Don’t Suffer from 'Squirrel Syndrome'; Focus On What REALLY Matters

All this talk of FAANG stocks, tariffs and trade, and other distractions can throw you off your game as investor. The bond market and yield curve flattening are the REAL developments to follow!

|

I call it “Squirrel Syndrome.”

The term comes from the 2009 Pixar movie “Up,” one I really enjoyed watching with my now-teenage daughters when they were younger. In the movie, a talking dog is in the middle of a sentence. Then out of the blue, a squirrel runs by, and he loses his focus. In fact, he forgets entirely what he was talking about.

You can watch the scene here on YouTube. So, how does it apply to today’s market? Let me explain ...

Most of the financial media is focusing very intently these days on the China-U.S. trade talks. They’re reporting on every twist and tariff tweet from President Trump, attributing virtually all the market’s moves to those.

They’re also running countless stories each week about popular tech and “FAANG” stocks like Apple (AAPL, Rated “B”) and Amazon.com (AMZN, Rated “B”). And they’re trotting out guest after guest who claims that IF the Federal Reserve makes dovish comments or pauses its rate-hiking campaign, it’ll cause stocks to soar.

|

But those are all just “squirrels”! Distractions that will keep YOU from focusing on what REALLY matters.

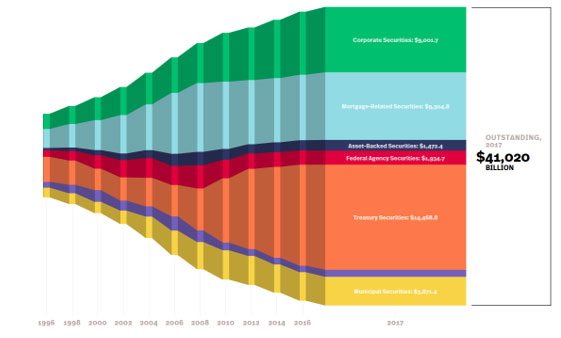

Start with the bond market. This isn’t some small corner of the financial world you can safely ignore. There were around $41 trillion in outstanding U.S. bonds (of all types) at the end of 2017. That’s far greater than the $32.1 trillion combined market capitalization of U.S. stocks, according to the SIFMA trade organization.

|

|

Source: SIFMA |

That’s why I pay so much attention to the recent trading action in bonds. As I said last week, the flattening of the yield curve to multi-year lows is a huge, huge deal given its track record for predicting bear markets and recessions.

It’s also why you can’t get swept up in all the claptrap you’re hearing about the Fed. Many on Wall Street are saying that IF the Fed doesn’t hike interest rates on Dec. 19 ... or if it (more likely) signals a temporary pause to its rate-hiking campaign after a December hike ... that would be bullish.

But sometimes it helps to, you know, look at the actual DATA rather than just parrot a narrative. With that in mind, here’s a chart I cooked up and recently posted on my Twitter feed (@RealMikeLarson if you’d like to follow me).

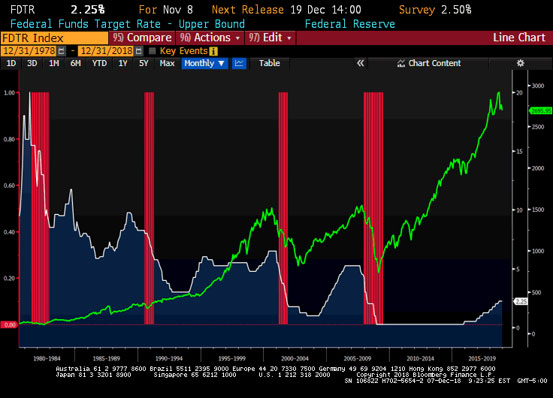

It shows almost four decades of market history. The benchmark Federal Funds rate is in white, the S&P 500 is in green, and past recessionary periods for the economy are in red.

|

|

Source: Bloomberg |

You can see that when the Fed “paused/stopped” hiking rates in 2006, it was just before the start of a massive bear market and the deepest U.S. recession since the Great Depression. The S&P 500 ultimately plunged by around 57%.

You can also see that when the Fed paused/stopped hiking rates in 2000, it was just before the start of a massive tech-led bear market and yet another recession. The S&P 500 ultimately tanked by 50%.

The Fed pause in the late 1980s? Yep, that was followed by a lousy market and yet another recession. Oh, and we also experienced a little something known as the Savings & Loan crisis around that time. Hundreds of financial institutions ultimately failed at a cost of around $160 billion, according to the General Accounting Office and FDIC.

I could go even further back to the early 1980s, when yet another Fed halt was followed by a weak market and recession. But I think you get the picture.

Truth is, the ONLY time a Fed pause after a notable series of rate hikes was bullish for more than a short period of time was in 1995. But that was also only a few years into a bull market and economic expansion — NOT after a nine-plus-year bull run for stocks and one of the longest expansions in modern history like today.

Can we see short-term bounces? Sure. A couple may even be prompted by trade headlines or Fed statements. But ultimately, they will likely prove to be nothing more than distractions. Trifles. Things that knock you off the “scent” of the market overall — one that I’ve been saying since March is increasingly bearish.

So, my goal is to make sure you stay focused. Don’t let those squirrels distract you from what you should be doing: Using rallies to unload weak stocks with SELL grades from Weiss Ratings ... raising cash levels overall ... hedging against downside risk with select inverse ETFs or options ... and keeping any remaining funds allocated to stocks parked in defensive, “Safe Money” sectors.

Until next time,

Mike Larson