Economic Impact from the Second Wave of Lockdowns

|

I know what is like to be poor. At one point in my life, my mother and I lived under a bridge and ate out of garbage cans for three months in Tacoma, Wash.

But thanks to four decades of 60-plus hour work weeks, no one in my immediate family will ever go hungry or homeless.

I wish I could say the same about others in our society.

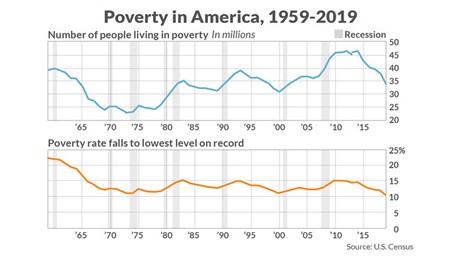

Sadly, the unfortunately reality is the number of Americans living in poverty has exploded due to COVID-19, despite being at all-time lows prior to the start of the pandemic.

In case you’re unfamiliar, a family of four earning $26,200 or less is considered to be living in poverty. The number of Americans in poverty has increased by 8 million since May, according to a Columbia University study. All together, we currently have a total of 55 million Americans qualifying as living in poverty.

55 million!

Researchers from the University Notre Dame and the University of Chicago reported that six million more Americans are now living in poverty in just the last three months alone.

|

Sadly, the increase in poverty has disproportionately affected minorities and children the hardest. Worse yet, the number of Americans struggling with poverty increased after the $600 per week payment from the CARES Act ended on July 31.

This number is only going to get worse as some states — like California, Washington, Michigan and New York — announce a new round of lockdowns.

Congress needs to pull their heads out of the sand and pass another stimulus package. That said, I’m not holding my breath it’ll happen quickly. It seems like all Democrats and Republicans do is insult each other.

And even if Congress agrees on a new rescue package, our economy is still a long way from recovering from the first coronavirus shutdown. Plus, layoff announcements and persistent unemployment are still a very painful reality for millions of Americans.

That’s why investors need to remain more vigilant than perhaps ever before.

With the combination of unemployment, new lockdowns and the absence of a second stimulus program, I expect consumers to cut back on spending … and this is a huge deal for the overall economy.

The University of Michigan’s consumer sentiment index dropped to 77.0 in the first half of November, a huge drop from 81.8 in October. And that’s before the newest round of lockdowns!

The U.S. economy is highly consumer-spending driven and my expectation is that the stock market is headed for a collision with an impenetrable wall of resistance in the very near future.

Now, that doesn’t mean you should dump all your stocks tomorrow morning. As always, timing is everything. But I think there is no question that the stock market has gotten ahead of the fundamentals and is completely ignoring the deadly rise in coronavirus infections across the United States.

They say the stock market climbs a wall of worry, but we’re talking about Mt. Everest-type heights. That’s a mountain that the Dow Jones just can’t climb.

Take a look at your portfolio. How many high flying, nosebleed P/E stocks do you own? Do you own any short-term bonds or cash? How about precious metals? Do you use protective stops?

These are all questions you should be asking to prep your portfolio for more economic hardship. You should also look to diversify your investments and keep an eye out for reasonable entry levels for stocks with long-term staying power. And use the Weiss Ratings to help you evaluate potential opportunities.

And if the second round of lockdowns isn’t as economically severe as I believe it will be? Then you’re no worse off. If there’s anything I want to get across it’s that nothing goes up forever, and risk management never goes out of style.

Best,

Tony Sagami