Google, Amazon Join Forces to Win the Streaming-TV Wars

|

Piece by piece, a new foundation for media distribution is taking shape.

Unlikely alliances are forming. Lines once drawn are being crossed.

YouTube TV, a cable TV alternative, is coming to Fire TV, according to an official blog post from the platform provider. This move unites Alphabet (GOOGL) and Amazon.com (AMZN) in the battle for America's living rooms.

Traditional cable TV providers should worry. The media landscape is about to change dramatically.

This is a once-in-a-generation shift. One that will disrupt the status quo with new business models … and bring huge opportunities to smart investors.

It may seem strange to buy a TV subscription from Amazon or Google. For now, anyway.

In the not-too-far-off-future, this is just the next step in their plan to monetize and monopolize your time.

Big tech companies across the board have played the long game and are now offering alternatives to traditional media that are very compelling.

Related post: TV+: Apple's future depends upon this dramatic moment

About 34% of all U.S. households have cut the cord from traditional cable in 2019, according to The Convergence Research Group. And online services are poised to bring in $22 billion in 2019.

|

|

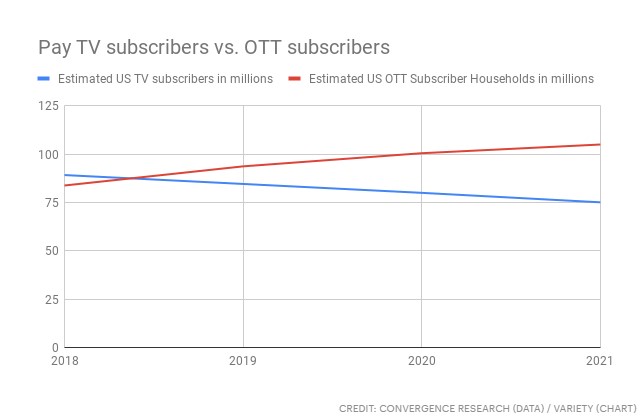

In 2019, the number of people who subscribe to "Over the Top" (OTT) media services is set to surpass traditional pay TV subscribers for the first time. |

This leaves a sizable market for competitive tech, media and internet service providers to fight over.

A key part of the plan to entice cord-cutters is brand recognition. Amazon Prime Video is currently in 25% of U.S. households, and YouTube is by far the most popular video platform in the world.

Activated in 2005, YouTube is a platform of 1.9 billion monthly users. Alphabet claims that 80% of people age 18 to 49 will visit the site in an average month.

They can watch on any screen with an internet connection. And analytics show they're spending more time browsing short videos than watching regular TV.

YouTube TV is a natural extension of the brand. It's as slick as Netflix (NFLX), with a live-TV twist.

For $50 a month, subscribers get six individual accounts for family members … artificial intelligence-powered search … unlimited, cloud-based video recording for true on-demand programming … and 70 channels, including local sports and news.

Everything streams over the internet. There is no need to rent cable boxes, schedule installation or commit to long term contracts.

It's a cable cord-cutter's dream. And now it's coming to Fire TV, Amazon's over-the-top (OTT) digital TV platform.

Comprised of dongles, micro consoles and software license agreements with TV-makers, Fire TV brings an intuitive user interface and Alexa integration.

TechCrunch reported in May that Fire TV is the most popular streaming media player platform in the United States, United Kingdom, Germany, India and Japan. The number of users now tops 34 million.

In the past, Google and Amazon were locked in a bitter feud that kept YouTube off Amazon Echo, Fire TV and other consumer technology devices. And Google hardware was locked out of the Amazon online store. But the tech giants put that in the rear-view mirror in April with a historic agreement.

Google and Amazon have become unlikely allies — locked in a battle with traditional pay TV companies and even internet service providers.

As direct-to-consumer business models proliferate, traditional barriers into the living room are falling. More players — including tech and media companies and internet service providers — are racing to develop and offer media content.

- Apple is set to launch Apple+, a subscription video-on-demand service in November.

- Disney Plus, a massive new subscription video on demand (SVOD) service, will follow two weeks later.

- And Peacock, a new direct-to-consumer media channel from Comcast (CMCSA), will debut next year.

Investors should not miss the size of this opportunity.

Although penetration is falling, a staggering 44% of U.S. households still had cable service in the first half of 2019. Pay TV revenue was worth $103 billion, according to research collected at Statista.

The tech companies are coming with lower prices, more content and better user experiences.

They will win part of this business.

And as consumers look to trim their TV-spending budget, the odds are that they will stick with the best streamers … and cut the cord for good.

Best wishes,

Jon D. Markman