Fed’s QE Offers Strong Reason to Get into the Stock Market

|

We came close to starting a war with Iran ...

... went through a presidential impeachment process, only the third to ever occur ...

... and are in the middle of one of the deadliest pandemic outbreaks in modern times.

Yet the stock market continues to march higher!

That is especially true for tech stocks. Take a look at how the Nasdaq 100 index has performed over the last 10 years:

2009: +55%

2010: +20%

2011: +4%

2012: +18%

2013: +37%

2014: +19%

2015: +10%

2016: +7%

2017: +33%

2018: +0.1%

2019: +39%

And the Nasdaq is up another 10% so far this year.

There are lots of reasons for the stock market’s resilient performance. But I believe the single most important reason is the ridiculously friendly Federal Reserve.

|

Every time the stock market stumbles, the Fed is eager to inject a new batch of monetary steroids into the economy.

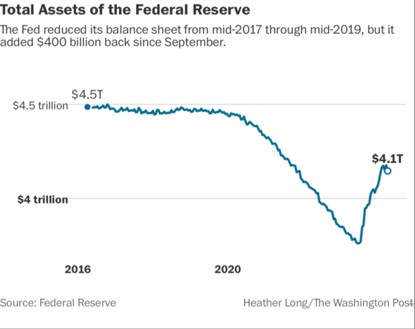

Sometimes it comes in the form of interest-rate cuts. But the latest rocket fuel has come aggressive Treasury security purchases — aka Quantitative Easing.

Jose Canseco, Roger Clemens, Jason Giambi and Sammy Sosa used steroids to enhance their performance on the baseball diamond. The stock market is enjoying the same type of boost courtesy of the Fed’s policies.

The Fed’s current buying binge stands at $60 billion a month. Its purpose is to keep borrowing costs low. However, the side effect is that prices for risky assets — like tech stocks and junk bonds — are soaring.

Just like with steroids, the long-term effects of QE aren’t pretty. But they work like a charm in the short-term, and I believe even more monetary steroids are on the way.

Why do I believe that?

Well, just take a look at President Trump’s newest nomination for the Federal Reserve Board, Judy Shelton. She went before the Senate Banking Committee last week for a confirmation hearing.

Shelton, a former Trump campaign adviser, has publicly argued for lower interest rates and has even praised the use of negative interest rates.

In fact, there is a good possibility that Shelton will replace Jerome Powell as Fed chair when his term ends in 2022. Assuming Trump wins the re-election, that is.

Trump has previously publicly criticized Powell for not cutting interest rates fast enough or low enough. Many people — including me — believe that Shelton will do exactly what Trump wants.

And what Trump wants is to goose the U.S. economy and pump up the stock market. And the combination of a Trump re-election and Shelton’s appointment to the Federal Reserve would send stock prices to the moon.

That doesn’t mean that the stock market will going straight up, though. What it does mean, at least to me, is that you shouldn’t be scared to put more of your money into the stock market.

You should be looking for opportunities to get in, not excuses to get out.

Best wishes,

Tony Sagami