Forget About Stocks Post-G20; Pay Attention to BONDS!

|

This past weekend, President Trump and Chinese President Xi Jinping called a temporary truce over trade and tariffs. The news that the U.S. wouldn’t raise tariffs on $200 billion worth of Chinese imports to 25% from 10% on Jan. 1 sent stock buyers into a frenzy. Dow futures signaled a 450-point-plus gain early Monday, and that’s exactly what we saw at the open.

But then stocks started to fade late in the day. And yesterday, they imploded! The Dow plunged 799 points, while sectors like financials and transports got creamed.

Why? Because the BOND market went bonkers! Treasury prices surged, yields tanked and the yield curve flattened like a pancake! This has incredibly important implications for all markets going forward.

First, let me recap the details ...

- Long bond futures jumped more than a point and a half in price on Monday, then surged another point on Tuesday. Thirty-year yields gave up early gains and finished down 12 basis points in two days. That’s a BIG move for bonds.

- The benchmark 10-year yield barely rose even as stocks soared. Then it reversed and knifed down through 3% AND its 200-day moving average, closing at its lowest level since mid-September.

- Short-term yields didn’t move nearly as much, and that resulted in a dramatic compression in the yield curve. The difference between the 2-year note yield and 10-year note yield collapsed to 12 points – the lowest since June 2007!

- Meanwhile, we saw the first minor curve INVERSIONS of the cycle. Specifically, the 2s-to-5s and 3s-to-5s Treasury curves flipped into negative territory.

Why does this bond market action matter? Who cares about curves? I’m going to put my interest rate analyst hat on and explain:

For one thing, it’s very unusual to see stock prices ramp so much and Treasury yields tank alongside them. If investors were truly getting “bulled up” about the implications of a trade truce on future economic and earnings growth, they should’ve been buying stocks and dumping bonds. But they weren’t. The message from bonds was much more skeptical than the message from stocks.

For another thing, consider WHEN we typically see yield curve inversions. They occur when the Federal Reserve is aggressively raising interest rates, asset price bubbles are out of control, and investors are worried the whole mess could come crashing down.

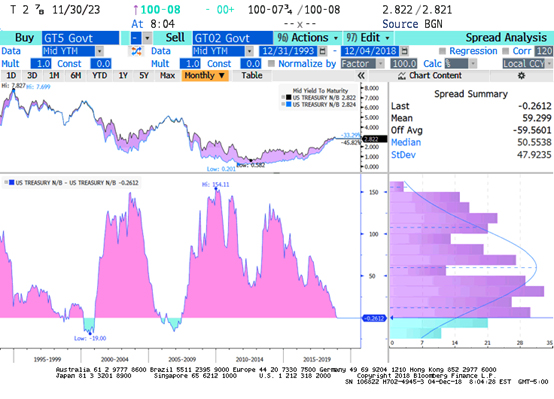

Just look at this chart, which shows a quarter-century of data on the 2s-to-5s yield spread. You can see on the far right that it has been dropping like a stone, and just sank below the zero-line.

Now look to the left and middle of the chart, when this spread last slipped into negative territory. Notice anything interesting about the timing of those moves? They were in early 2000 and 2005-'06 – right around the peak of the Dot-Com Bubble and the Housing Bubble, respectively!

|

Source: Bloomberg

You can also see that inversions are relatively rare occurrences. You don’t have a bunch of “false” negative signals, where the curve inverts and stocks just go on their merry way for long.

So, you know what I recommended my Safe Money Report subscribers use the rally for? A great opportunity to lighten up!

Specifically, I sent out a special Flash Alert telling them to bank gains of around 17.6% in only six months on a conservative, higher-yielding Real Estate Investment Trust that had taken off like a rocket. You can get timely market alerts like that one by subscribing to my newsletter here.

Or if you’re not quite ready to take that step, just promise me one thing: You’ll pay close attention to what’s going on in bonds as well as stocks.

Because... as an analyst who has been following interest rates closely for more than two decades ... I can tell you that the latest action is both abnormal and extremely important. Consequently, it could have major, major implications for your wealth.

Until next time,

Mike Larson