|

Geez, how'd I get so stinkin' old so fast?

I admit it; I was hit with a feeling of melancholy on my 50th birthday. But it got even worse when I received an invitation from AARP a few weeks later.

That was back in 2006! Fast forward 12 years, and I now find myself eligible for Social Security. WTF!

My vegetable farmer father worked well into his late 80s and I (and my friend and co-worker Martin Weiss) plan on working for many, many more years.

And maybe you should, too.

Martin and I are lucky; we are still working because we truly enjoy what we do. I hope you're in a similar position, because your retirement is likely to last a lot longer than you may think.

|

8,000 Days of Retirement

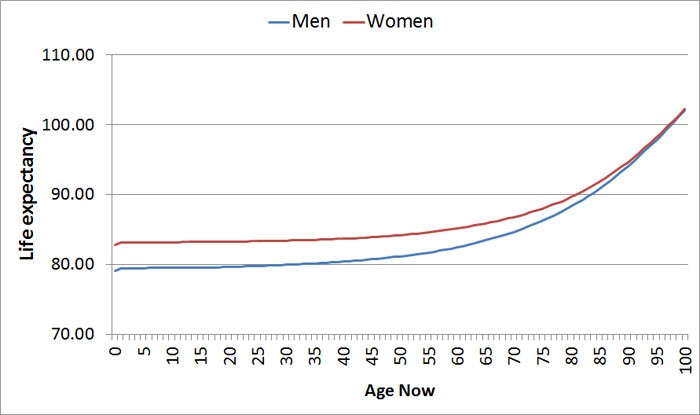

According to the Social Security Administration, a 65-year-old man will likely live another 20 years. A 65-year-old woman will live nearly 22 more years. This works out to somewhere around 8,000 days of what is considered the traditional retirement period.

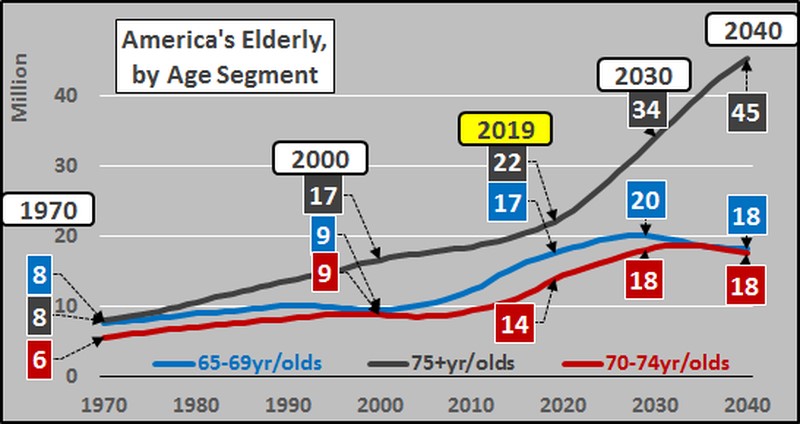

However, a growing number of seniors, like Martin and me, are working more and retiring less. According to the U.S. Bureau of Labor Statistics, 27% of 65- to 74-year-olds and 8% of people over 75 years of age are still working.

|

The average Social Security benefit is around $17,500 a year. But you can increase it by roughly 8% for each year you delay taking benefits at your full retirement age (which is 66 years old and 4 months, for people born in 1956 like me) up to age 70 when the waiting bonus maxes out.

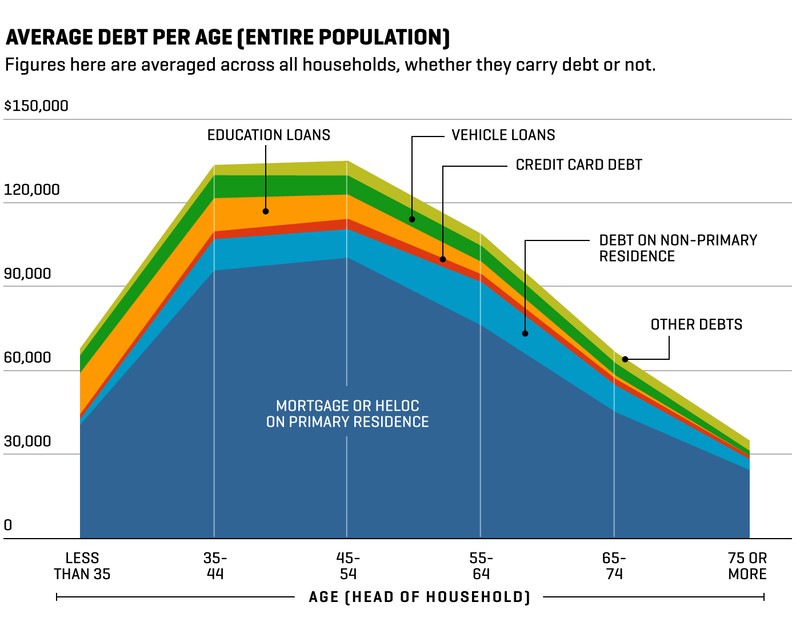

Not only will working longer goose your Social Security check, but you will be able to pay off debt as well as save more money, which many Americans desperately need to do. According to the Center for Financial Services Innovation, an unbelievable 42% of Americans have nothing saved for retirement.

Zip. Zilch. Nada!

Compounding the problem, most Americans owe an average of $66,000 in debt at age 65. The list of debts includes credit cards, auto loans and even student loans from decades-ago college studies!

|

The combination of zero savings, inadequate Social Security income, and debt is a retirement dream killer.

Hey, maybe you've been a diligent saver and squirreled away a mountain of money. Maybe you're eligible for a generous pension. Maybe you've paid off all your debts/mortgage.

If so ... congratulations. Seriously.

But study after study shows that most Americans have saved too little and lived too high on the hog.

If that describes your situation, just do what Martin and I are doing: working past traditional retirement age … and loving it.

Part of my job is investing some of Martin's retirement money, and you can trade right alongside me when you join our Weiss Ultimate Portfolio service. We invest strictly in solid, liquid stocks and ETFs, which makes it suitable for your life savings, including IRAs and other retirement accounts.

And just this week, we banked a nice 21% gain in a stock we added to the portfolio in January. Not bad for a little over three months' time!

There are plenty more recent gains where those came from. Click here to see how we do it, and to get on the list to receive my next recommendation.

Best wishes,

Tony Sagami