income-exploding secret this coming Tuesday, Jan. 14 at 2 p.m. Eastern in Weiss Ratings’ first ever Instant Income Webinar. The best part? It’s FREE for Weiss subscribers. Click here to save your seat.

That’s not the only big opportunity in the new year. Tech stocks are also set to soar in 2020.

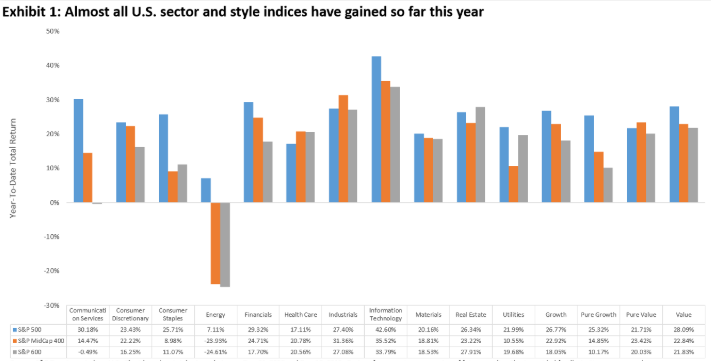

The S&P 500 was up 29% in 2019, but as always, some parts of the stock market did better and worse than the broad averages. Tech stocks were the strongest performer, increasing by 48% while energy stocks were only up by an average of 7.6%.

|

|

Source: S&P Dow Jones Indices. Chart based on total returns between Dec. 31, 2018, and Dec. 10, 2019. |

Big difference!

NOTE: My friend Sean Brodrick, who I think is the smartest gold investor in the world, reminded me that gold bullion was up 15% last year. And gold mining stocks were up by an average of 40% in 2019! If you want specific trading recommendations to multiply your gold profits by several orders of magnitude, watch this video.

We investors must always look toward the future.

What Will 2020 Hold for Us?

History tells us tech stocks will continue to move even higher.

Since 1980, the Nasdaq has delivered nine years of 30%-plus gains. In the years following those 30% moves, the Nasdaq continued to move even higher eight out of those nine times. The only exception was in 2000.

Last year, the Nasdaq Composite Index was up by 35%, so the historical odds are stacked in a favor of another good year for tech stocks.

|

Of course, there aren’t any guarantees, but the same forces that propelled stocks higher in 2019 are still in force today.

Such as ...

Friendly Fed: In 2019, the Federal Reserve cut interest rates three times and unleashed its biggest asset-buying program of all time. The Fed has also purchased more than $400 billion worth of government bonds since October.

Trump Tax Cuts: The Trump tax cuts were not a one-year wonder. Businesses and individuals will still benefit from the same lower tax rates in 2020. Lower taxes translate into bigger corporate profits … and more money in consumers' wallets.

Jobs! Jobs! Not only is the unemployment rate at a 50-year low, but wages are also on the rise. Wages for nonsupervisory employees, who make up 82% of the workforce, increased by 3.7% over the last year. That's the largest increase in more than a decade.

Billions of Buybacks: U.S. corporations bought back $710 billion of their own stock in 2019. For perspective, buybacks have averaged $450 billion a year since 2011, so the thirst for buybacks has been growing. This is a major positive for future stock prices.

The S&P 500 is trading at not-expensive-but-not-cheap 18x earnings, so there is room for stocks to move even higher. In 2002, stocks were trading for 22x earnings.

2020 is, of course, an election year and Wall Street is going to focus its attention on the presidential election. But love it or hate it, the Trump economy is chugging along at a very prosperous pace.

If you believe Trump will be re-elected, stay fully invested in the stock market with a heavy emphasis on tech stocks. However, if you expect Trump to lose, I strongly suggest you formulate a well-defined exit strategy.

For the best stocks and ETFs to buy, no matter who's in Washington, consider taking my Weiss Ultimate Portfolio for a test-drive. I target only the highest-rated assets in our vast Weiss Ratings universe. And I drill down even further to find the ones with the biggest profit potential, in the shortest time frame.

Get positioned now for profits, protection and everything else this new decade will bring. Start here.

Best wishes,

Tony Sagami