|

"EBS, or Everything but Bad Stuff."

— Lynn Turner, chief accountant, Securities and Exchange Commission, on modern-day earnings reports

Wall Street accountants can be some of the most creative humans on the planet. Heck, the newest generation of them should get their own shows on the Food Network. That's because they are cooking the corporate books more creatively than at any time since the dot-com bubble days.

There is a canyon-wide hole that these financial magicians drive their trumped-up earnings through. That is, the legal-but-misleading reporting of profits on a non-GAAP basis.

GAAP stands for generally accepted accounting principles. So, any company that reports its profit on a non-GAAP basis is (legally) overstating its profitability.

Non-GAAP profits exclude non-recurring, or "one-time," items. Things like restructuring expenses, office/plant closures, layoffs, regulatory penalties and accelerated depreciation. In other words, profits that are ex-this and ex-that.

My ex-wife had the best explanation of non-GAAP that I've ever heard. "You'd be handsome ex-50 pounds," she said.

|

Why do corporations even use non-GAAP numbers? Mainly to goose the stock options of corporate insiders.

Or, in simple terms, corporate greed.

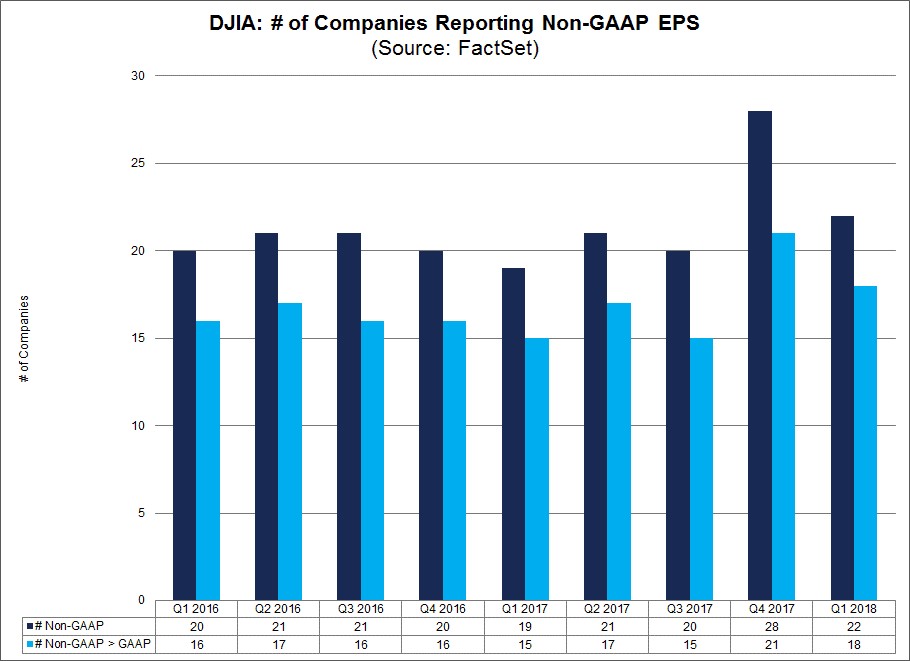

Worse yet, the use of non-GAAP profit reporting is growing. The members of the S&P 500 Index reported earnings in 2018 that were $19-per-share higher on a non-GAAP basis than GAAP basis.

Some of the most aggressive abusers of non-GAAP numbers are young tech companies. Tech upstarts often lose mountains of money for years and rely on non-GAAP accounting to make them look like viable businesses.

In the dot-com heydays, you used to hear a lot about "eyeballs," "page views" and "unique users." Today, the new non-GAAP buzzwords are "annual recurring revenue," "billings" and "bookings."

For example, look at Uber (UBER).

|

Uber produced the largest one-year loss in the history of American IPOs, with a $3.7 billion loss in the 12 months through March.

However, using what Uber calls "core platform contribution profit," it claims to have made $940 million.

Uber has lots of aggressive accounting company, and the growing, um, gap between GAAP and non-GAAP profits is something that you should consider before buying any stock.

What I strongly recommend is that you check out the Weiss Rating for every stock you own or are thinking about buying. A Weiss Rating cuts through all the financial prestidigitation and gives you a true picture of a company's financial health. Go to www.weissratings.com

And if you'd like to incorporate Weiss Ratings into your investment strategy, consider a non-risk subscription to my Weiss Ultimate Portfolio service.

What I do is invest only is stocks with a Weiss Rating of "B" or higher. I also rank that elite universe of rock-solid stocks by our proprietary performance index and create a portfolio that only invests in the top one-tenth of one percent (0.1%).

How has it worked? The Weiss Ultimate Portfolio methodology could have delivered:

- A 722% total return since 2007, averaging 67.2% per year ...

- Nearly five times the gains of Berkshire Hathaway ...

- Covering a period that includes the worst bear market and greatest recession of our lifetime!

See for yourself here.

To my knowledge, no other investment trading service or organization identifies and tracks the safest, highest-quality, highest-performing investments in the world like we do.

Give it a shot; I think you will be very pleased with the results.

Best wishes,

Tony Sagami