|

My father, a vegetable farmer in western Washington, was permanently affected by the Great Depression. For millions of Americans during those tough times, my father really learned how to pinch a penny and make do with what he had.

|

I don’t know about you, but the older I get, the more I act like my father. Which is why I have been saving money like mad since the coronavirus pandemic invaded our lives.

I’ve become such a homebody that I seldom put any gas into my car, I’ve frozen my gym membership, I’ve gone on zero dates and I’ve emptied out most of my food pantry.

As a result, my spending has gone way, way down ... and my savings have ballooned.

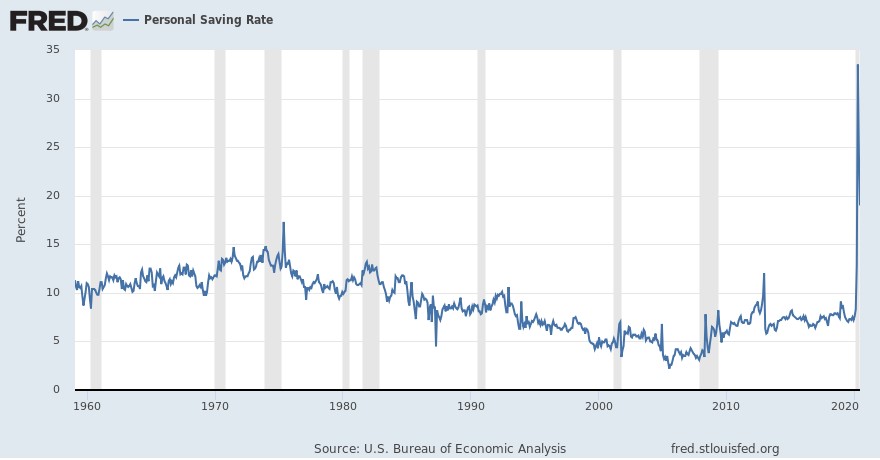

Humans become cautious when we are faced with uncertainty. Today, Americans have become so collectively nervous that we are stockpiling cash at a rate not seen since the first year of President Reagan's first term. The Commerce Department reported that savings rates climbed to over 25% in the second quarter of this year.

And that is even after the Federal Reserve slashed interest rates to zero and pushed the yield on bank savings, money market accounts and Treasury bonds to almost nothing.

|

Even at a near-0% return at banks, Americans are saving money as if their life depended on it. Maybe it does.

Some are saving money simply because they’re stuck at home like me, but there are millions of people that are so fearful about their financial future that they are squirreling away as much money as they can in case they lose their job or don’t get recalled back to work.

It’s not just people who are feeling the financial strain of the pandemic, either. People with steady, secure jobs are saving money. I think all of us are re-evaluating our spending priorities — realizing that money can’t buy happiness and permanently changing the way we live.

Even my Millennial-aged children are becoming smarter with their money. Good!

This saving push is going to last for a long time ... and there is going to be a fundamental change the way that we save money.

And there is one group of businesses that are going to prosper as a result of the increased savings rate: regional/local banks and credit unions.

Money is gushing into banks and credit unions. And sure, you can do the hard work of finding the best ones to invest in. Or you can do the smart work.

See, it’s not just that Americans are saving more, and so using their banks more. They’re also shifting where they’re doing the vast majority of their banking.

Online banking was already a success with big banks before the pandemic. Consumer use of mobile finance, banking and insurance apps jumped by 71% in 2019. Local banks and credit unions realized they are falling behind, and they’re freaking out.

Particularly in light of the pandemic. COVID-19 has changed online banking from “nice-to-have” to “can’t-live-without”.

The surest way to profit is by investing in the company that is making it possible for the banking industry to make the great leap in the digital world.

That company is Jack Henry & Associates (Nasdaq: JKHY, Rated “B”).

Jack who? Few investors have heard of Jack Henry, but you might be familiar with the term fintech. Fintech is a portmanteau of finance and technology and refers to any business that uses technology to enhance/automate the financial services industry.

Jack Henry offers the tools needed to provide the modern services today’s customers demand — such as online payments processing, deposit checks by snapping photographs, transfer money with swipes, taps and even voice commands. These applications look and feel like they were made by the local banks and credit unions themselves, rather than a corporate third-party.

And bankers love them for that.

Community banks and credit unions must modernize their offerings or die, and they know this.

The future for Jack Henry & Associates couldn’t be brighter.

That doesn’t mean you should rush out and buy it tomorrow morning. As always, timing is everything so do your homework before you invest your money.

But Jack Henry is one of the companies winning what my colleague Jon Markman is calling the Great Digital Transformation. And there are a bunch of others poised to profit on this shift from analog to digital.

In fact, Dr. Martin Weiss recently released his FUTURE SHOCK 2020 summit, which details Jon’s portfolio strategy for picking these tech winners AND reveals Jon’s ENTIRE model portfolio.

If you haven’t seen it yet, check it out quick! It’ll be taken down before long.

Best wishes,

Tony Sagami